Brilliant Tips About Tds Reconciliation In Excel

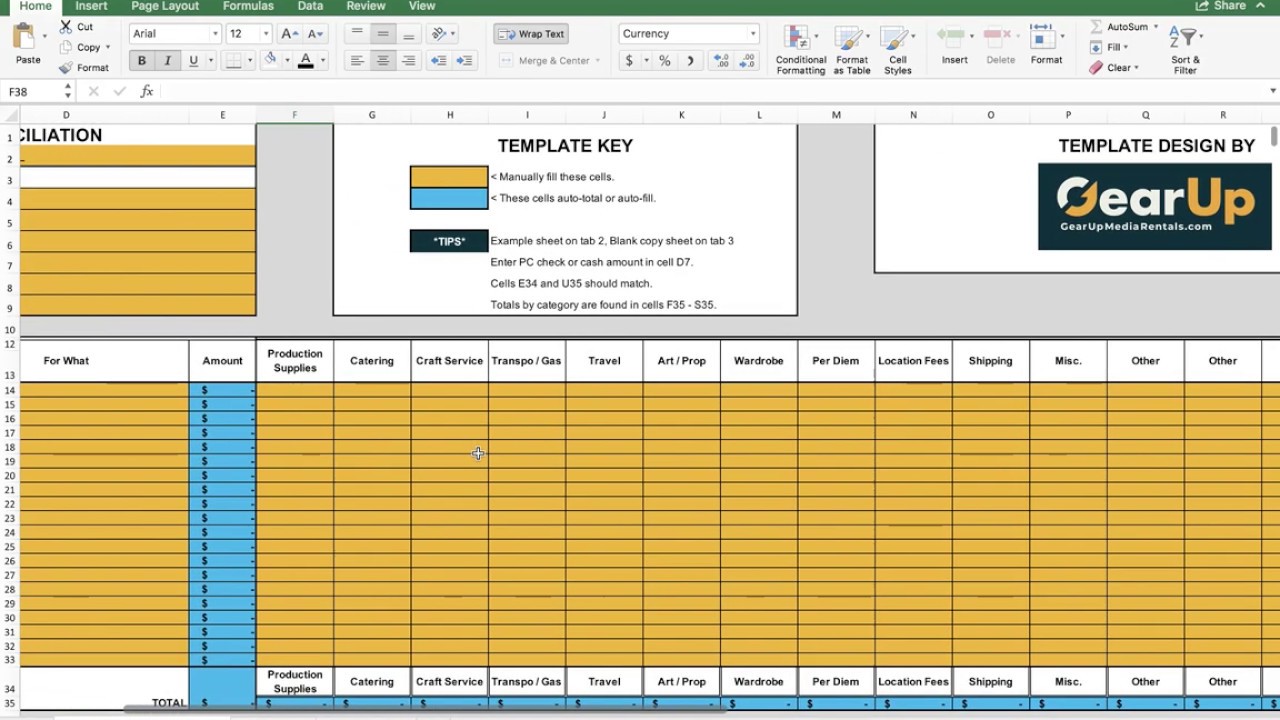

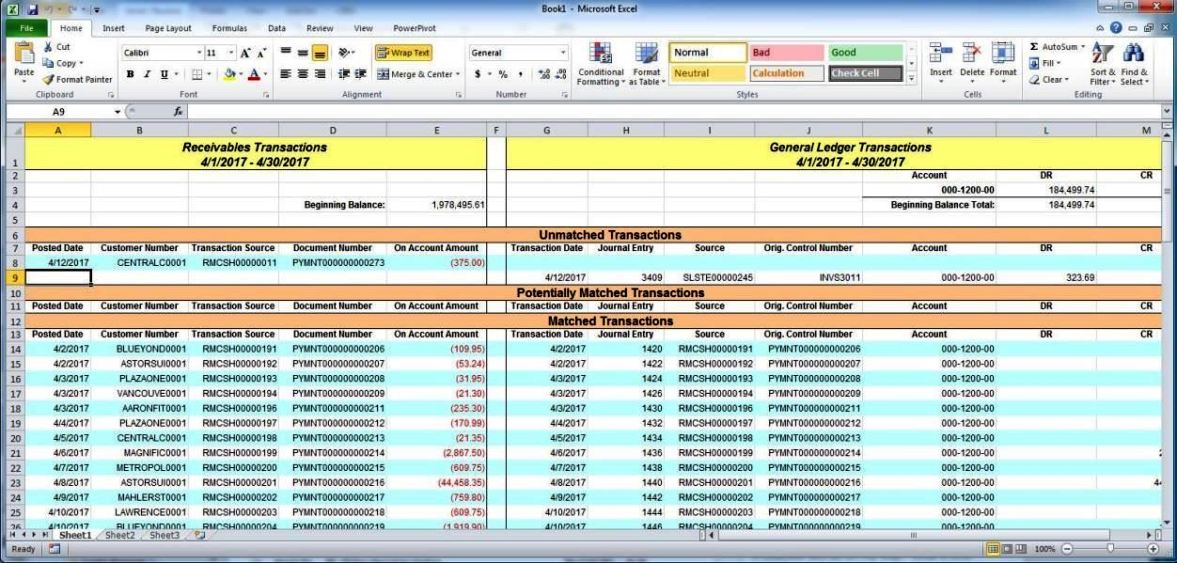

Convert and reconcile your raw data file into 26as format in microsoft excel with a single click.

