Formidable Tips About Annuity Excel Template

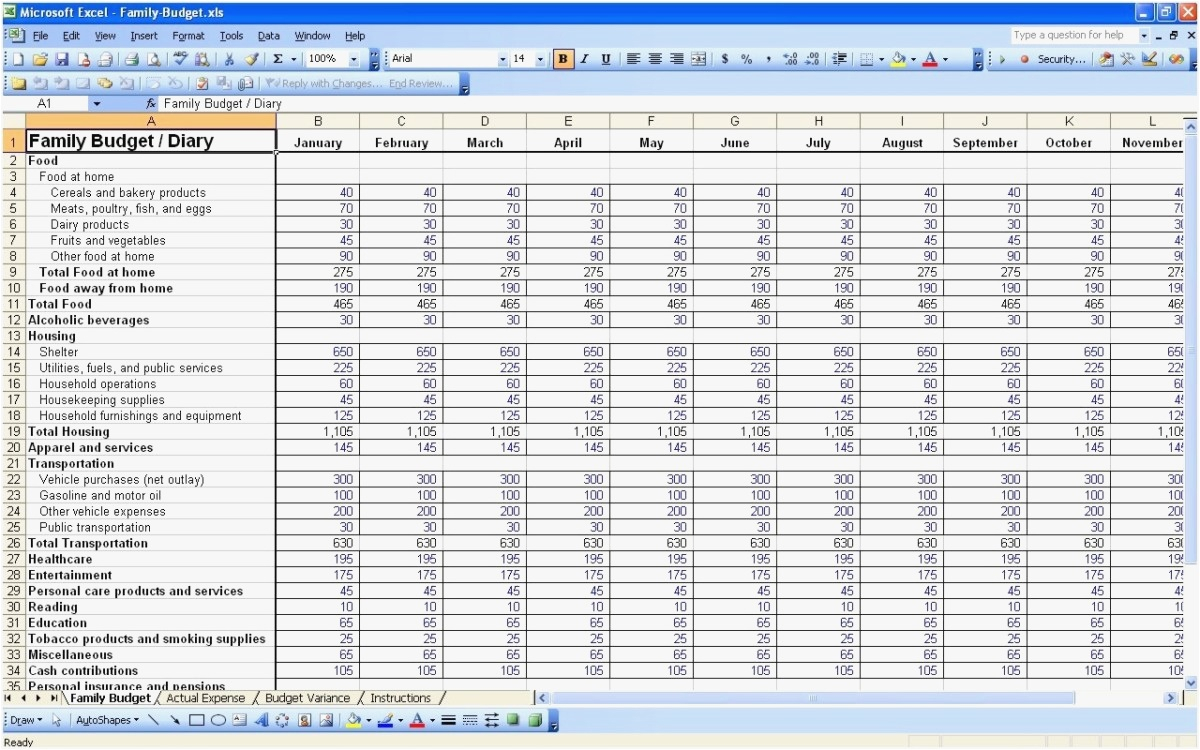

Common examples of annuities include retirement pensions, leases, and mortgages.

