Outrageous Info About Zero Based Budget Worksheet

Get expert advice delivered straight to your inbox.

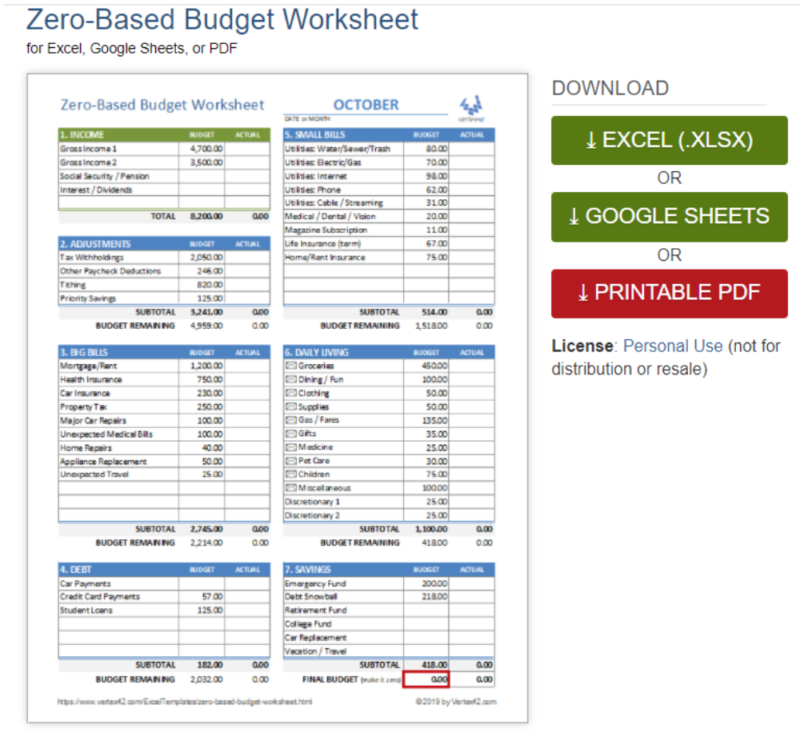

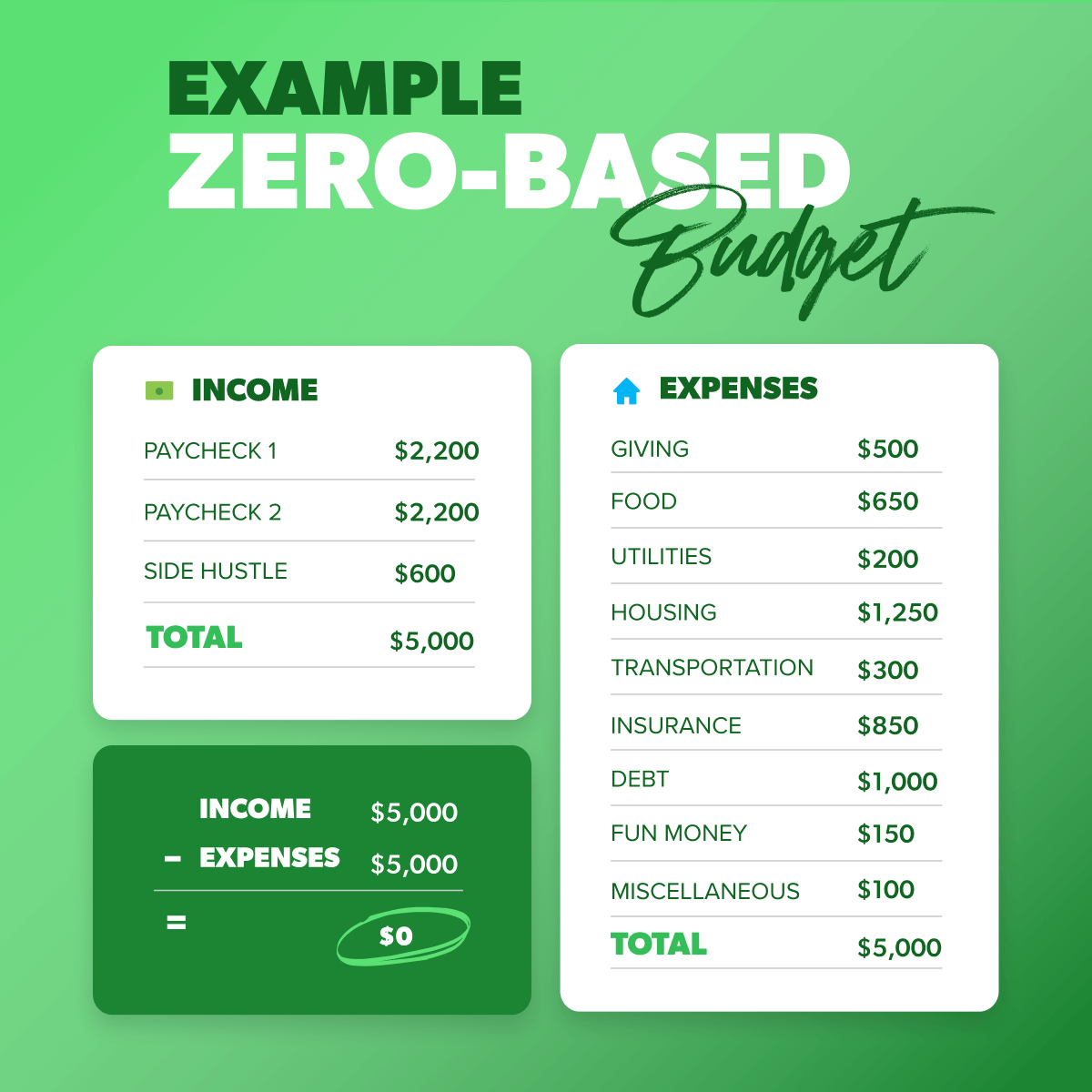

Zero based budget worksheet. $0 note that once you've budgeted for the essentials, the other spending categories can be for anything else. You would start budgeting from scratch without using previous trends as your basis. Budget percentages guidelines a good rule of thumb for budgeting often shared is to save 20%, spend 50% and enjoy 30%.

