One Of The Best Info About Accrued Payroll Reconciliation Template

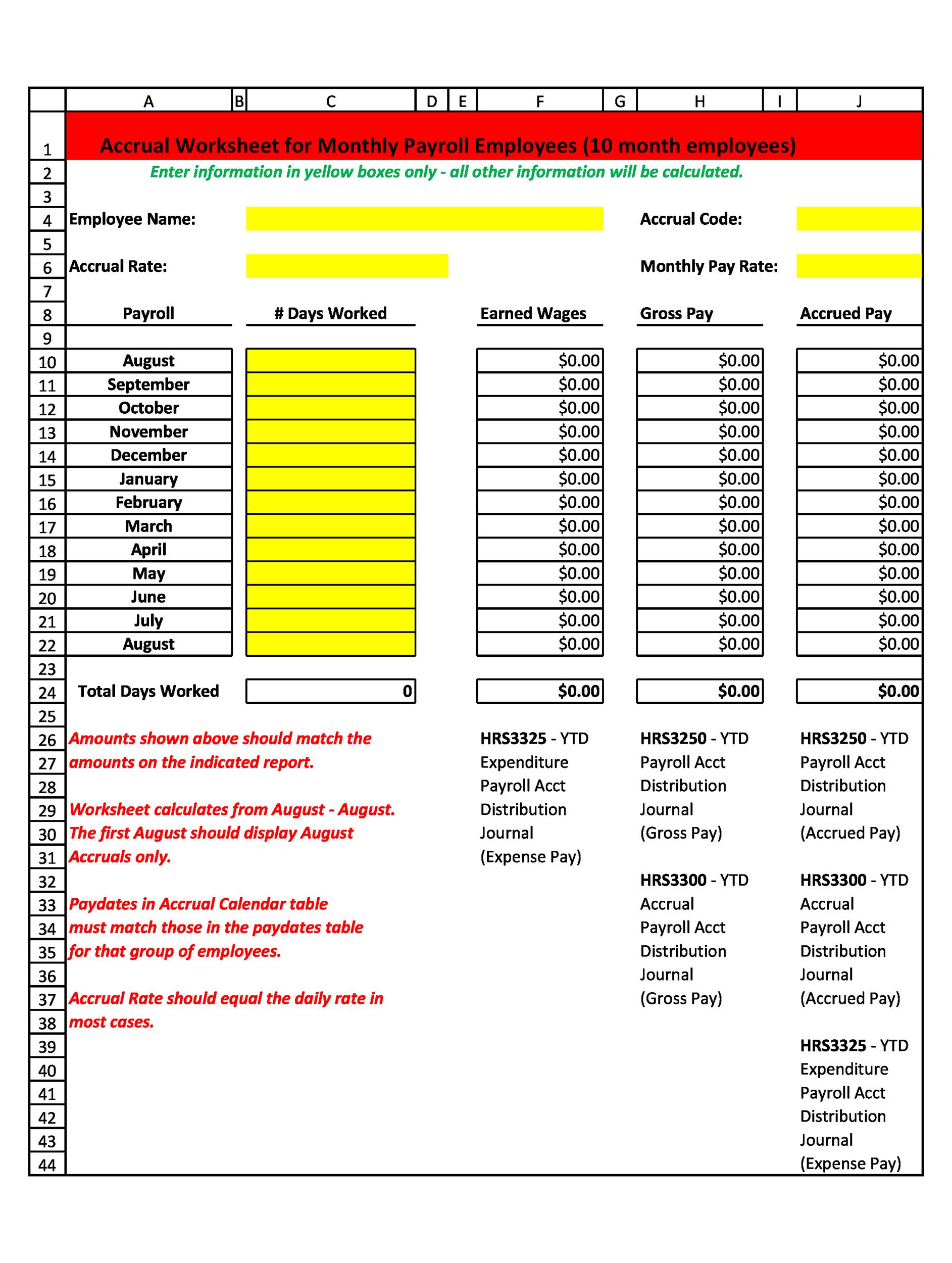

Using the accrued payroll reconciliation template.