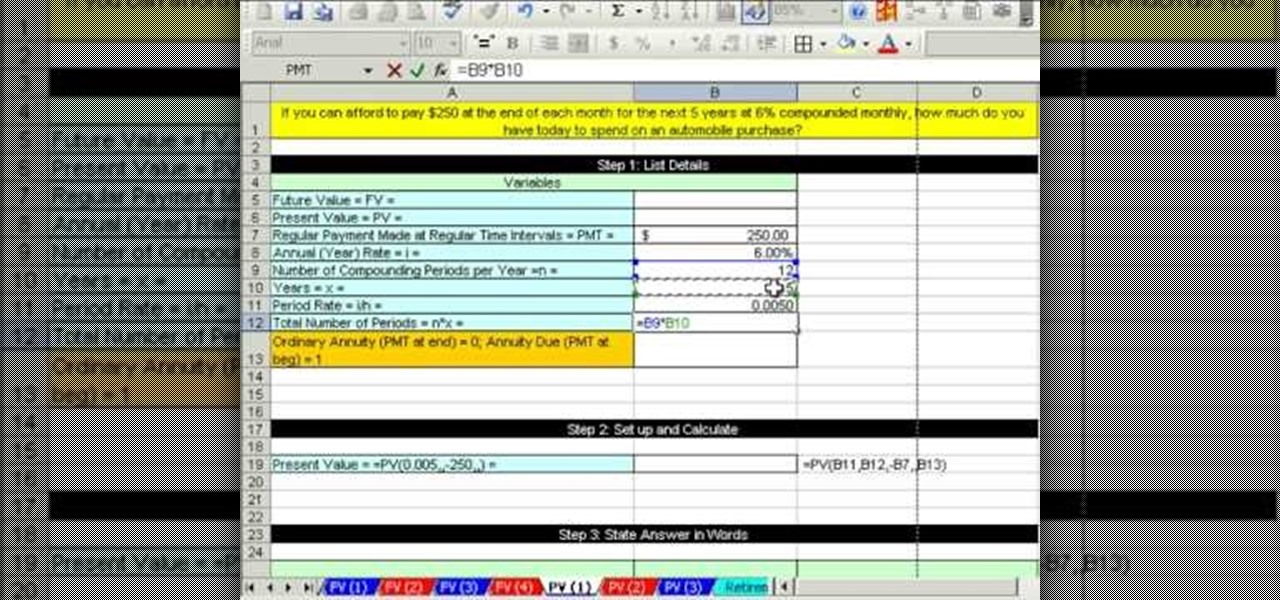

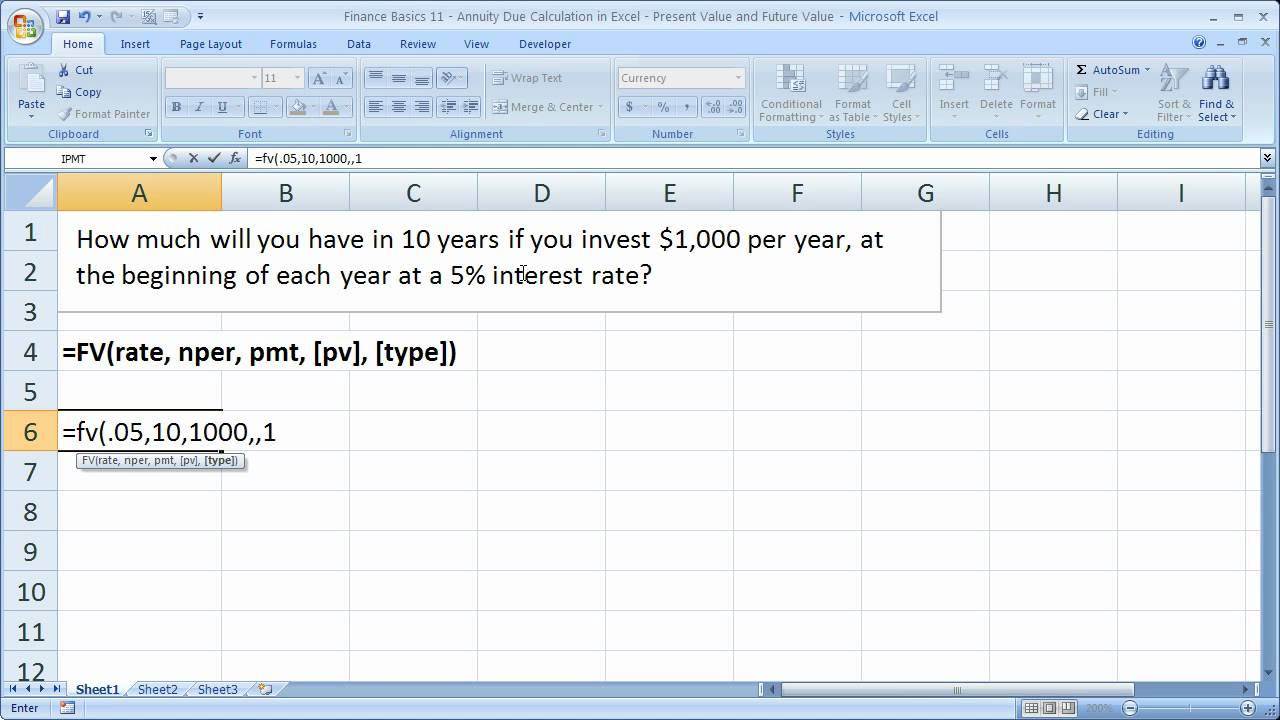

Annuity excel template. Here we discuss how to calculate the annuity due along with practical examples. You can use the rate functionto calculate the interest rate of annuity payments in excel. With an annuity due, payments are made at the beginning of the period, instead of the end.