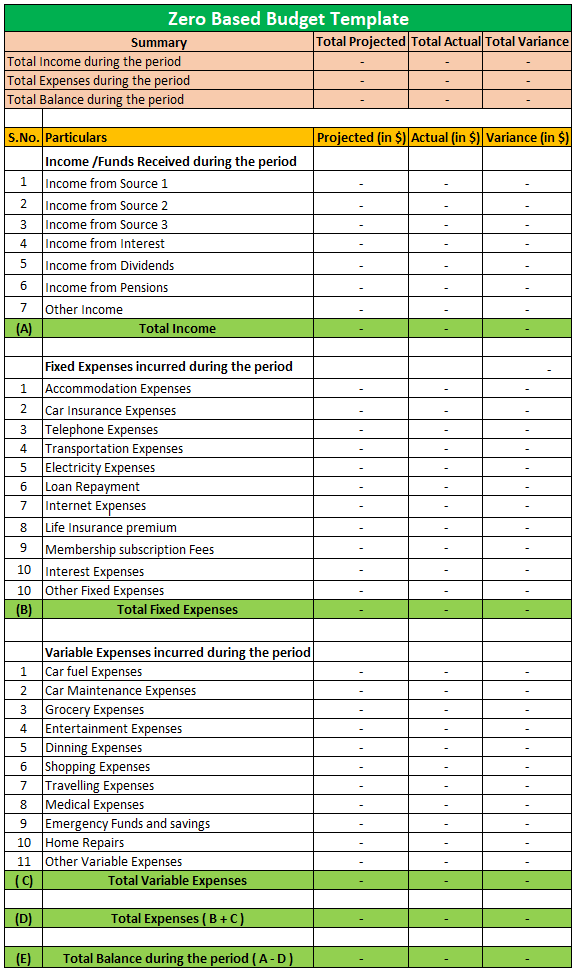

A zero based budget helps you choose how to spend each dollar before it even hits your bank account. Make a plan for leftover money 4. The zbb differs from the conventional or incremental budgeting system since it starts with a base of zero.

This budget is also known as the dave ramsey budget and it is very simple to understand. It creates an intentional plan for your money with your biggest goals and priorities in mind. At the end of the worksheet, if your budget is fully balanced, you should have zero budget left over.