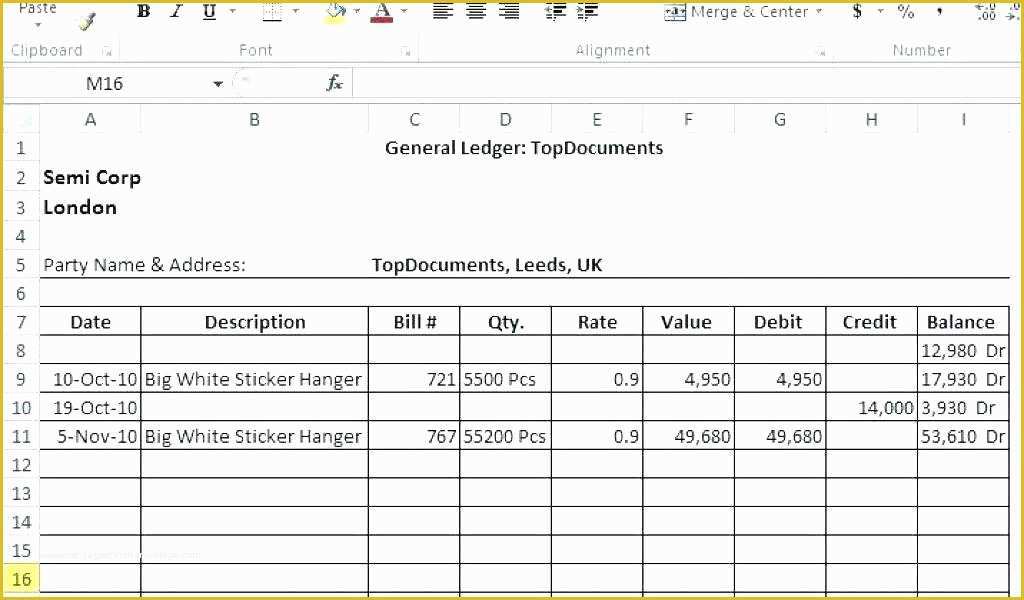

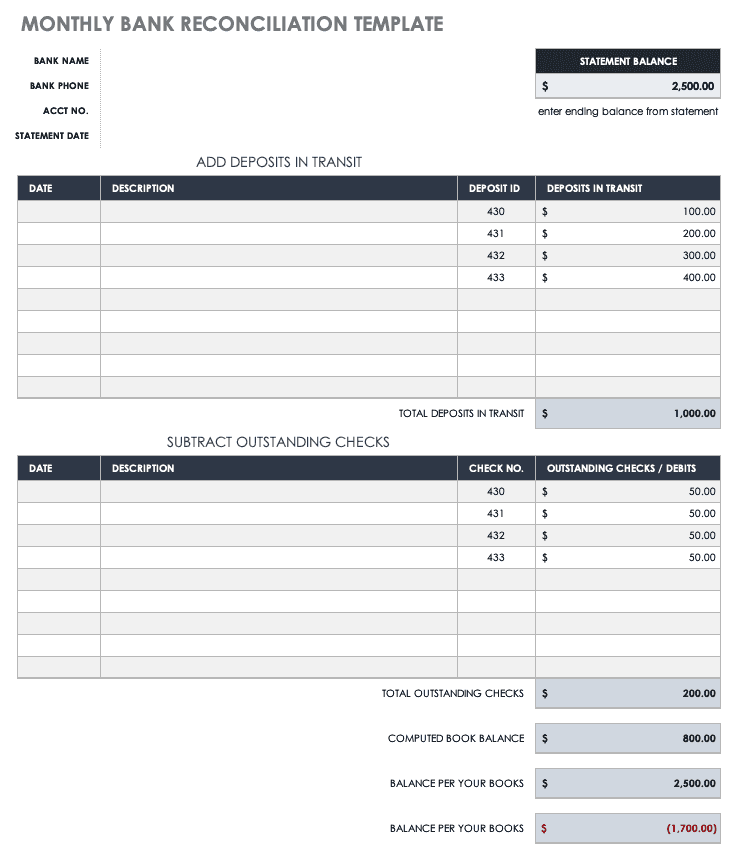

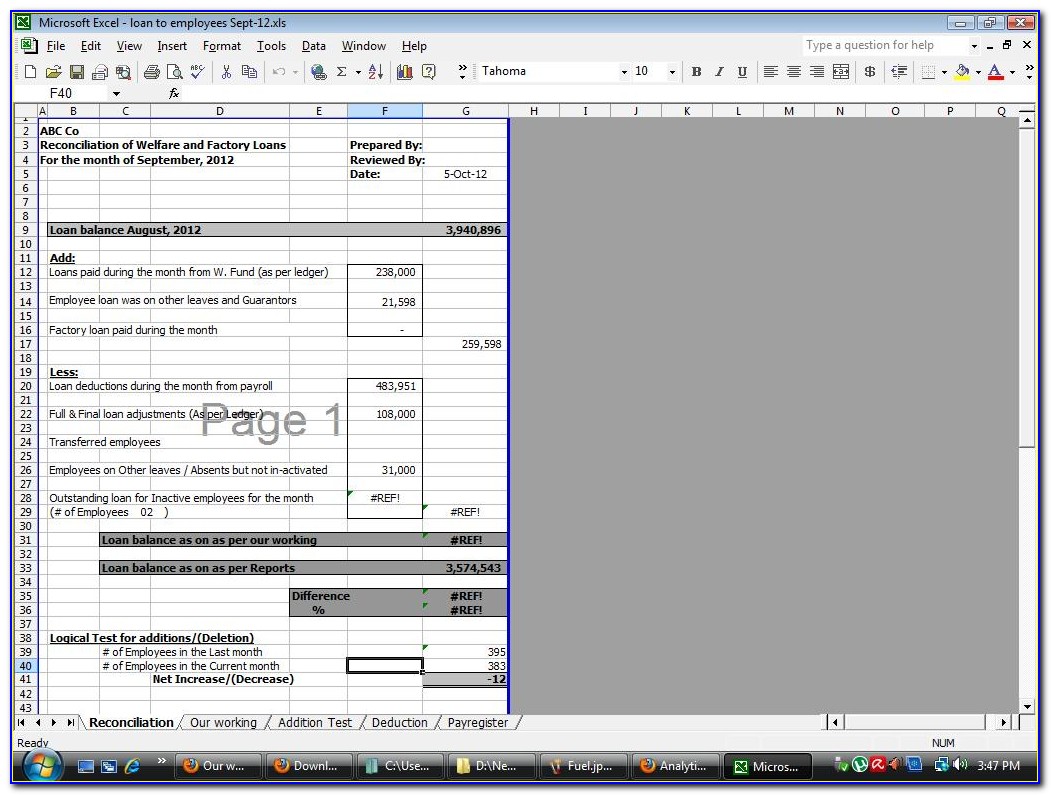

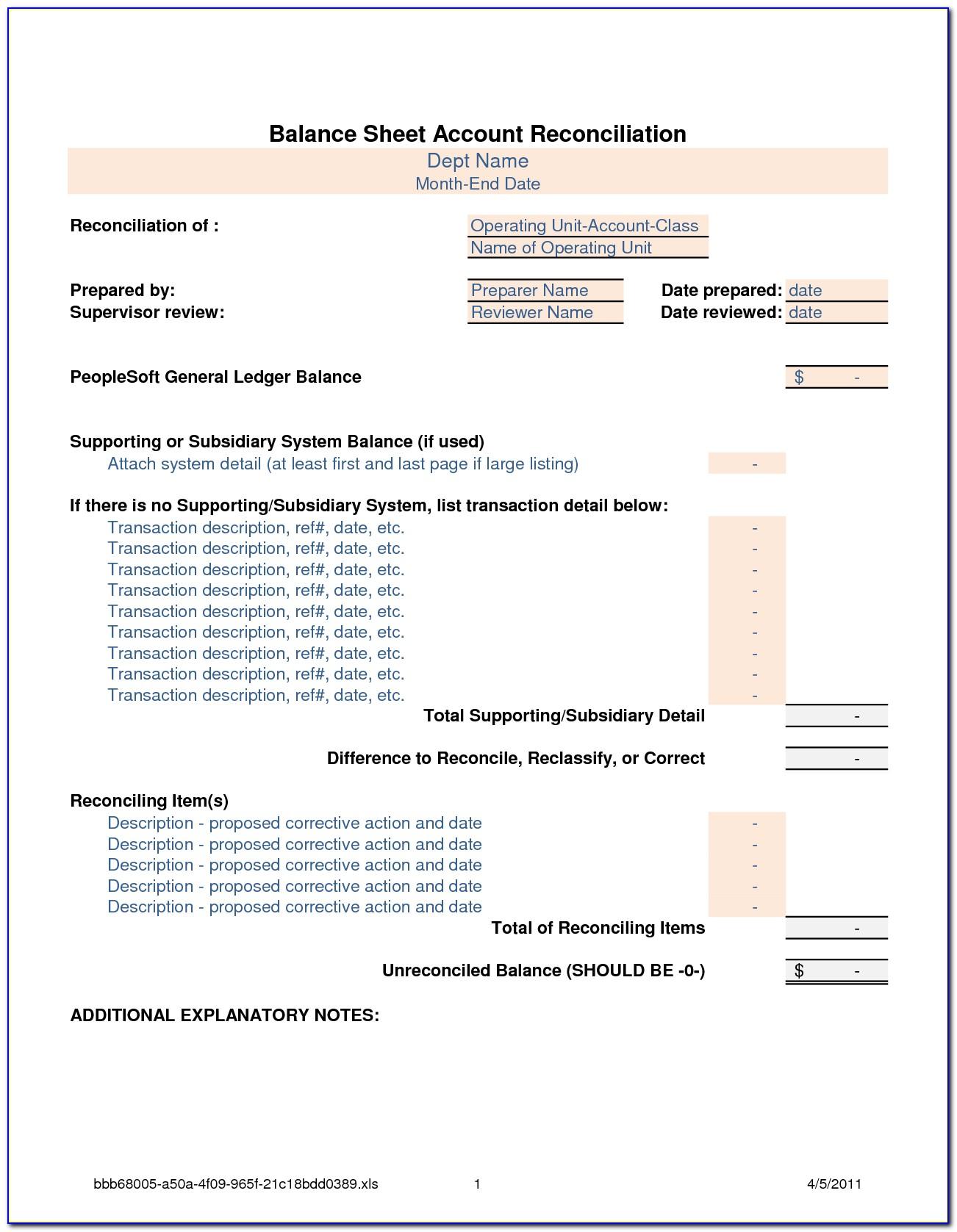

Accrued payroll reconciliation template. It is the total of all the. Debit interest expense 1,000 credit accrued interest expense payable. The accruable items template is used to manage reconciliation items expensed and accrued in the current accounting period and paid in a future accounting.

