Simple Tips About Debt Repayment Excel Template

An lbo model focuses on buying a company using a high level of debt.

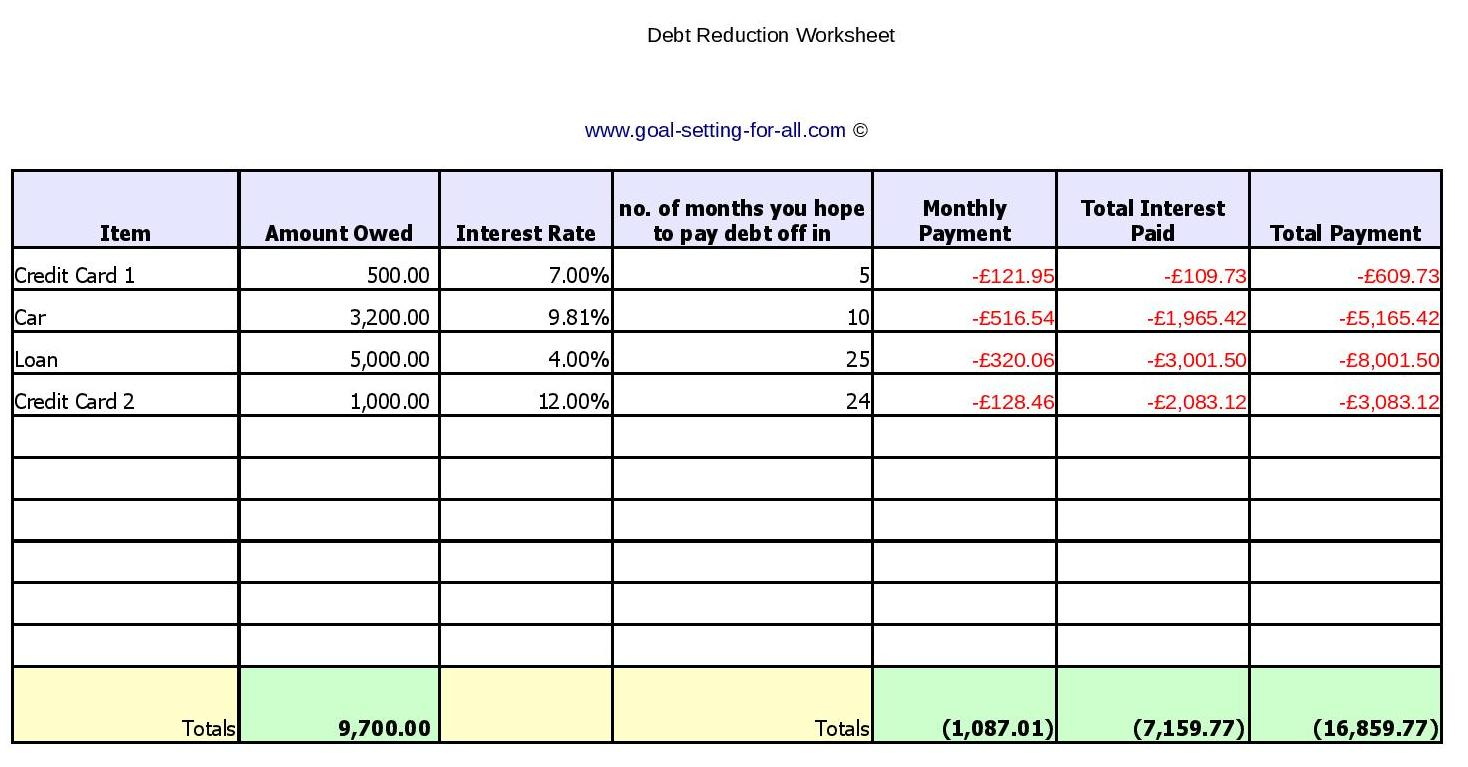

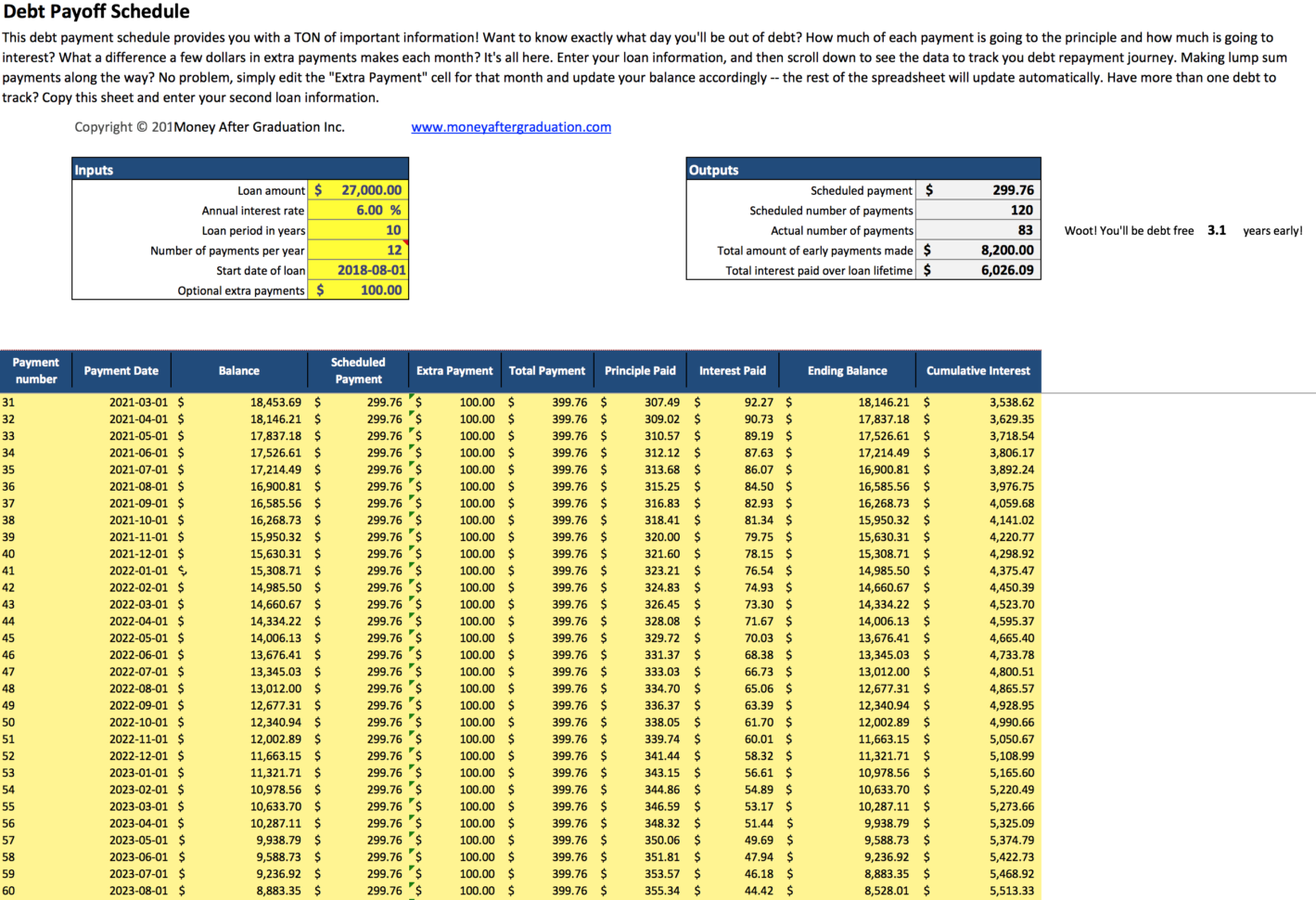