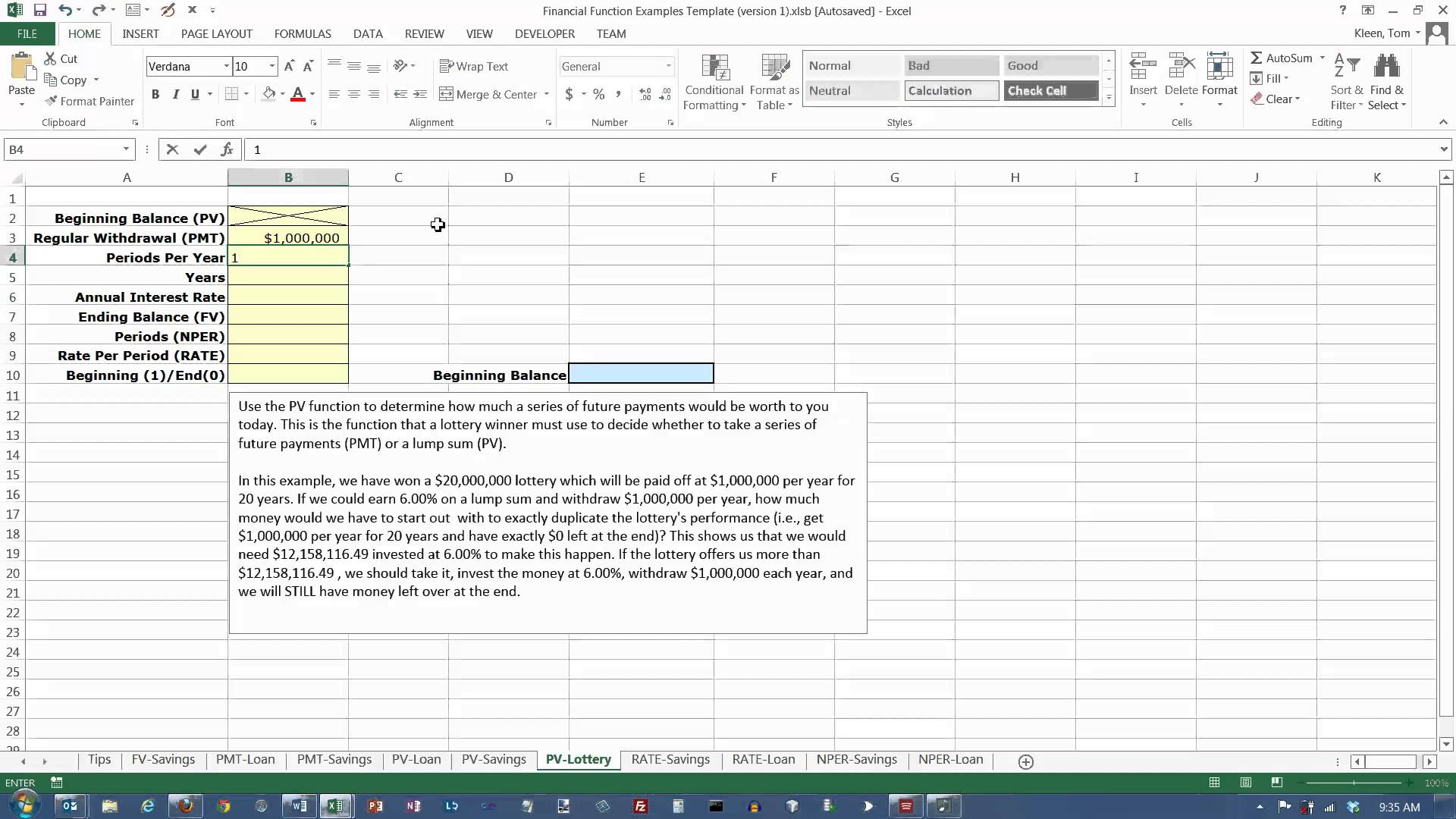

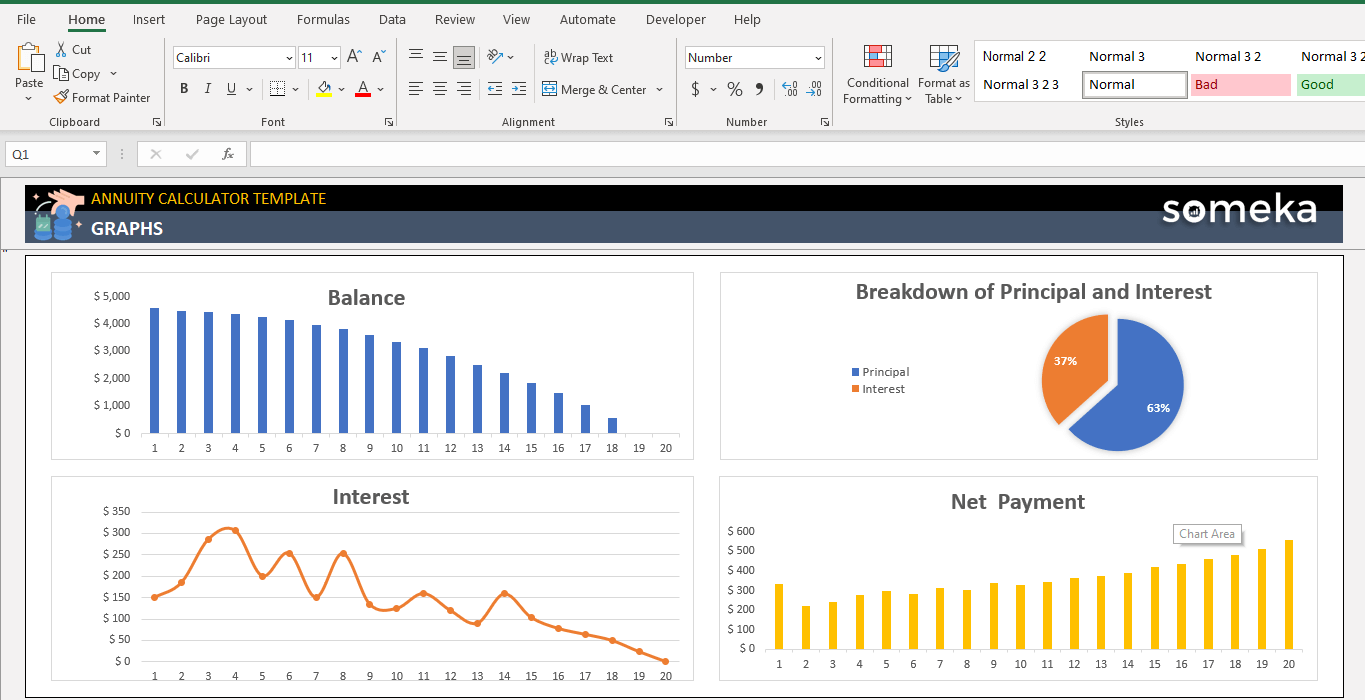

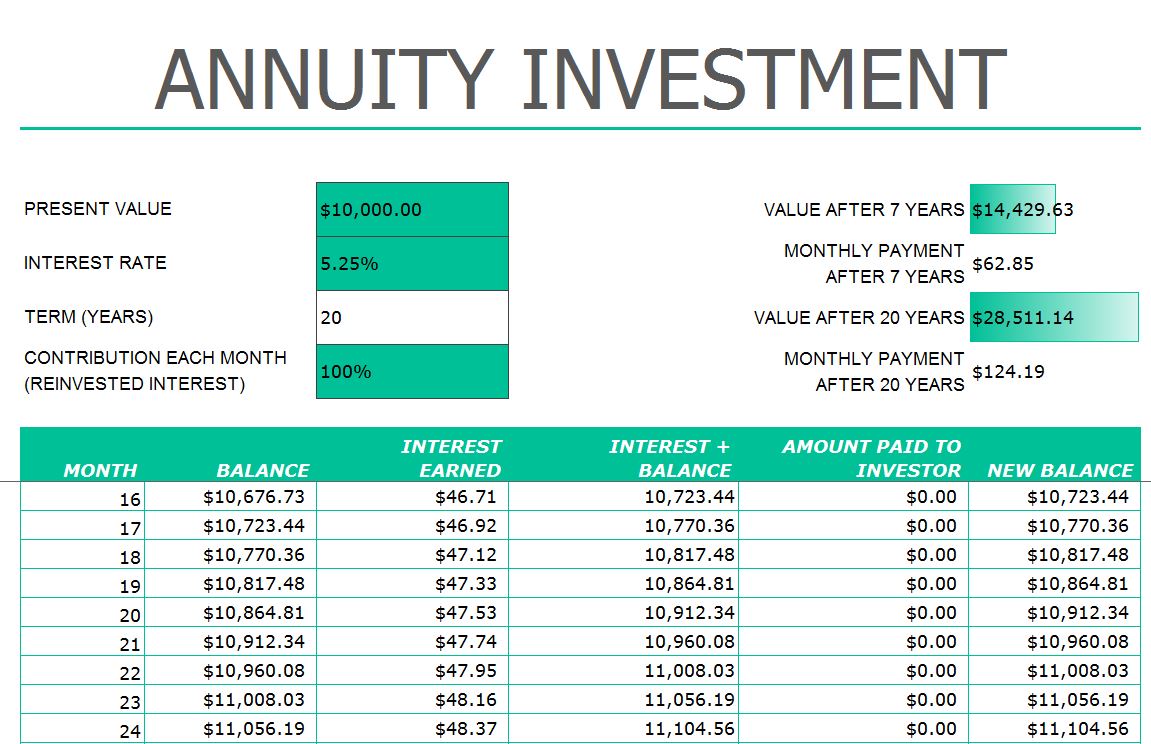

You can use the template to calculate the future value of a series of expected annuity payments, paid at the beginning of the