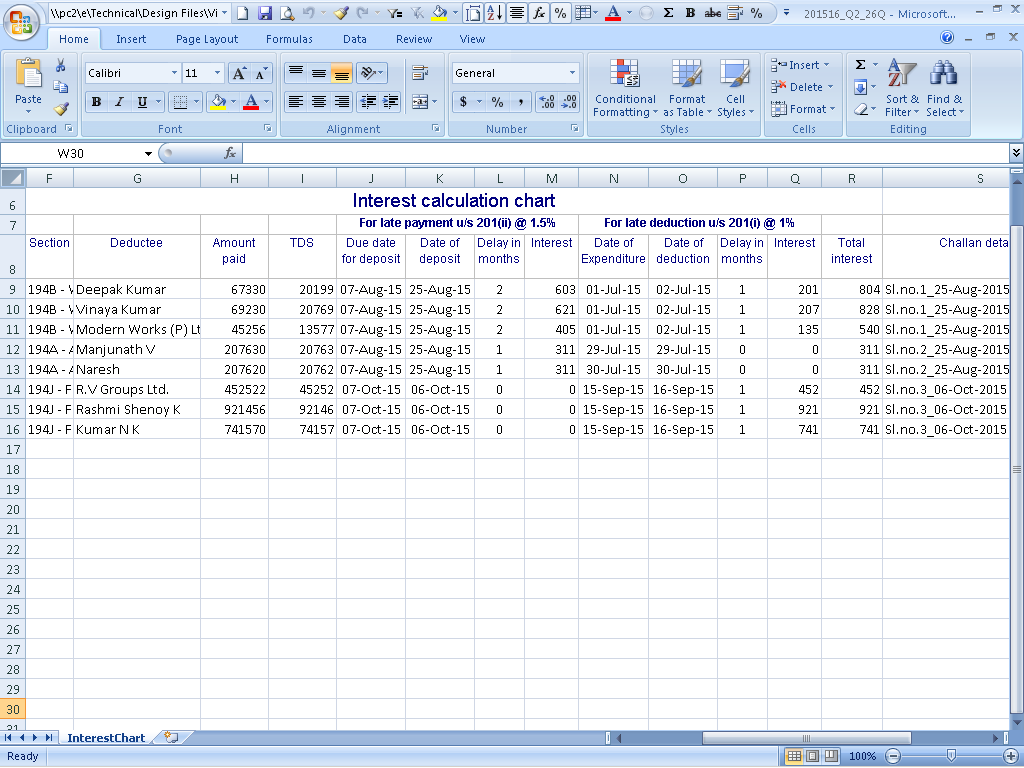

Tds reconciliation in excel. Automate your tds reconciliation. How to do tds reconciliation. Calculate yearly salary let’s assume that the monthly salary of a person is rs 70,000.