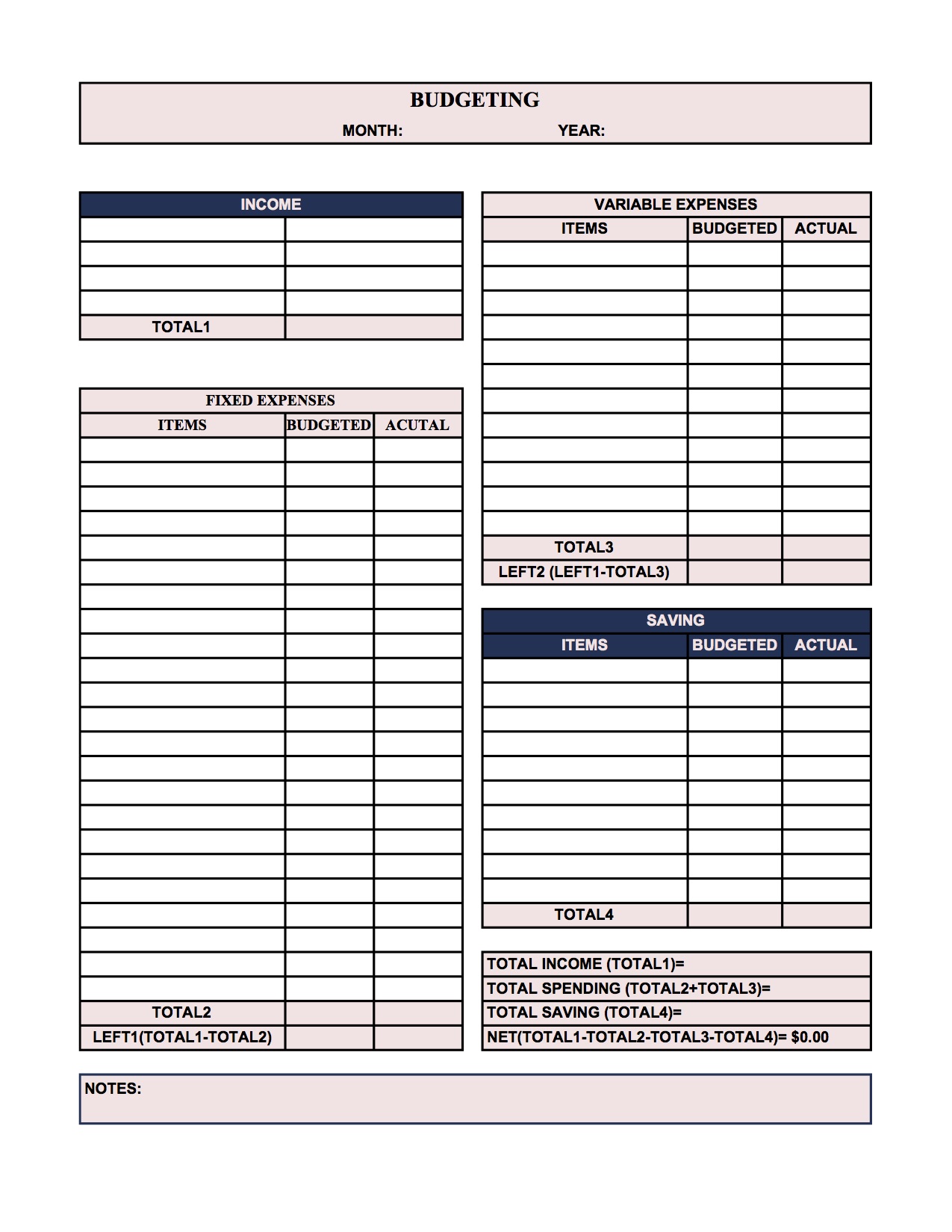

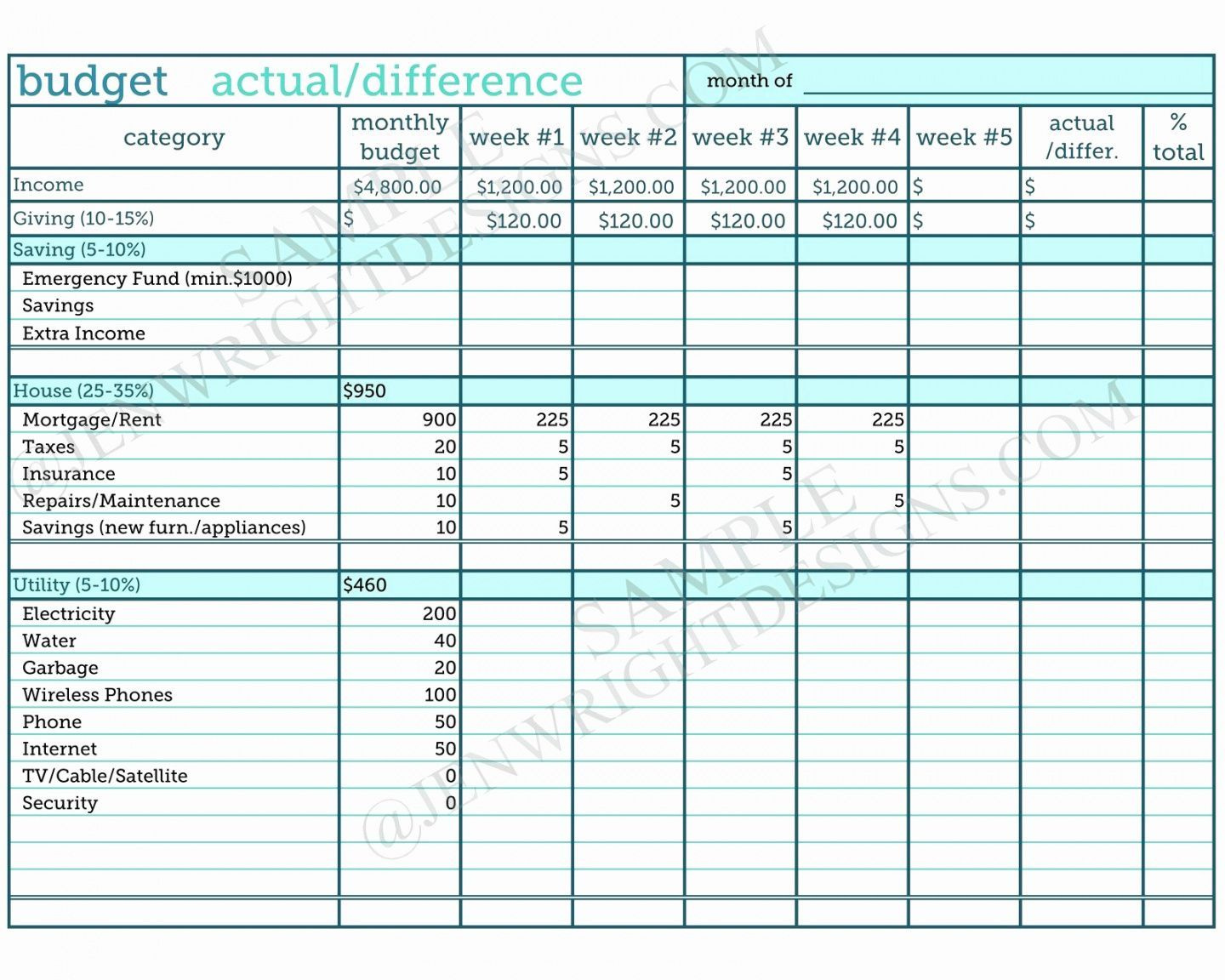

At the beginning of each month, plan out your budget for the next month by creating a new copy of the spreadsheet and adjust budget & income info. This is a strategy to allocate every dollar that you make. Or maybe you’d like to be able to see your entire year in one sheet.

Transform your finances with a zero based budget worksheet No, this does not mean you let your bank account reach zero. Determine your monthly expenses 3.