period. How to calculate annuity in excel introduction when it comes to financial planning, understanding the concept of annuity is crucial. You can use the pv function to get the value in today's dollars of a series of future.

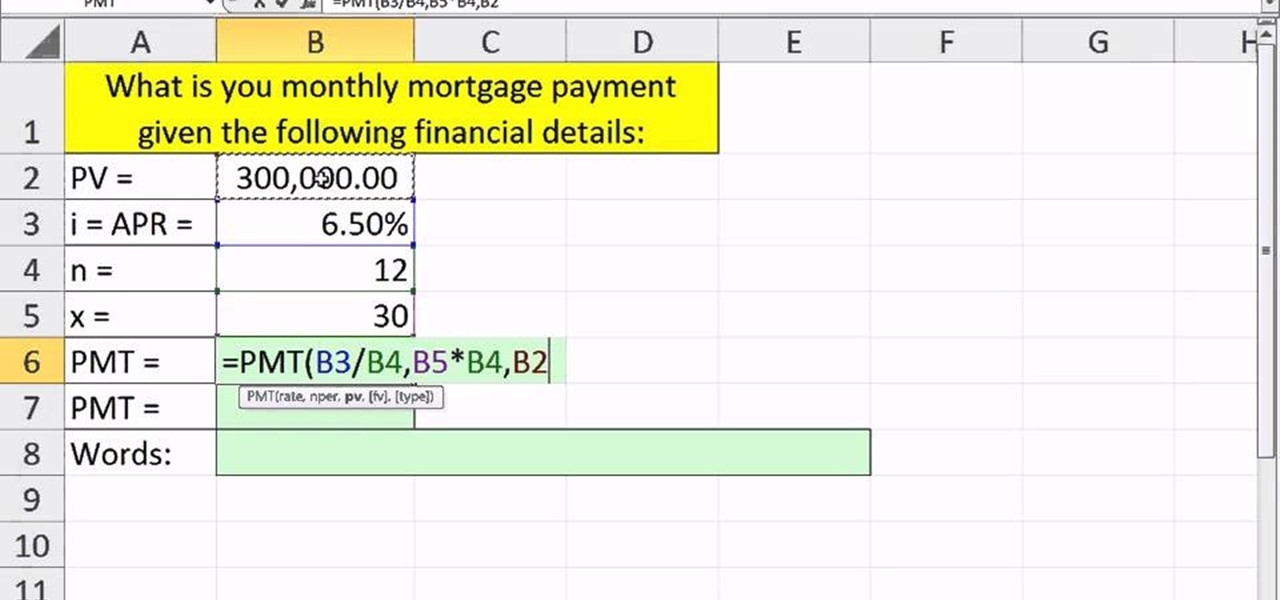

Finally, press enter to get the. Use this template to calculate the future payments for a loan, its interest rate, and the. The excel rate function is a financial function that returns the interest rate per period of an annuity.