Convert and reconcile your raw data file into 26as format in microsoft excel with a single click. It h ighlights error at validation process which help. Gather all pertinent tds data, such as tds certificates that have been received, tds that has.

Other files by the user. For any query or question contact me on [email protected] & you can also contact me for any other topic.thank you🙏💕 for watchingplease share wi. Finding the duplicates firstly, create an additional column named duplicate check as shown in the following picture.

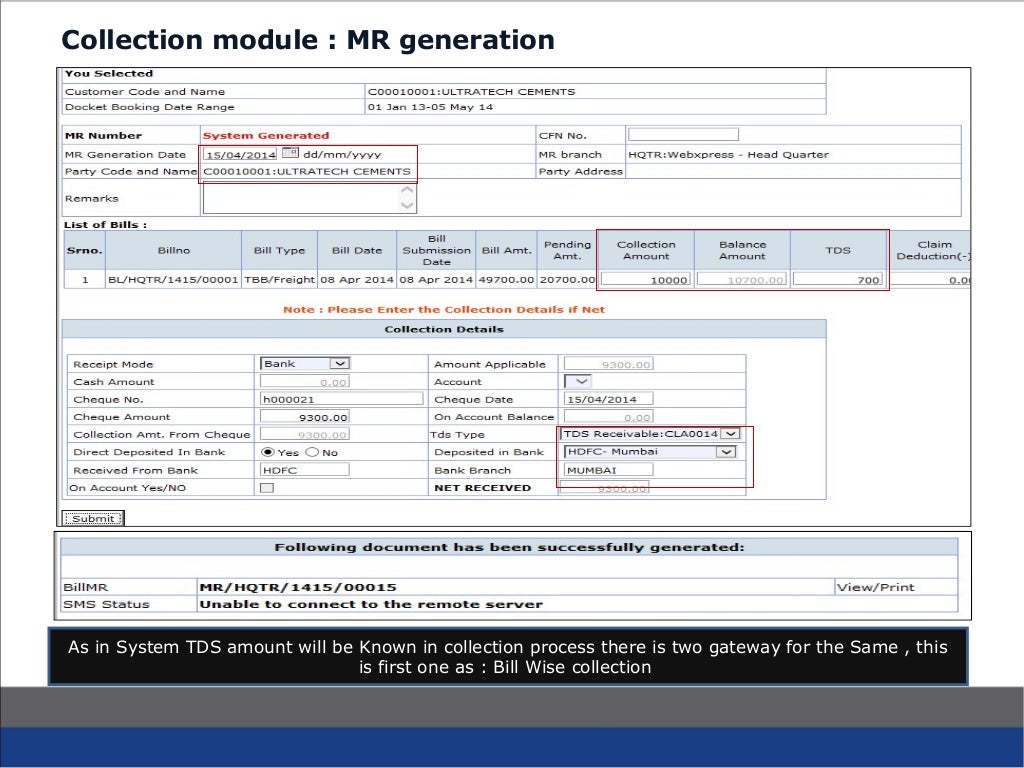

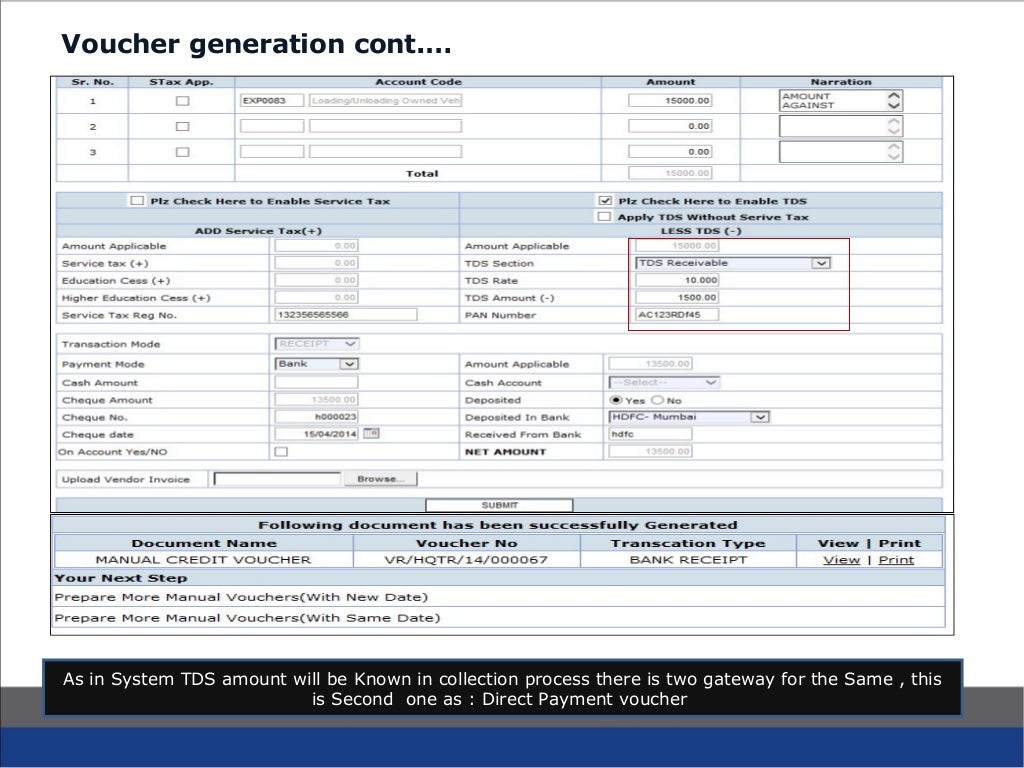

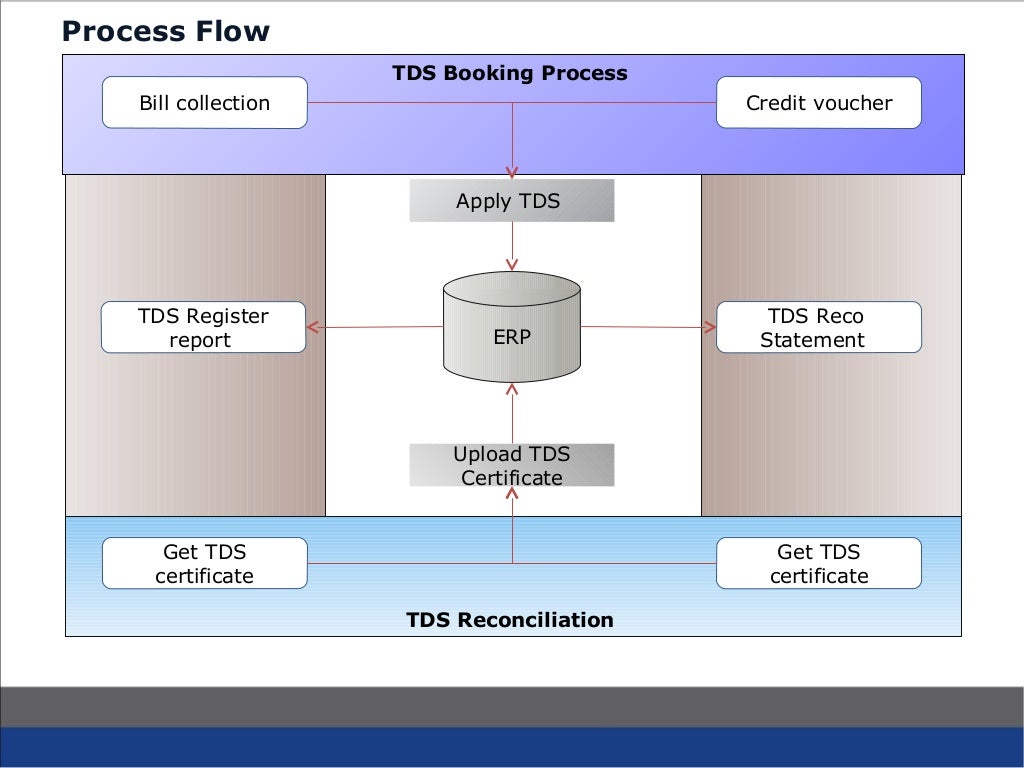

Analytical tcs or tds reconciliation dashboards with actionable reports are enabled for digitally managing such tcs or tds by identifying potential mismatches, mitigating cash. Now, i will calculate the annual salary. The question is simply that if a business needs to reconcile then it should reconcile with 16a issued by the deductors or the tax credit statement of 26as.

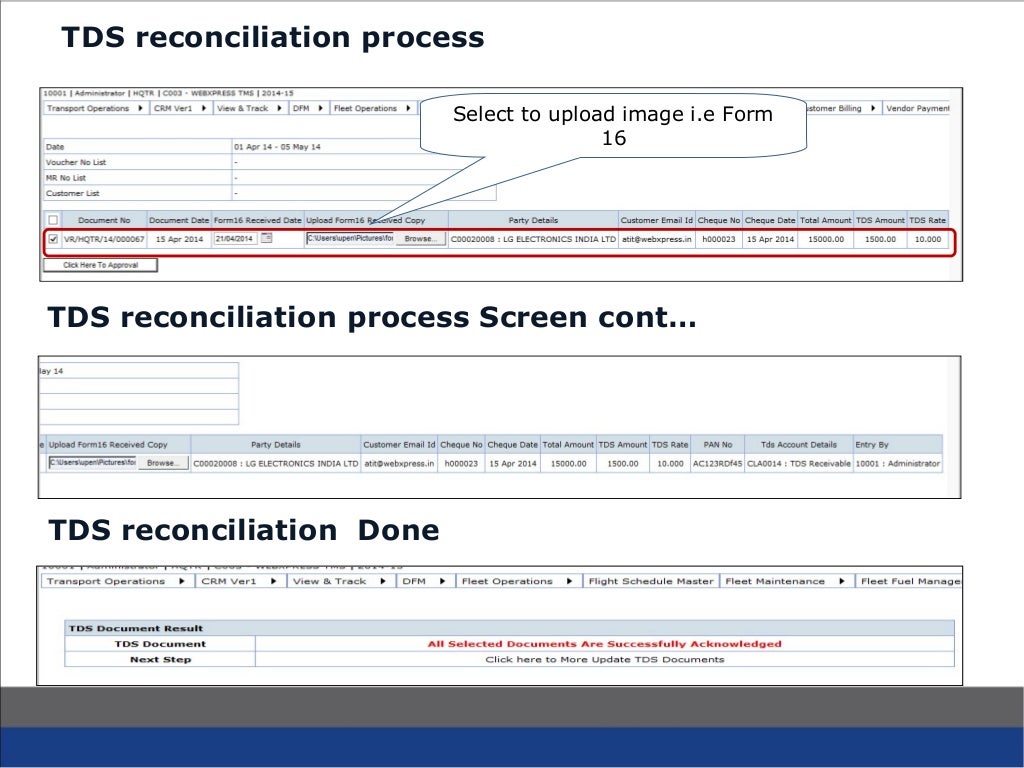

Tds reconciliation analysis and correction enabling system | home | government of india notice inviting tender (nit) for retender for selection of managed service. In this video we will show you how to prepare a tds working in such a manner that you get all the necessary data to file the tds return and also your tax. Reconcile tds deduction with this ststement #xlsx.

It is excel based very easy to use. Tds working in excel. Taxreco has been discussing it since feb 2021 as to how tds section 194q will impact or has already begun impacting the way that tax teams work in companies.

