Cool Tips About Get Out Of Debt Budget Worksheet

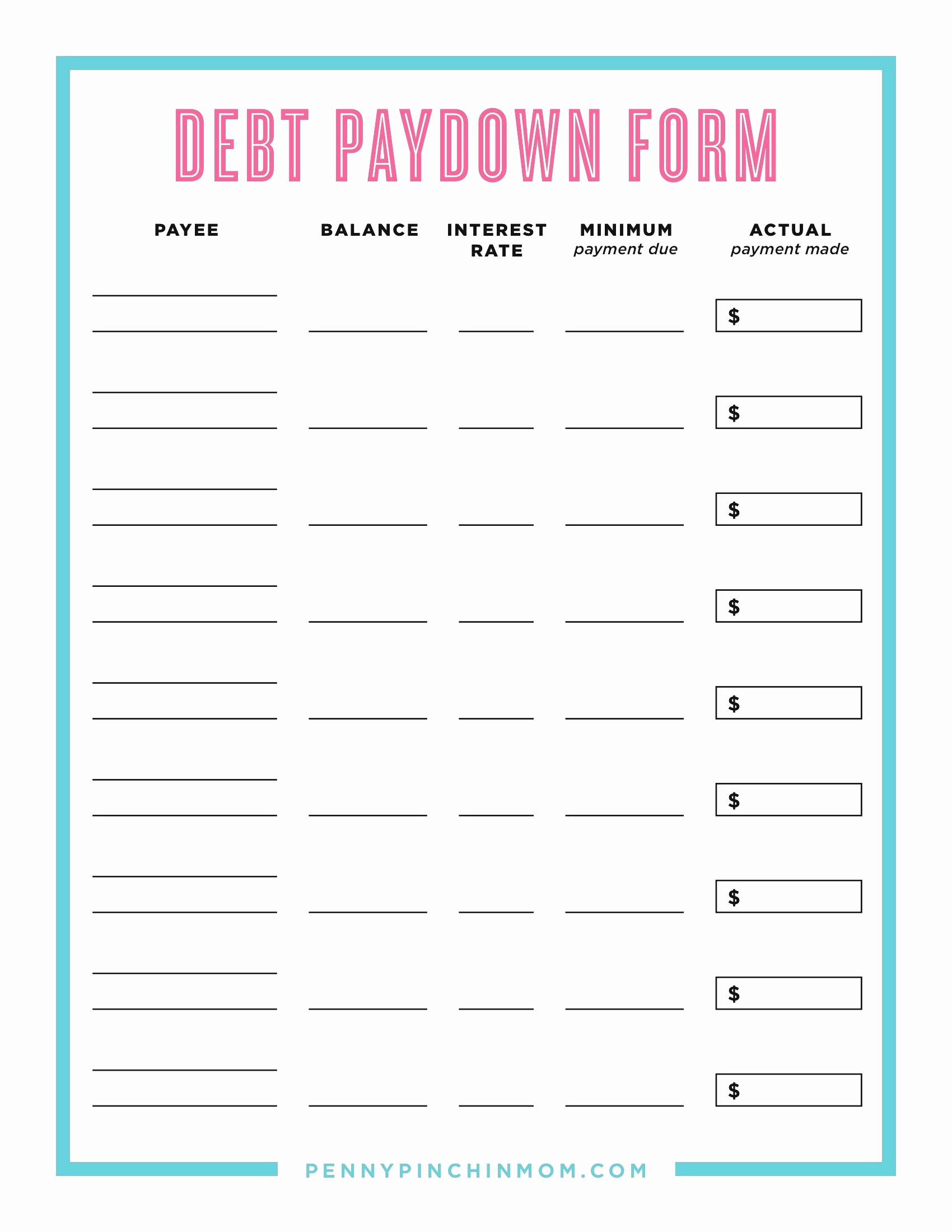