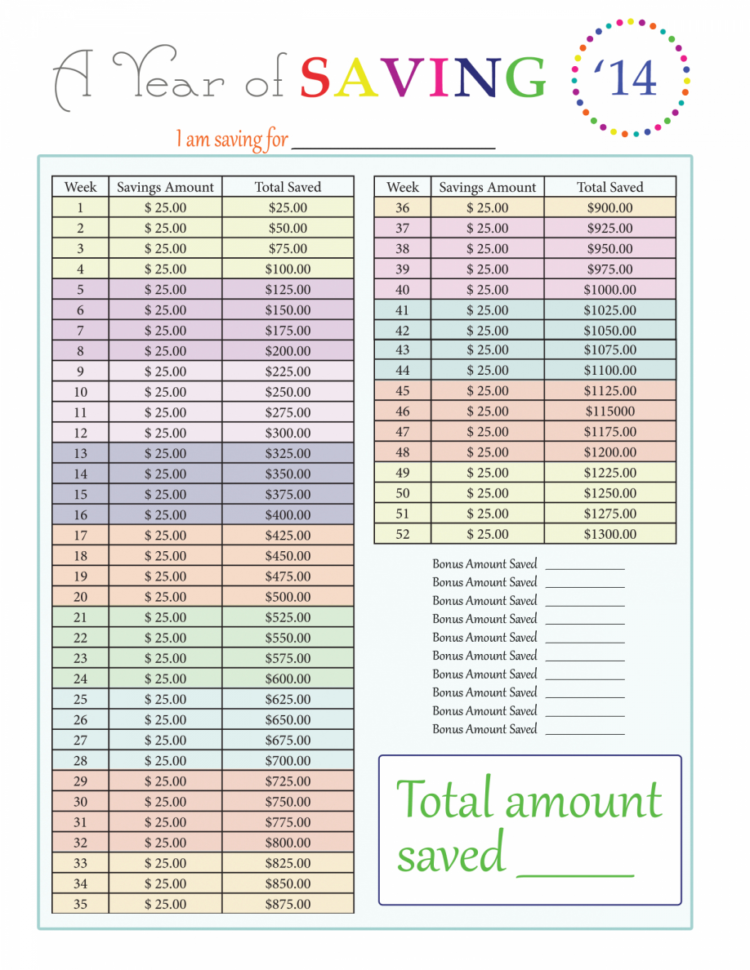

Debt repayment excel template. Last updated january 2, 2024 debt snowball spreadsheet template + guide (debt free 2023) watch on google sheets has always been helpful when you need to calculate. We often refer to such repayment schedules as debt amortization schedules. There are 6 loan templates with a total of 72043 downloads!