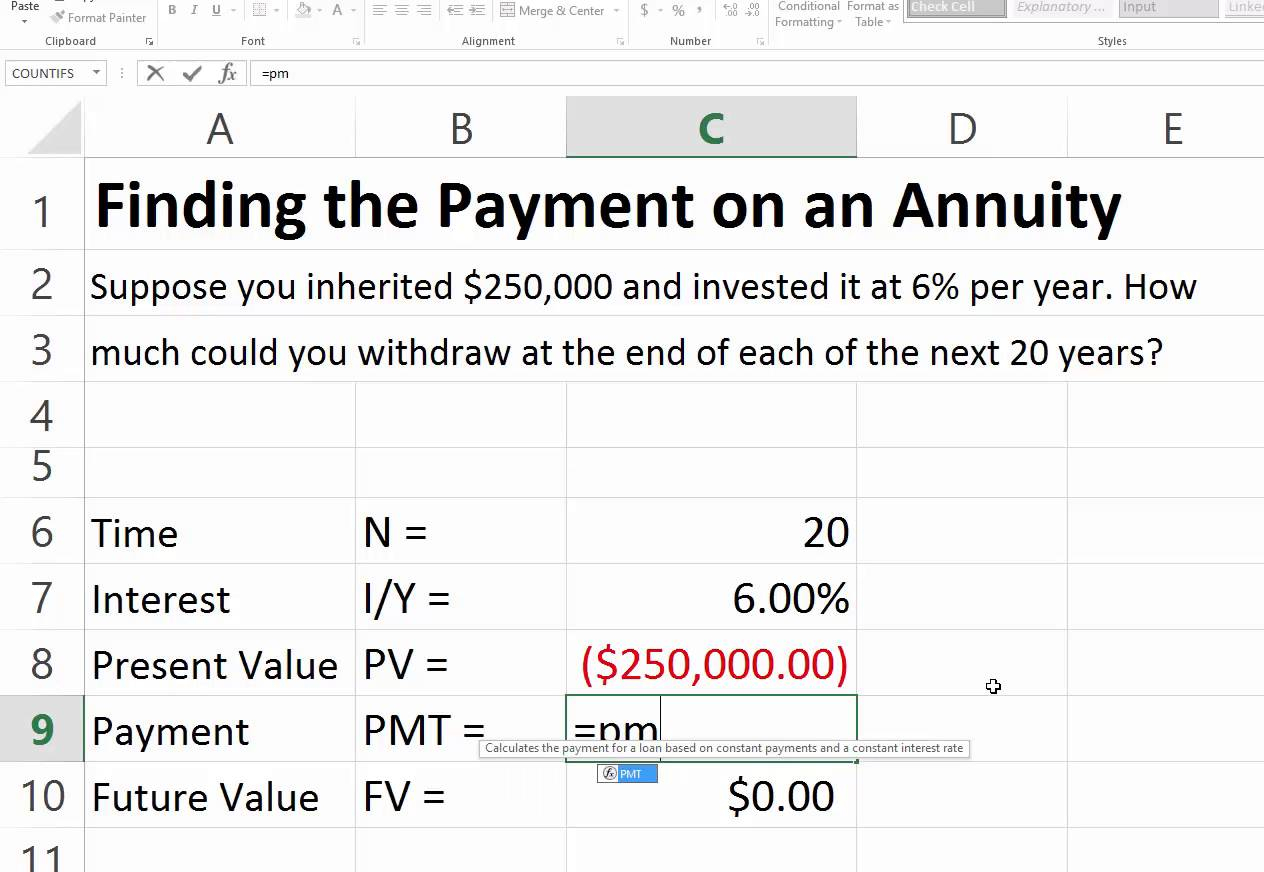

We also provide an annuity due. The basic annuity formula in excel for present value is =pv (rate,nper,pmt).