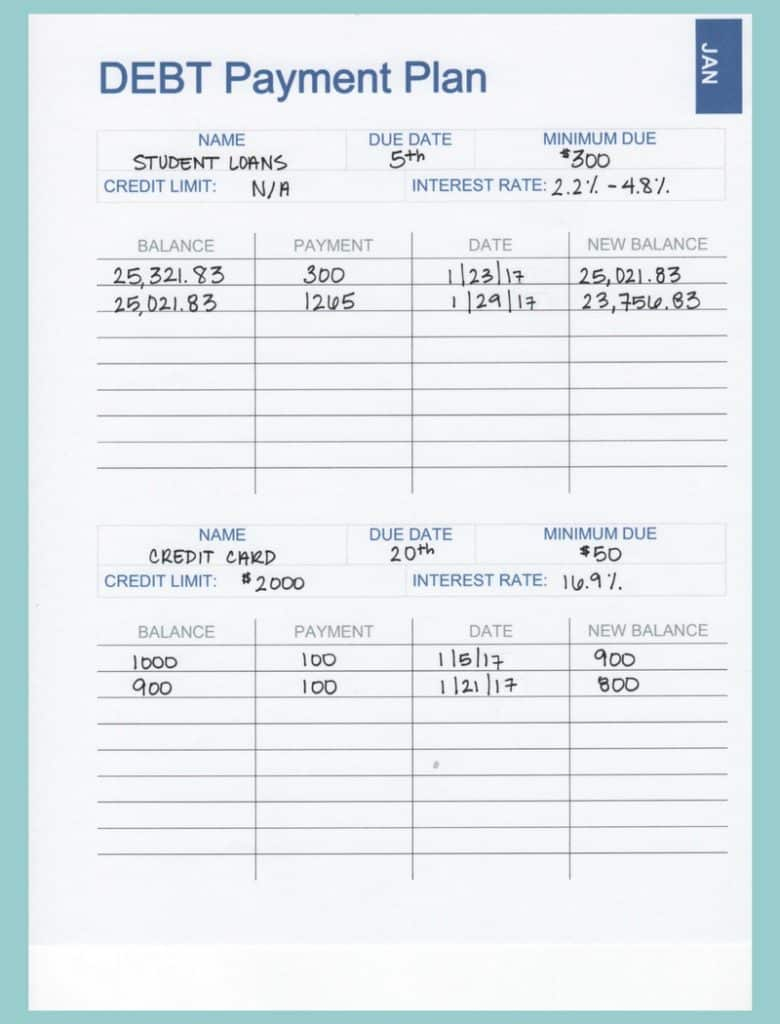

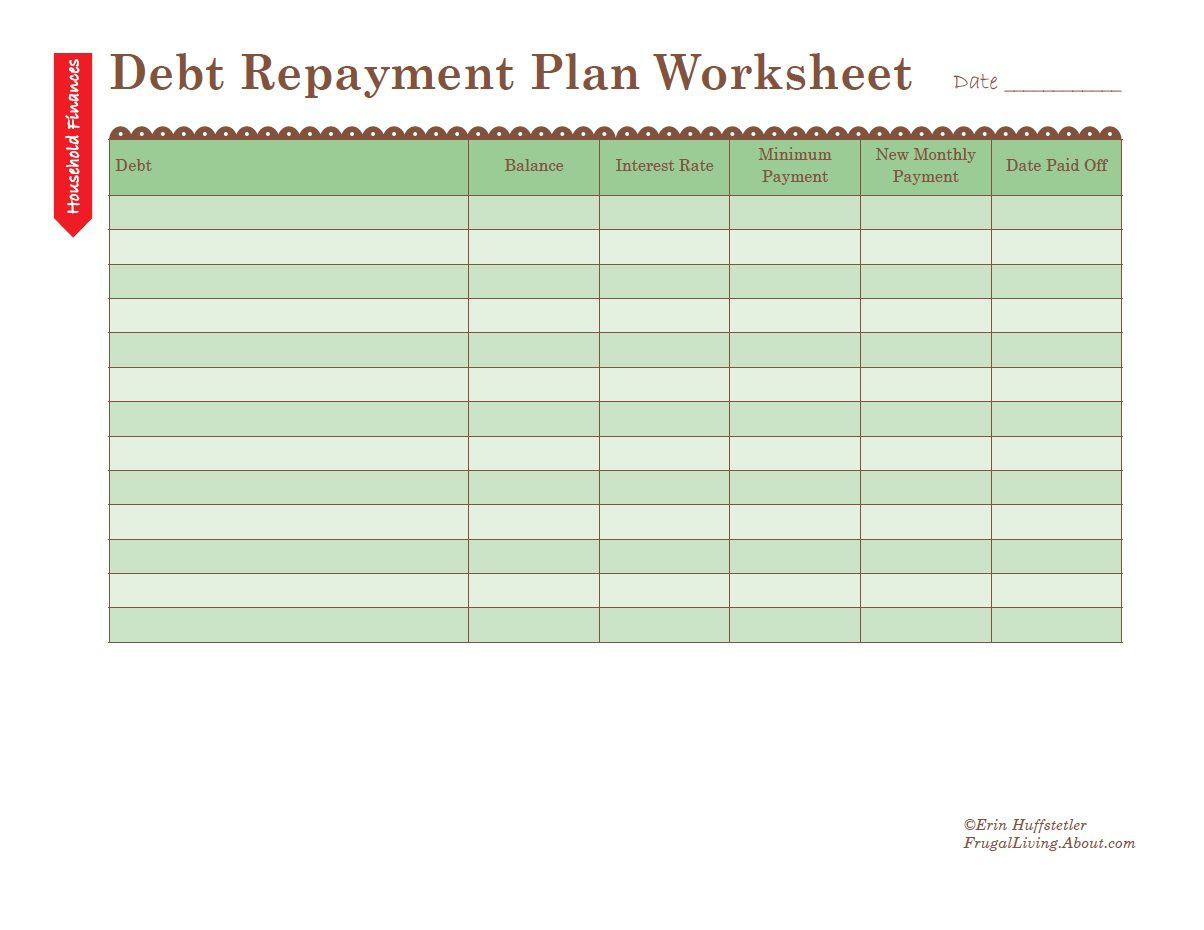

Also record the interest rate and minimum.