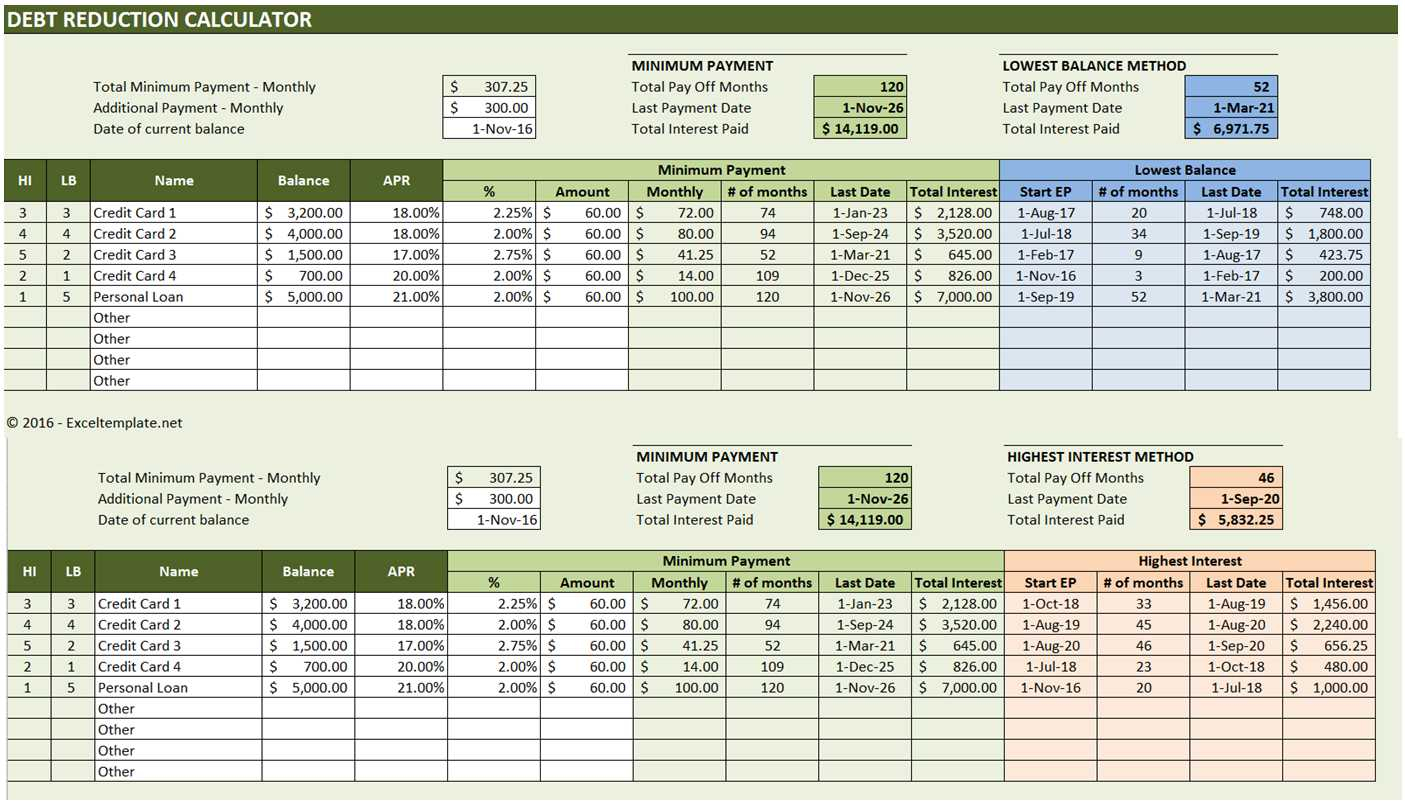

The excel formula for mandatory. So, it analyzes the company’s ability to repay debt and generate returns for equity holders. If all of your debts are lower interest and close to.