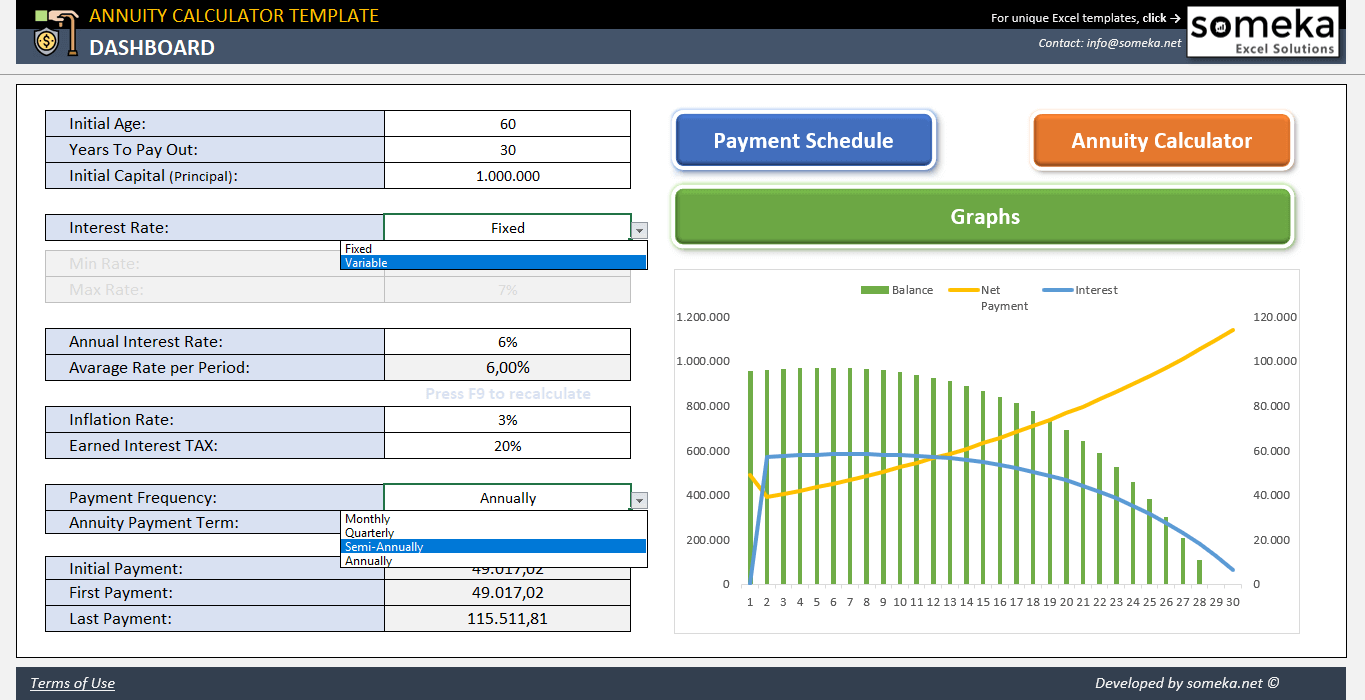

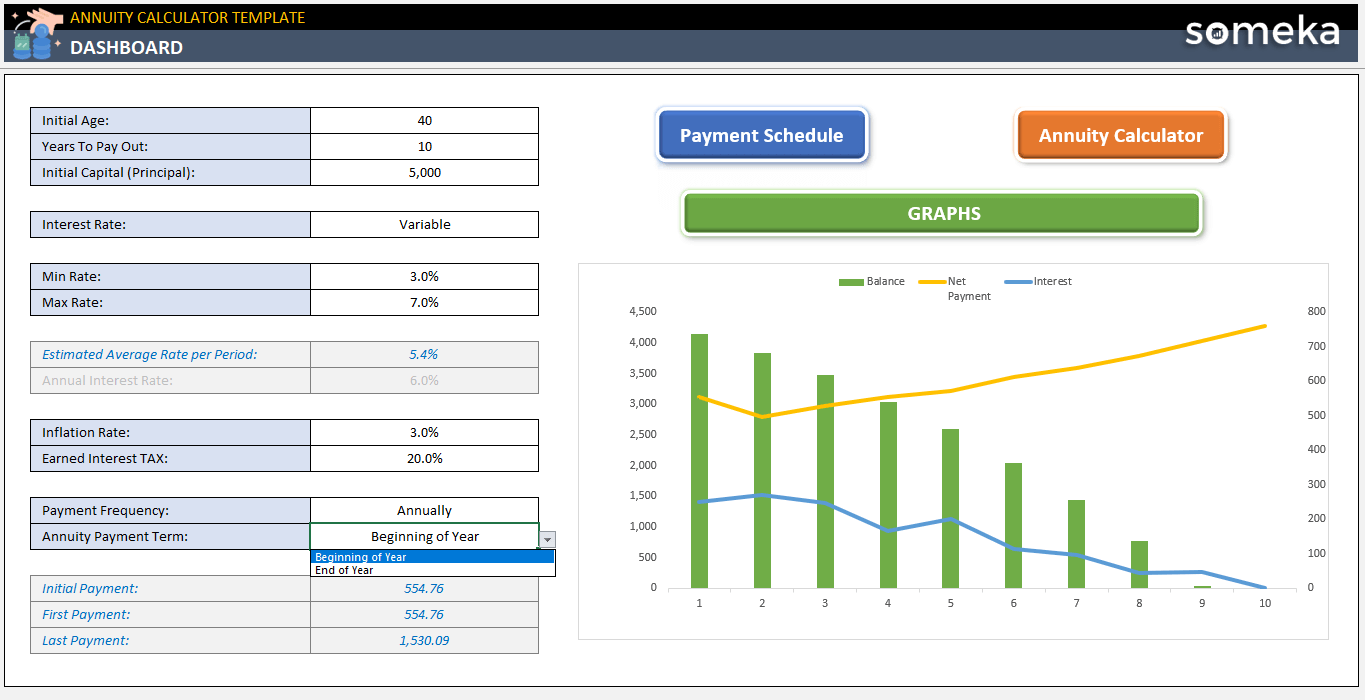