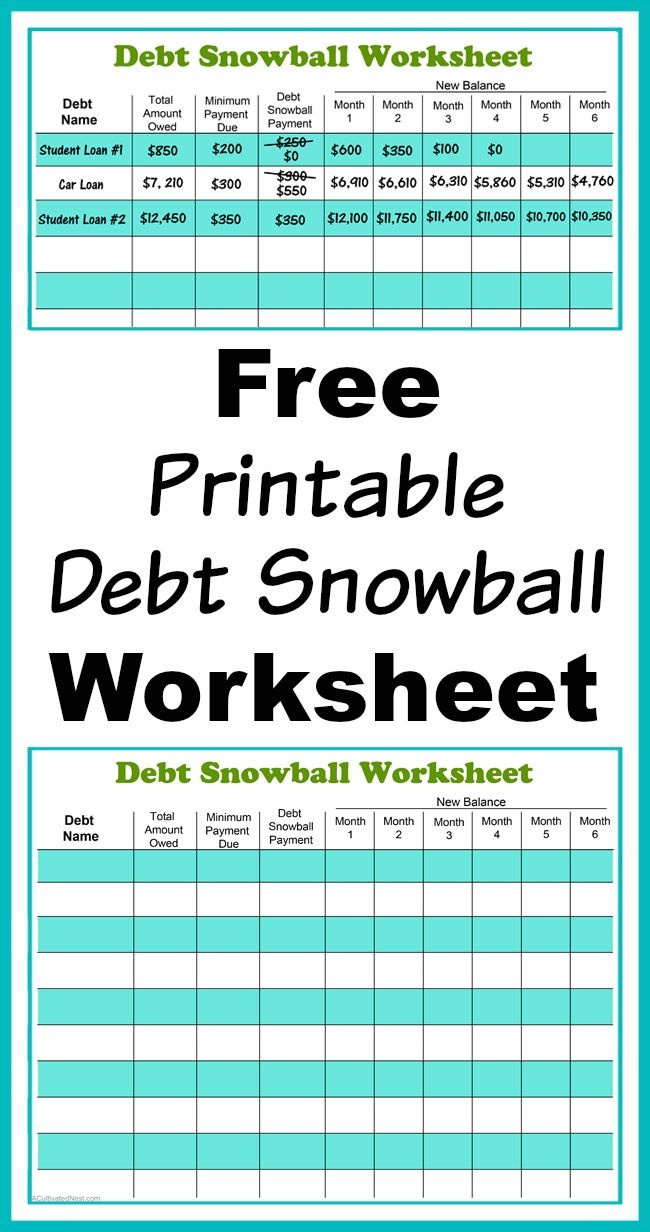

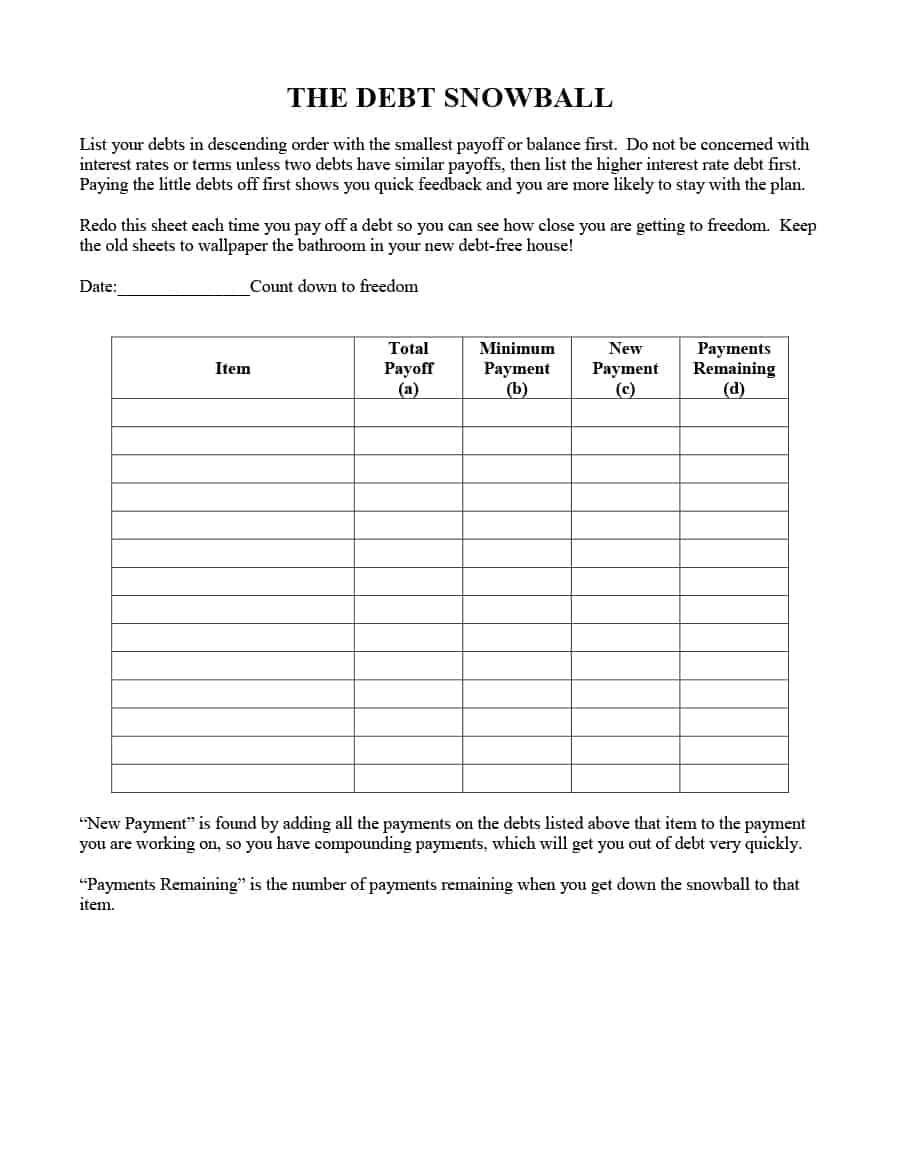

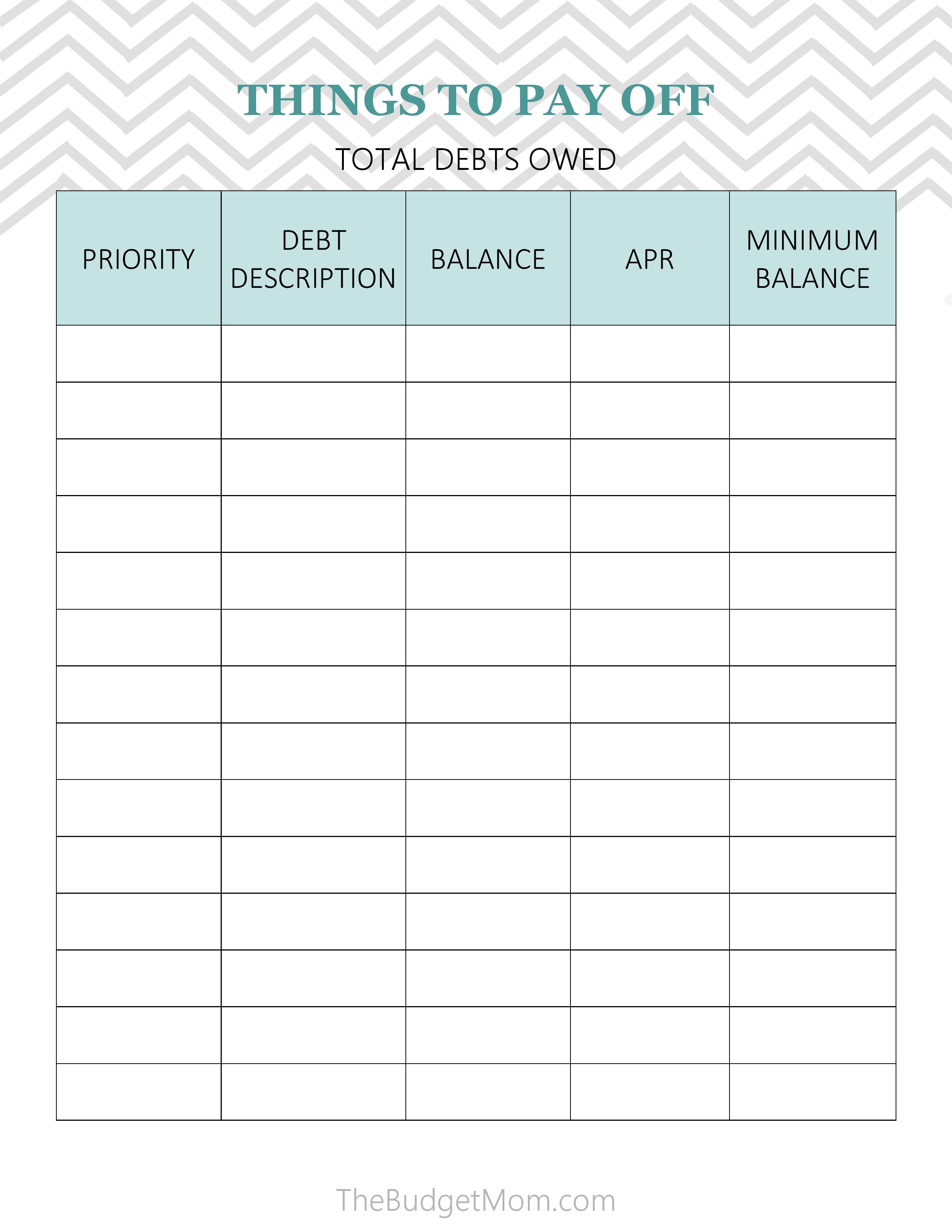

Get out of debt budget worksheet. When you do, make sure to include your balances, interest rates and minimum payments. You can organize your snowball debt as follows: Once that is paid off, use that money to pay the second smallest.