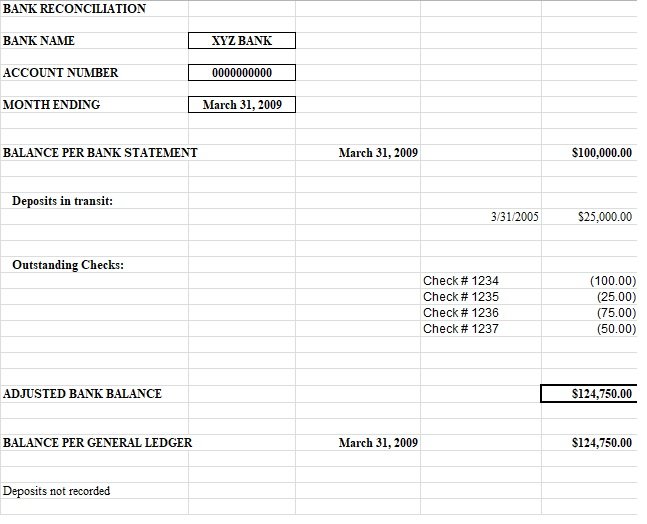

We can use this excel utility for calculating tds amount, for. By regularly reconciling tds details with form 26as, taxpayers can ensure the accuracy of their tax records. When you match your or reconcile your tds deduction calculation with 26as (form in which the tds deduction appears) it is called a tds reconciliation.