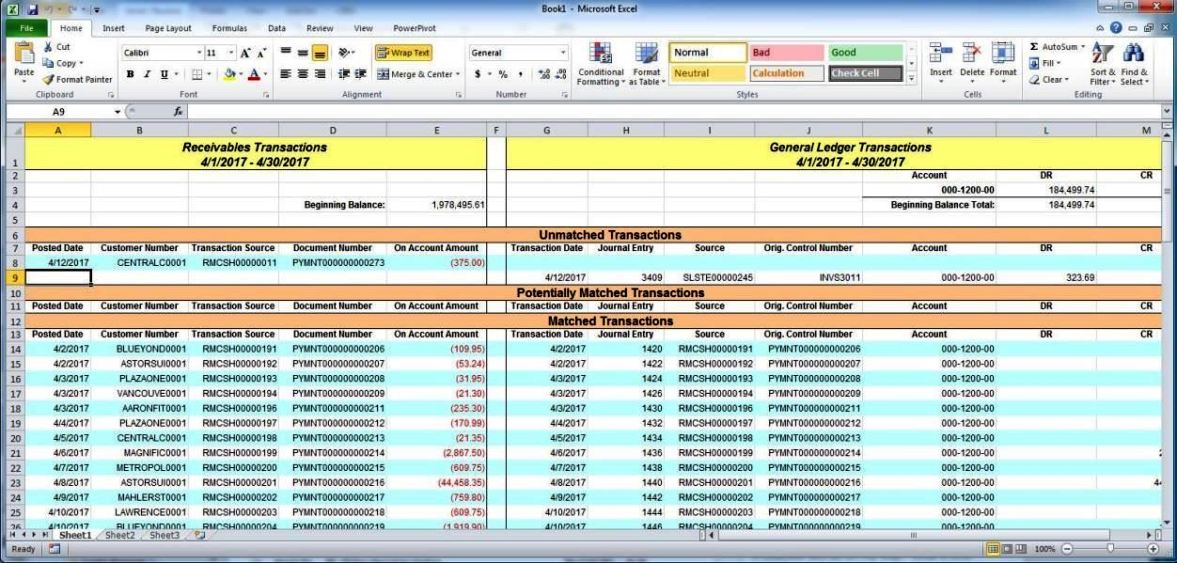

The accrued payroll reconciliation template provided below simplifies the reconciliation process and. Using the accrued payroll reconciliation template; They also affect the balance sheet, which represents.

Accruals are earned revenues and incurred expenses that have an overall impact on an income statement. How to prepare an accrued payroll reconciliation template preparing an accrued payroll reconciliation template involves several steps: Prepare data set with additional information the first step of this procedure is to prepare the data set that will help you make the calculator.

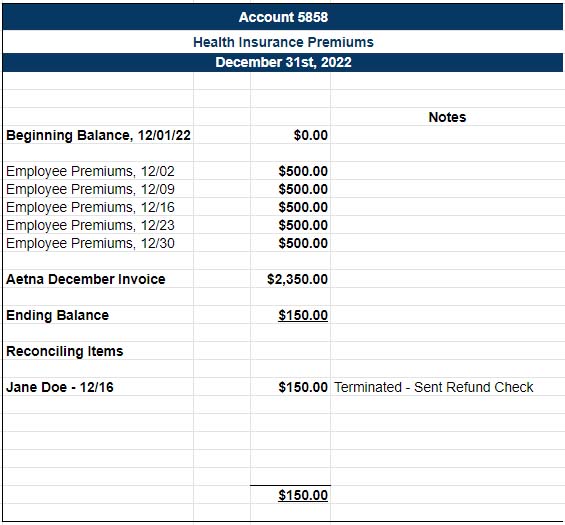

Payroll reconciliation is the process of verifying that the records and information supporting a company’s employee compensation is accurate. Reconciling journal entries to record the accrued expense, the following entry is made: Payroll reconciliation is far from exciting, but it’s one of the most important parts of running any business.