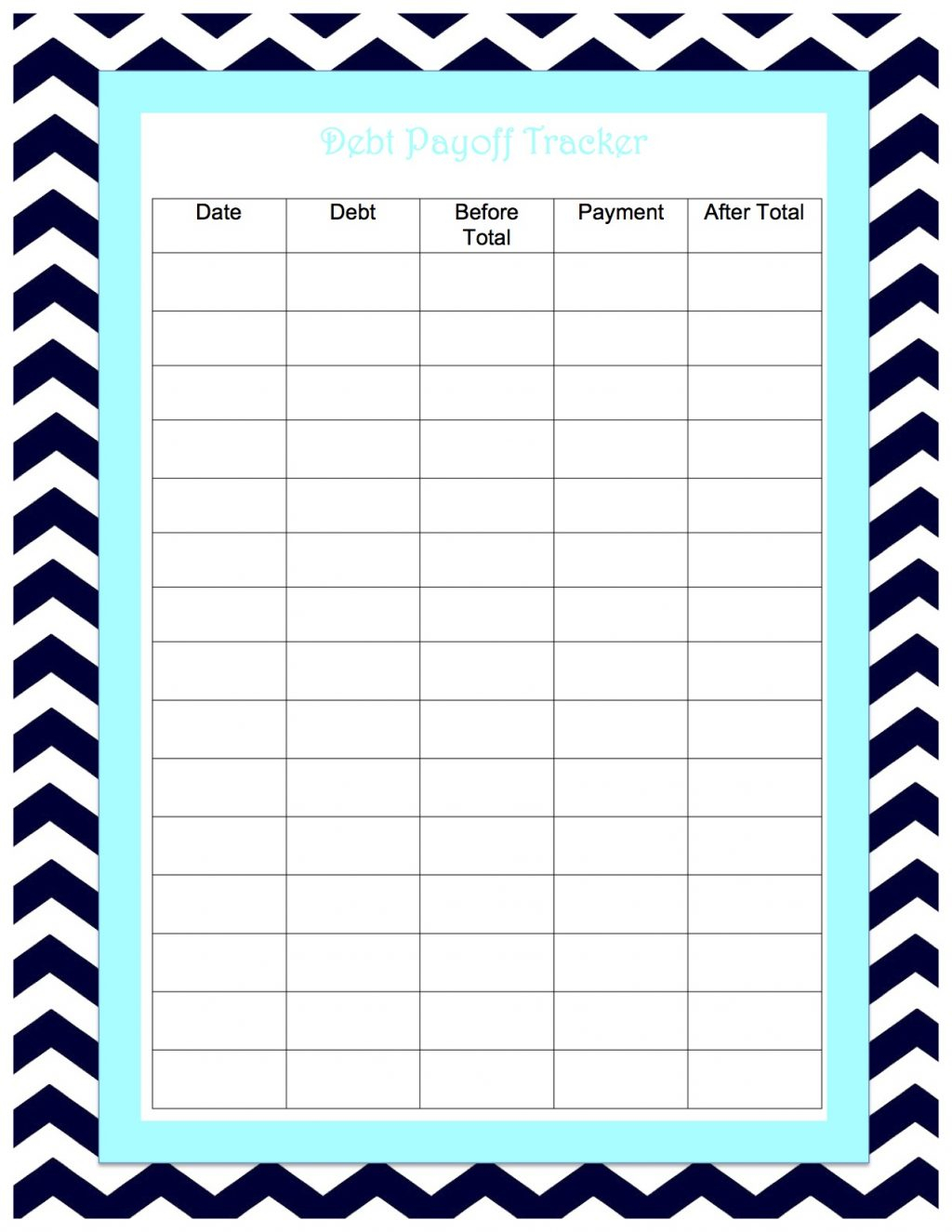

Make a debt list the first step in creating a plan to pay off debt is to calculate what debt you have, what you owe, and how much you owe. Make the minimum payments on each of the debts. List all your debts in the first column.