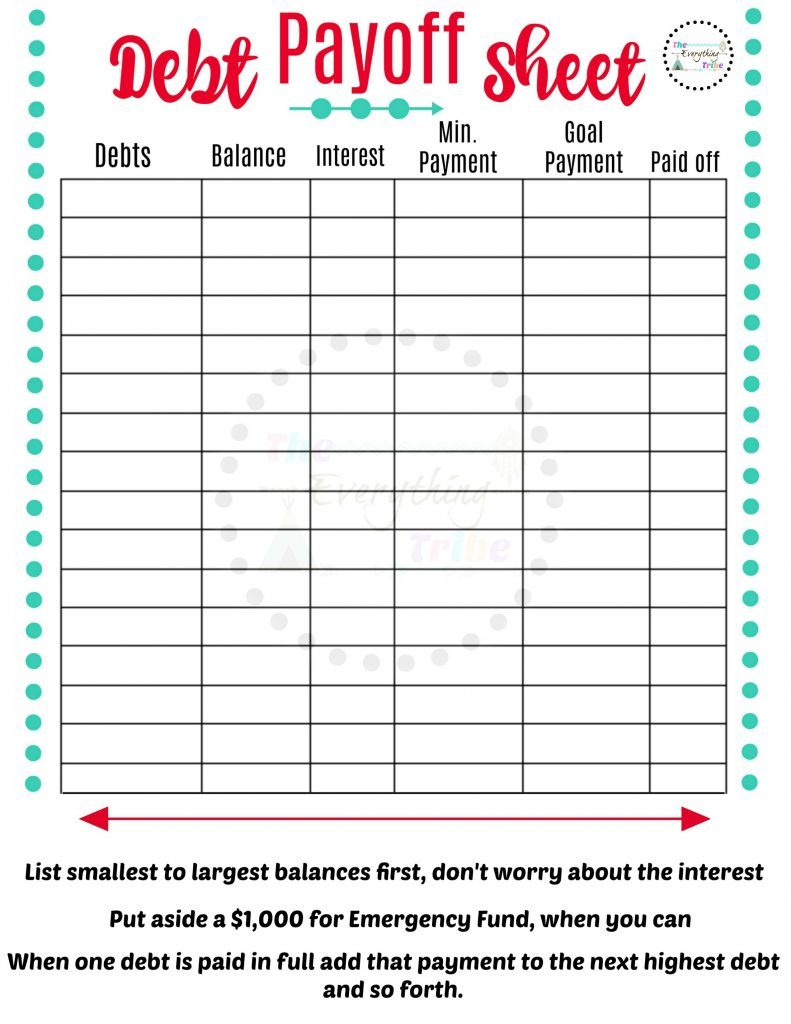

Using a free template is an easy way to get control of your debt. It depends on the total amount of each of your debts, the interest rates, and minimum payments. I = periodic interest rate.

With a template, you get a ready. Technically, these are spreadsheet templates that you can use with microsoft excel, openoffice calc, or google sheets. N = total number of repayment.

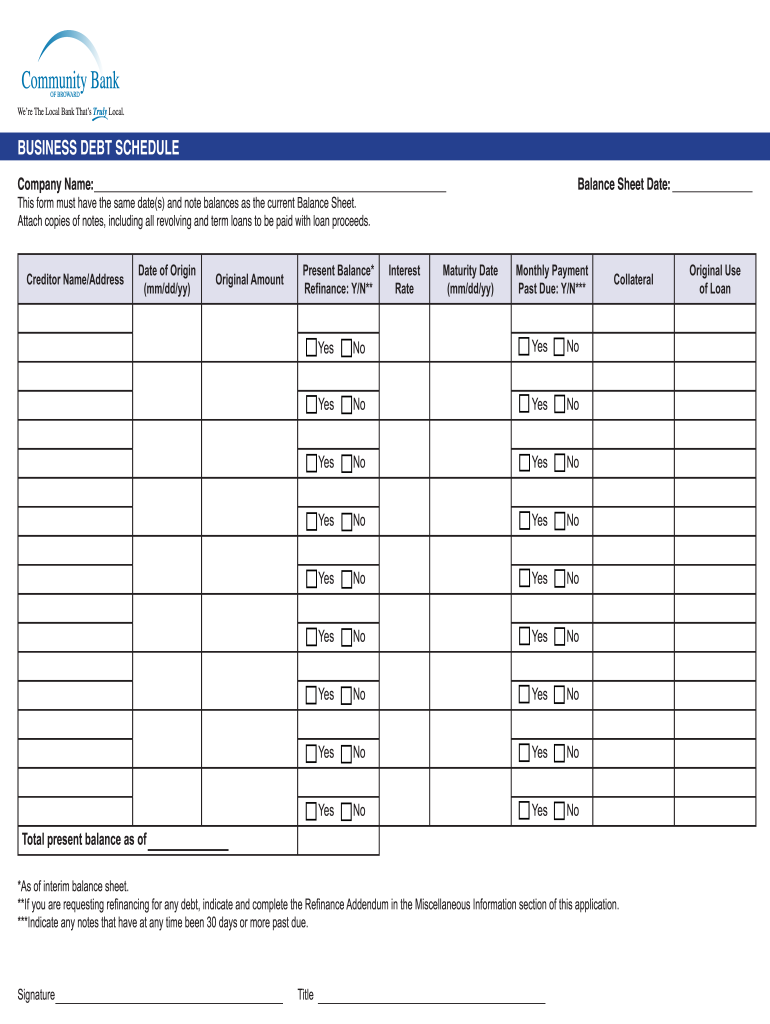

Find a budgeting spreadsheet the first order of business to paying. When you are owed a debt, and finding a way of huge amazement is very confusing for you then there is a need to manage and organize all of your debts. This page is a collection of various excel templates to manage debt and loans.

P = regular periodic payment. Your debt snowball spreadsheet will help you organize your debt, use simple formulas to calculate your debt payoff dates, order your debts from smallest to largest,. For that purpose, you can.

The answer is given by the formula: To name a few, our selection includes. This article will look at how to build these in excel, using the formulas pmt ,.

The ending debt balance cannot dip below zero, as that would mean that the borrower paid back more than the initial principal owed.