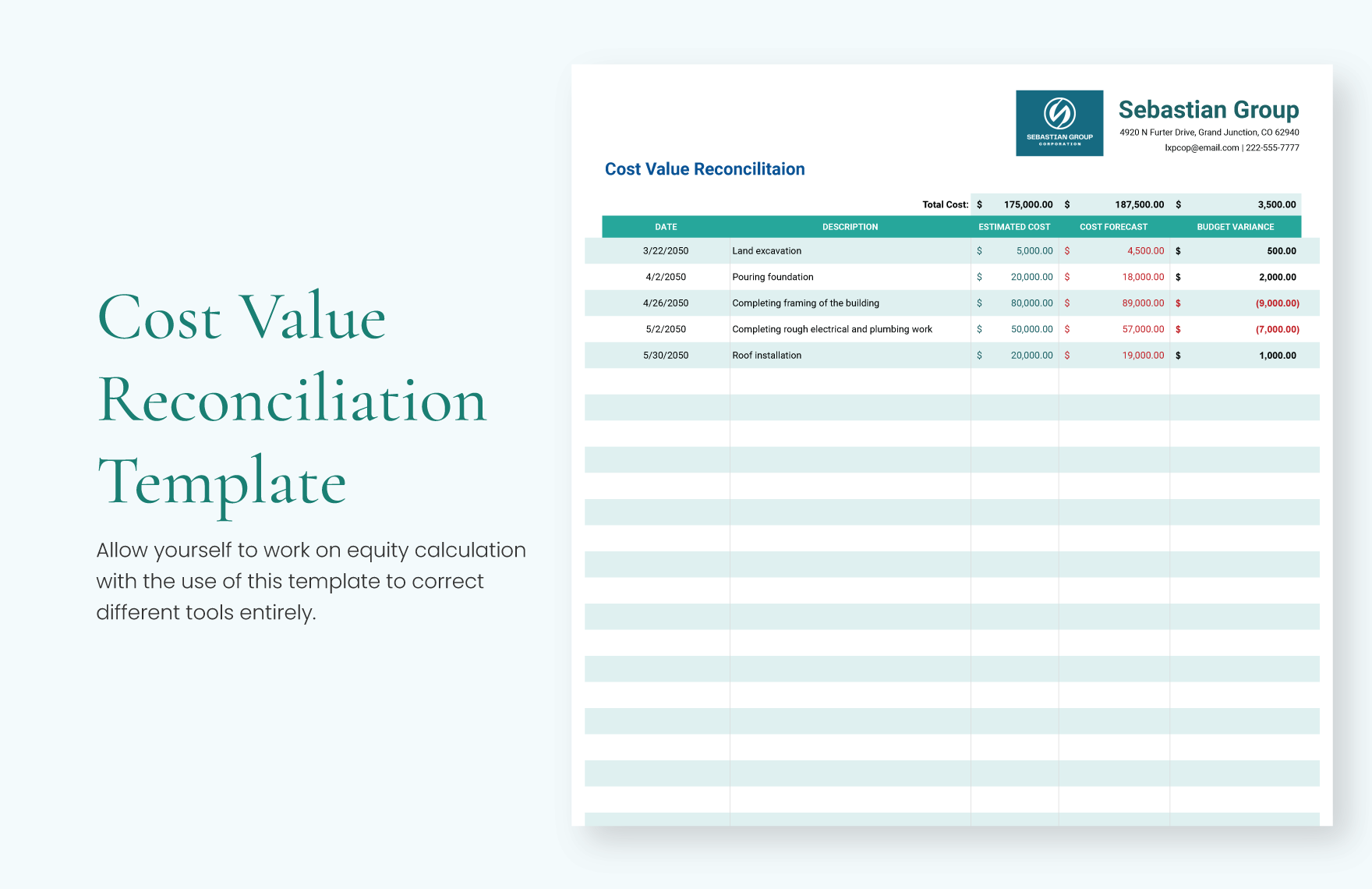

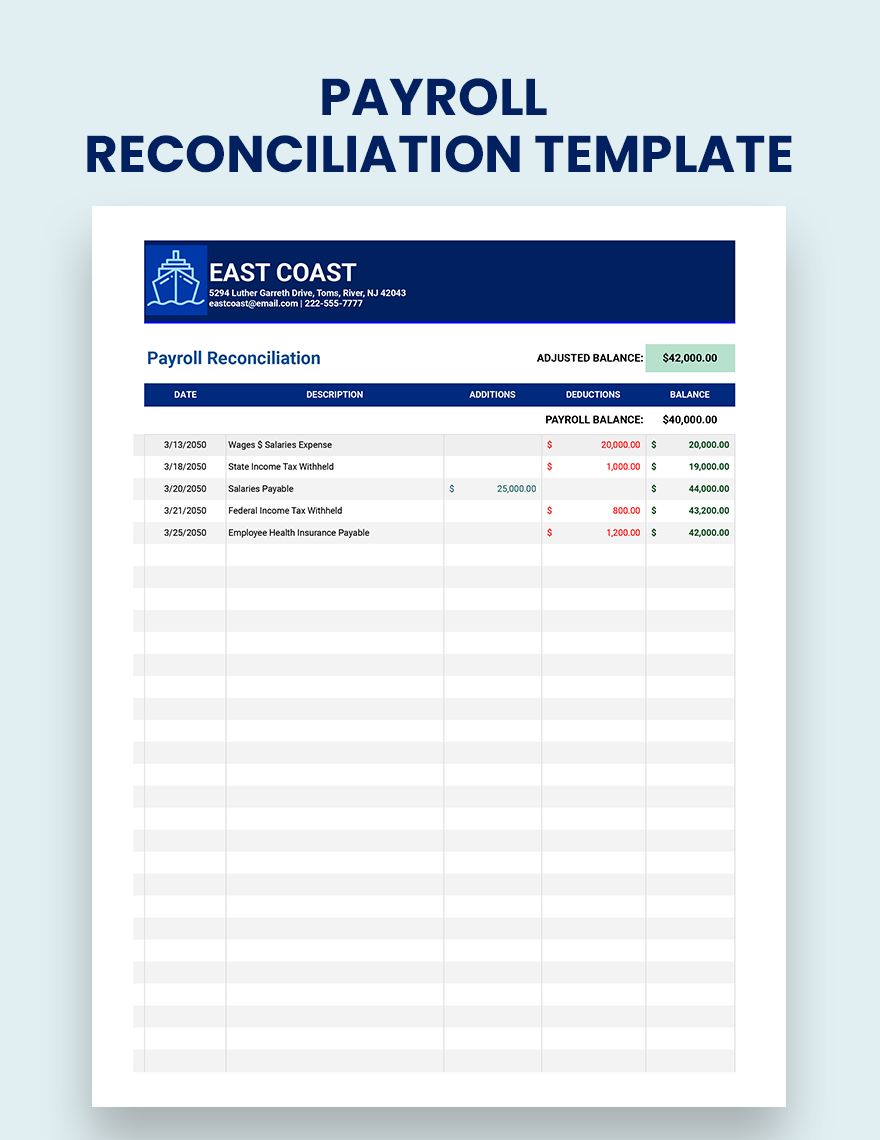

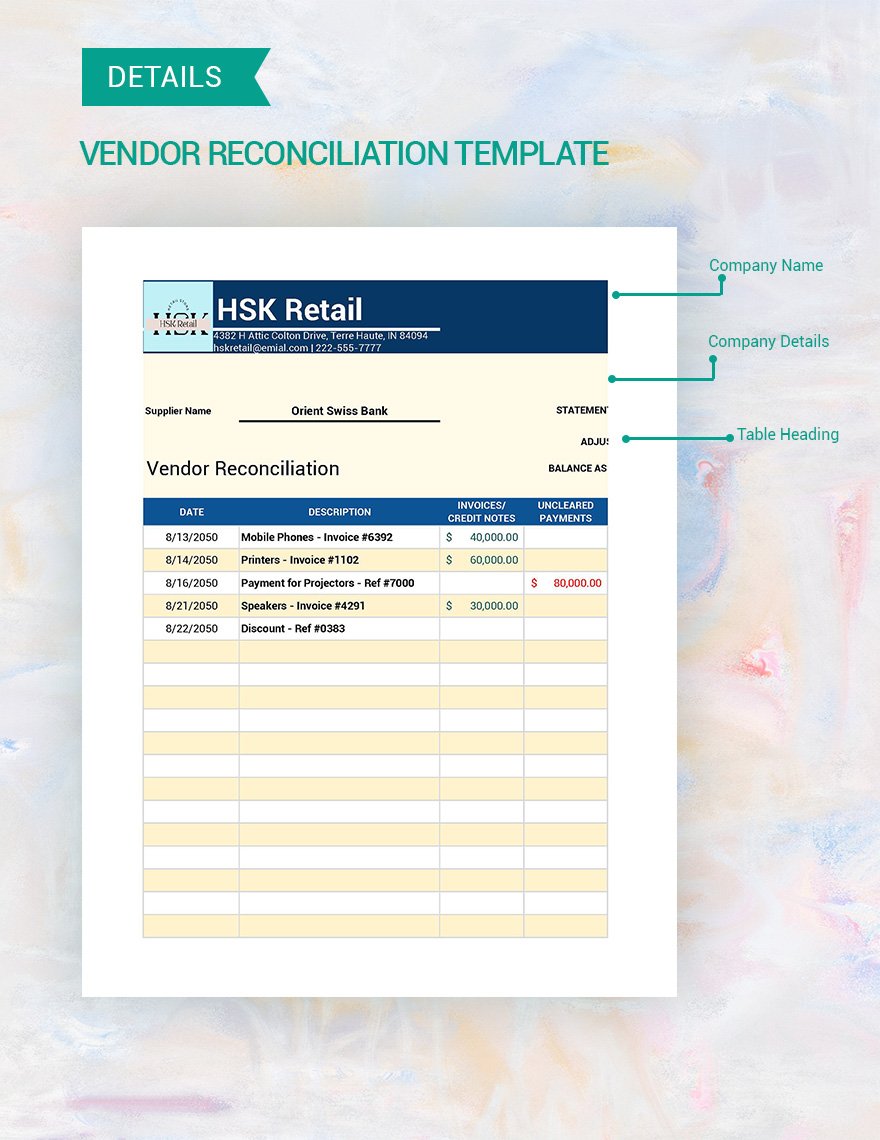

Other files by the user. How to prepare a tds reconciliation format in excel? Using a technology enabled tool for the task will help in managing tds and tcs credits as per form 26as and books of accounts and minimising leakages.

Following that, enter the following. The need for a robust reconciler unreconciled tax credits notices seeking explanation/ rejection of claims loss of business revenue tax credits can be claimed only if.