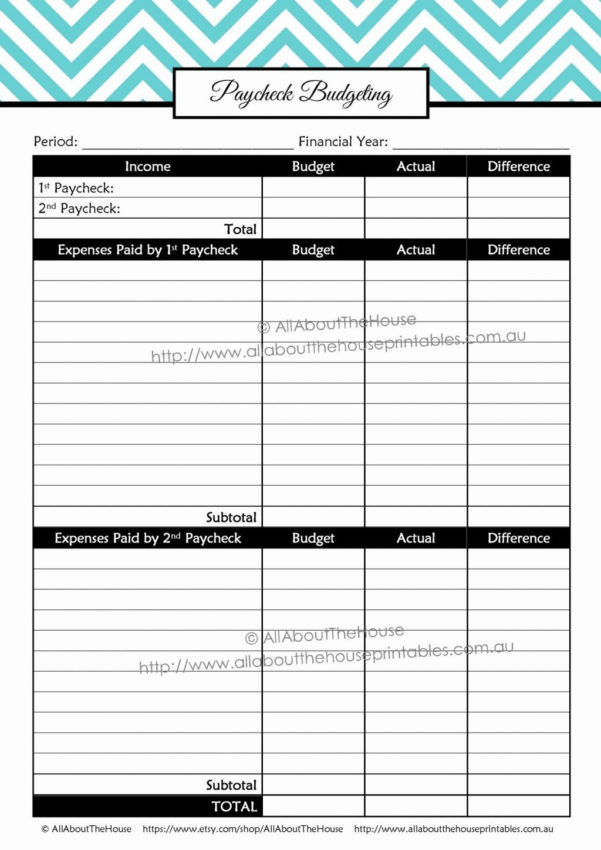

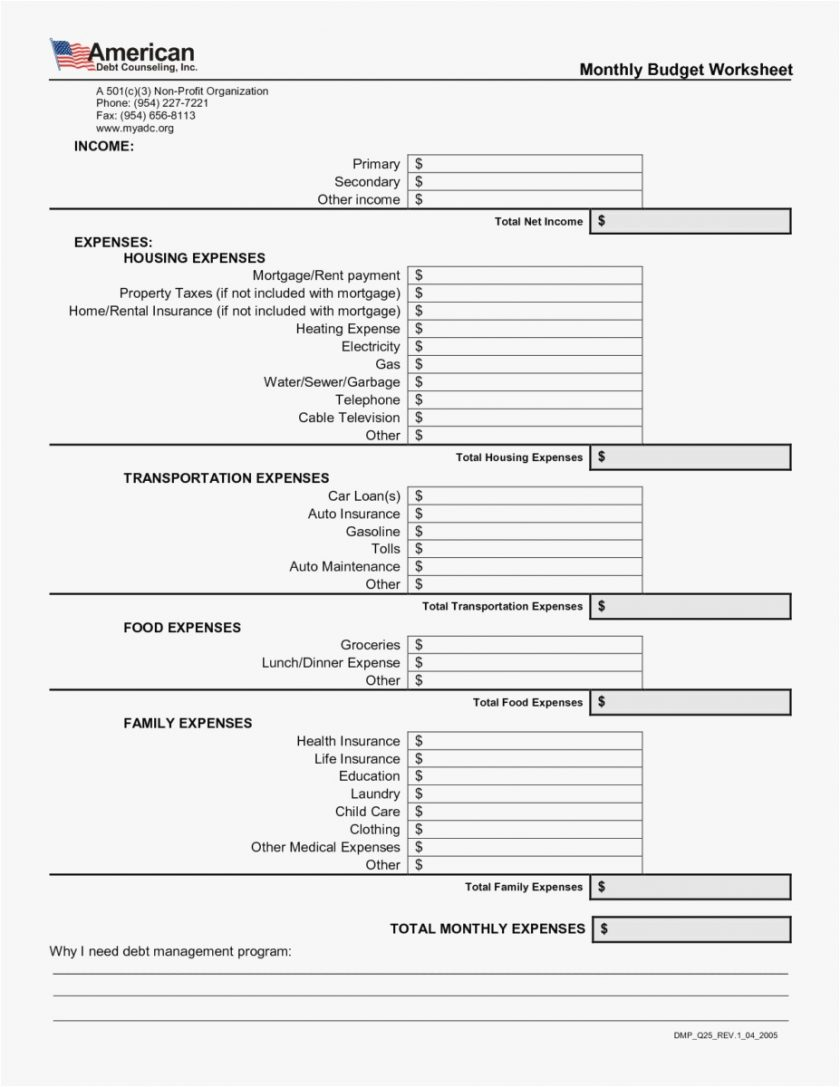

On the worksheet, you will. One of the best ways to do so is to list them on a spreadsheet. The free printable monthly budget templates that come in this binder are super helpful to get on track to saving more money, budget effectively, and paying off.

Click “new” in the upper left. Make minimum payments on all debts except the smallest—throwing as much money as you can at that. Combine your debt reduction plan with an overall budget.