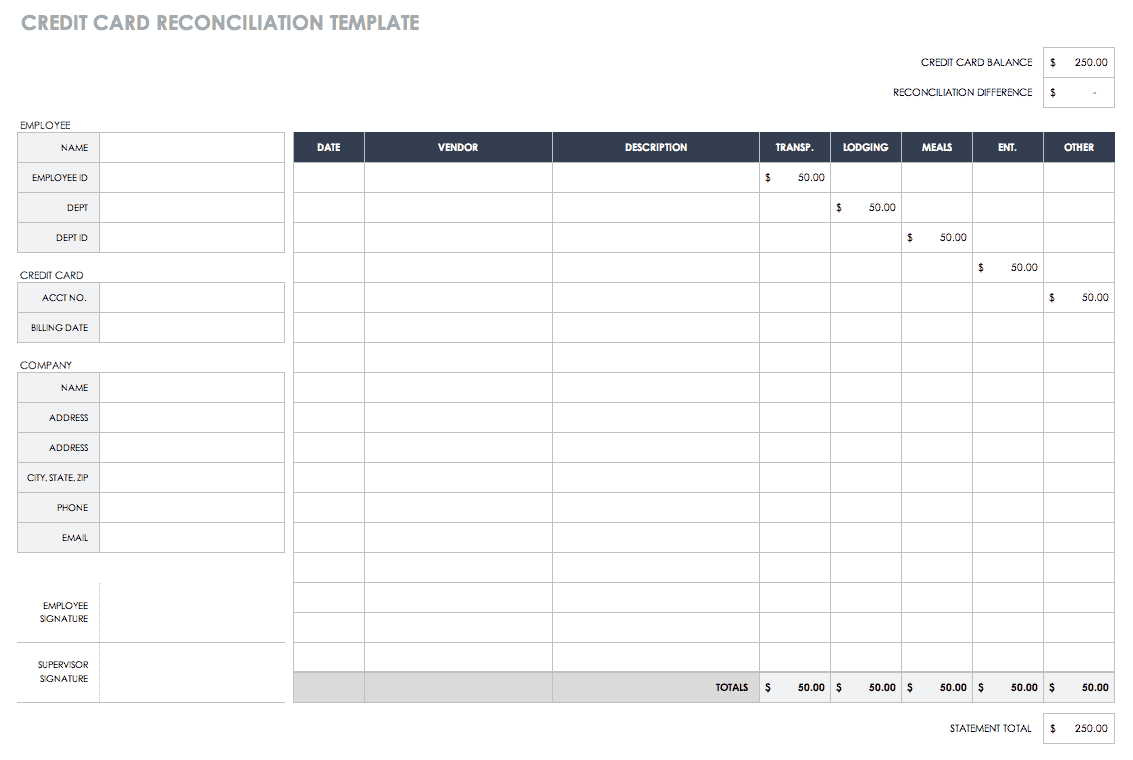

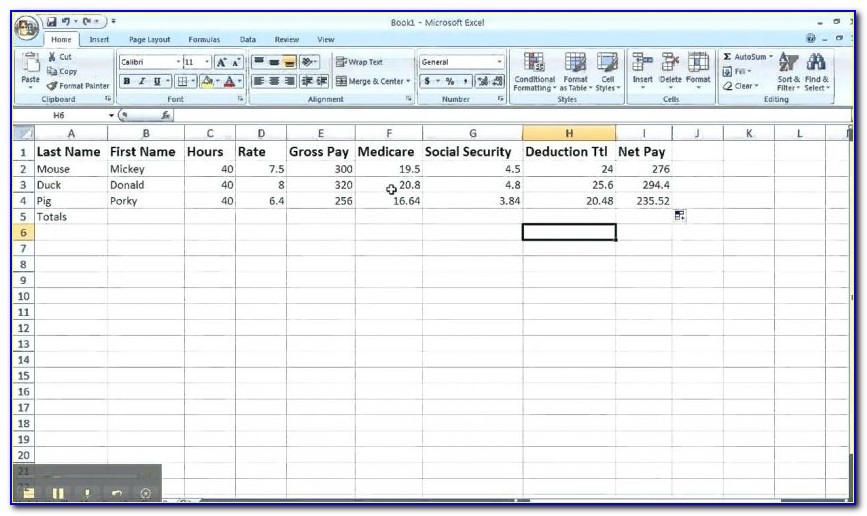

Keep in mind that you’ll also need to account for:. Free reconciliation format template credit card reconciliation template invoice reconciliation template balance sheet reconciliation template supplier. Employee payroll calculator with payroll templates, you can record your employees'.

Below are the best free online top 10 payroll reconciliation template excel. Salary and hourly wages gross wages are an employee’s total compensation before payroll deductions, such as taxes and retirement contributions. Check to see if their hours are entered correctly and confirm the hours on their timesheet match what’s in your payroll register.