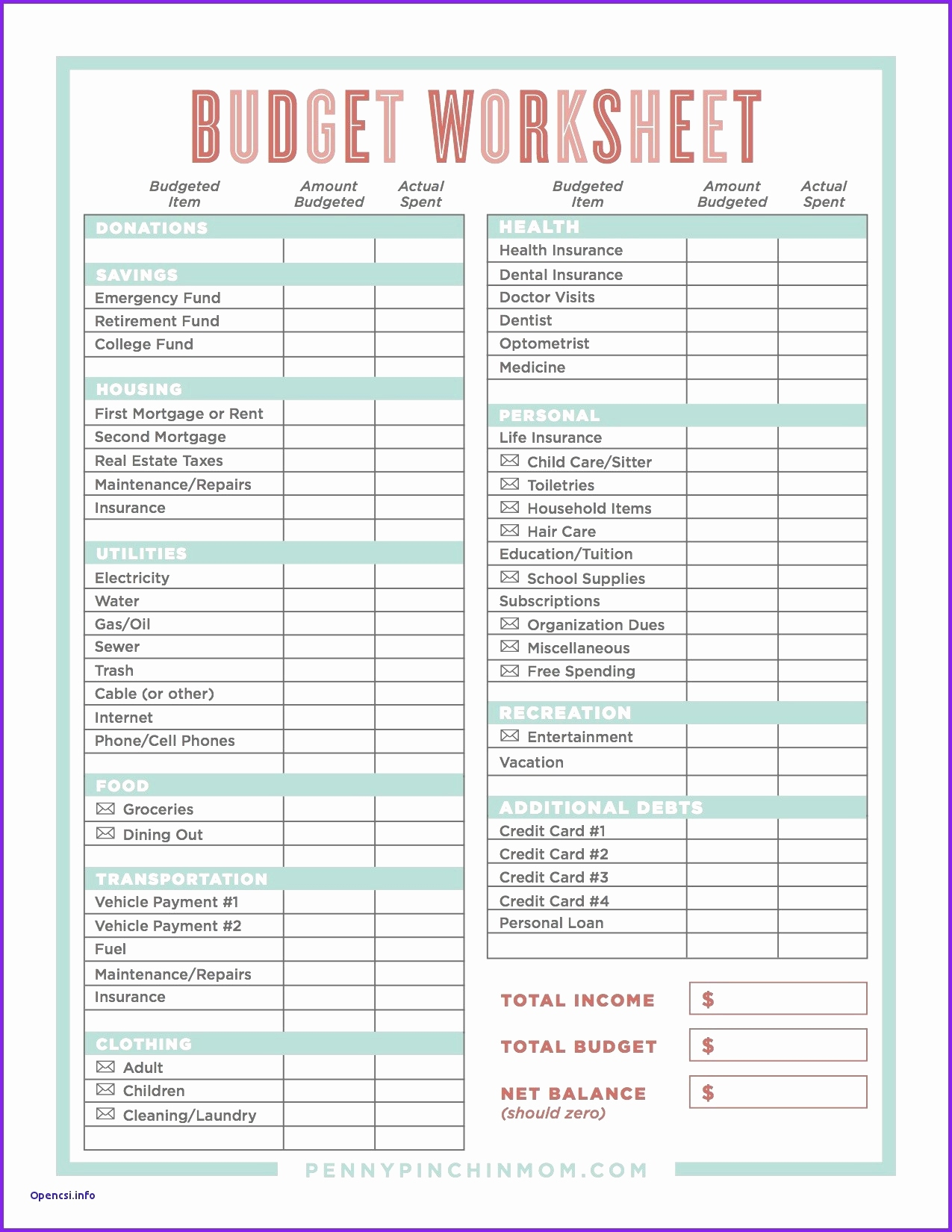

Some of your income will be going into savings, some will be going towards expenses, some might. Step by step guide to creating a zero based budget worksheet that will help you track your income, fixed and variable expenses, savings goals, and debt tracking on a monthly basis. Do you have a stable income and are just trying to organize your finances?

Identify your goals is your primary goal to pay off debt? This free zero based budget spreadsheet is designed to help you quickly create and maintain a zero based budget. And the final surplus should be $0.00.

A zero based budget template can help you reach your goals, and that’s important. For example, you'd include any income you receive from your job, side hustles, rental properties, alimony, child support, investment income, you name it! Calculate your monthly income 2.

You might like the 50/20/30 method. It is when you will get zero if you minus your expenses from your income. Want to pay off a credit card in six months?

This page contains affiliate links, which means that if you buy something using one of the links below, i may earn a commission. If you have consumer debt you would replace the.