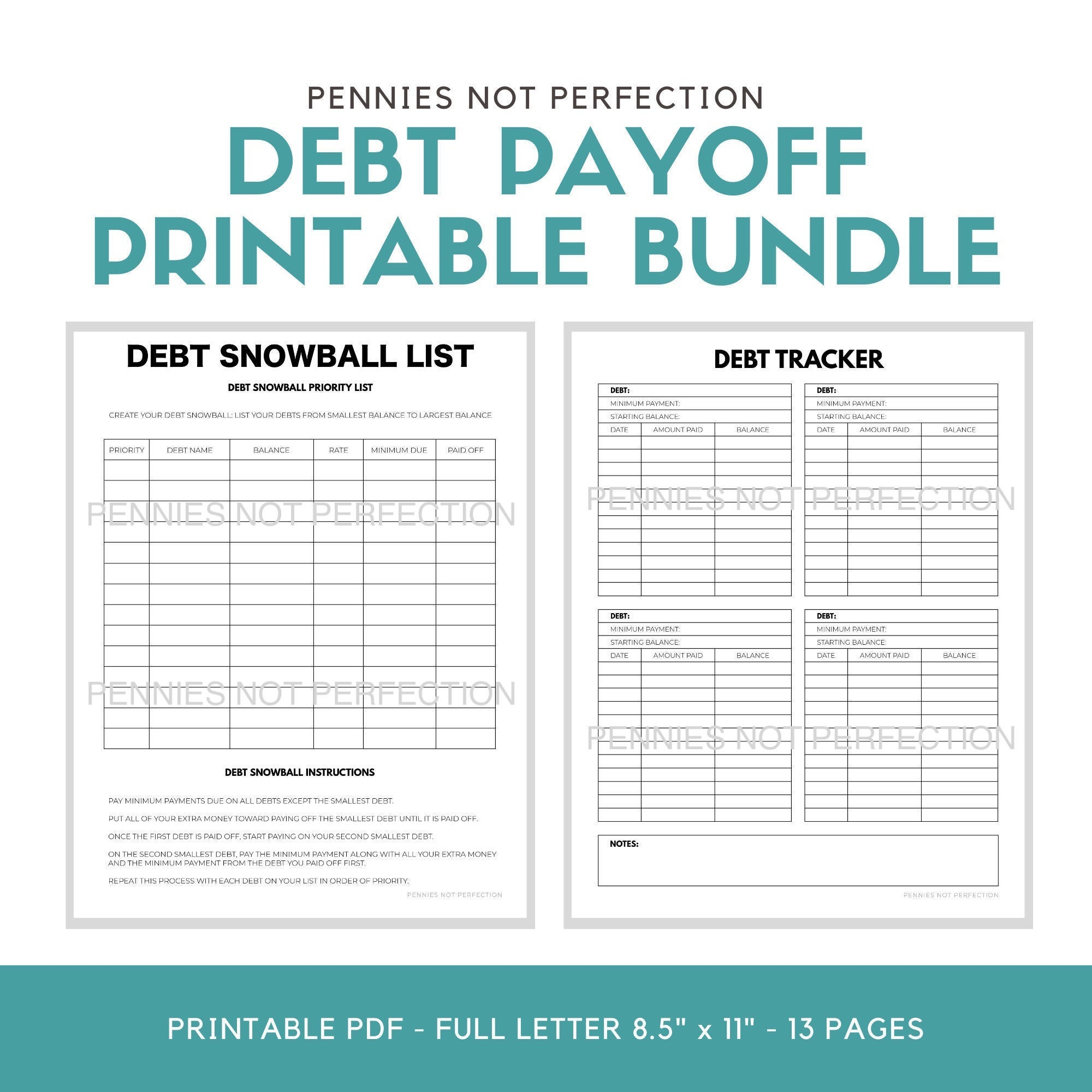

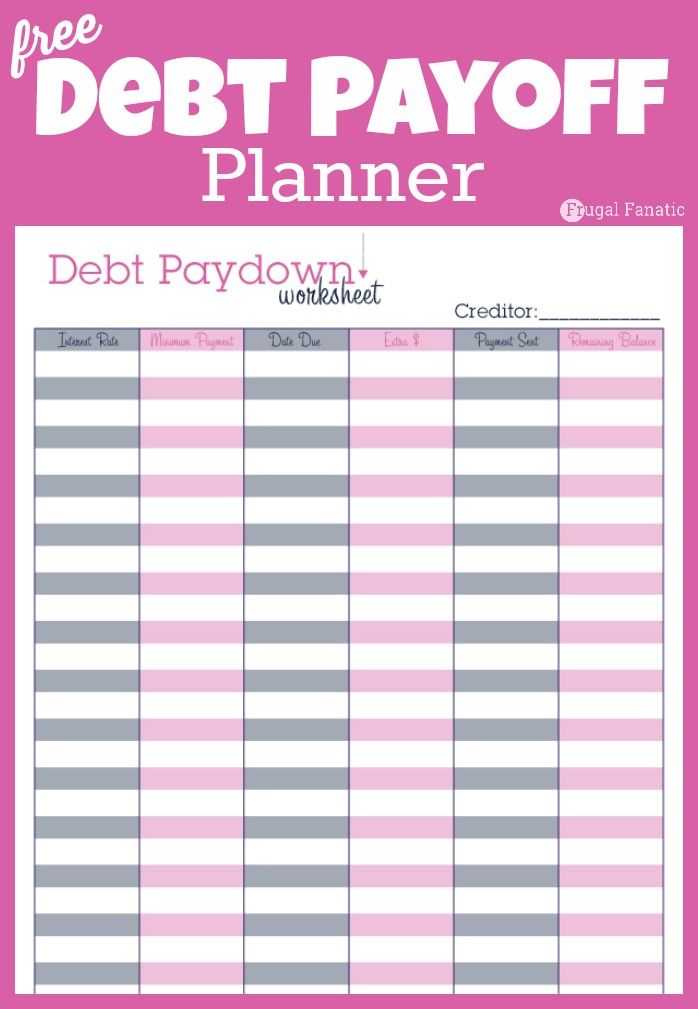

Using a debt snowball worksheet helps you prioritize your debts and figure out your debt payoff plan (you can download ours below). Find “the best debt avalanche excel spreadsheet” that you just uploaded and saved. You’re 30 seconds away from debt relief.

As you fill in the free excel budget calculator spreadsheet,. It will help you take control of your money, live within your. These help you in planning a strategy for paying off your debt.

List your debts from smallest to largest balance (not interest rate) 2. If you want to learn how to budget and get out of debt, this free budget calculator spreadsheet is for you! Log into each account to get the actual balance (don’t just guestimate).

It boasts plenty of tools to calculate monthly and yearly expenses. You can use this free budget planner worksheet to help you get your finances in order. Get out of debt with this monthly budget.