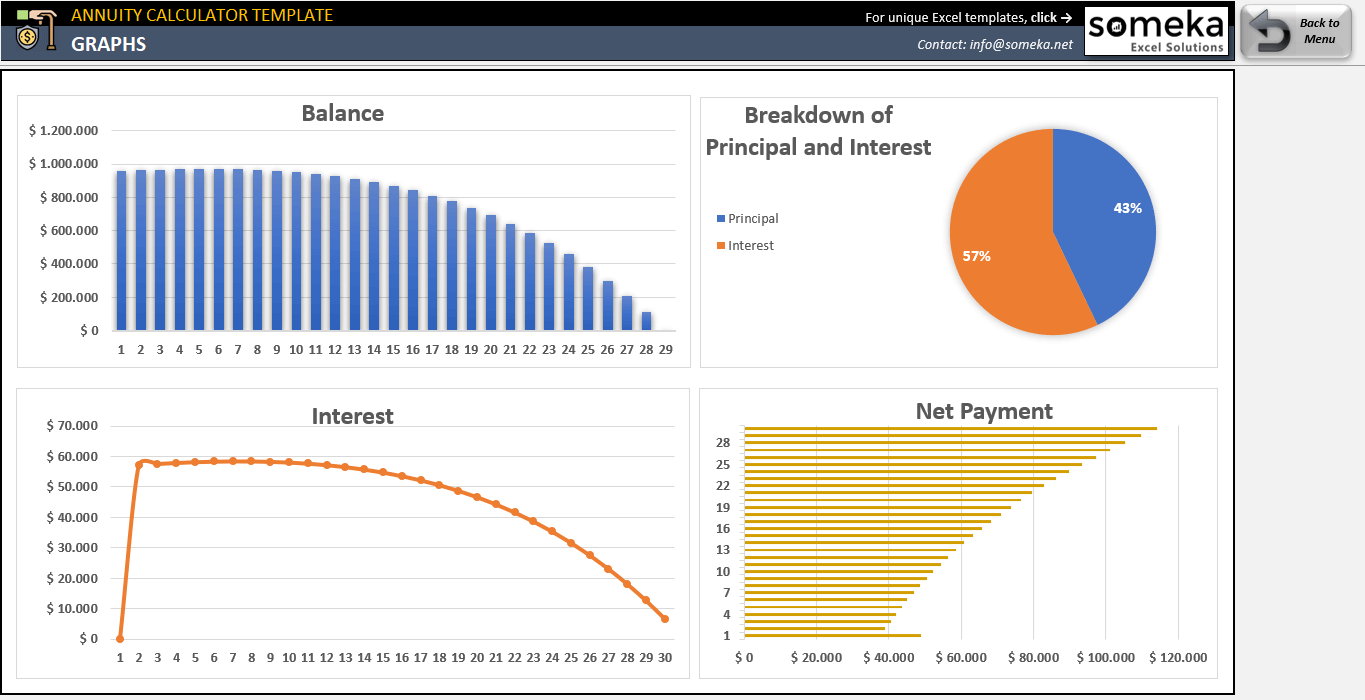

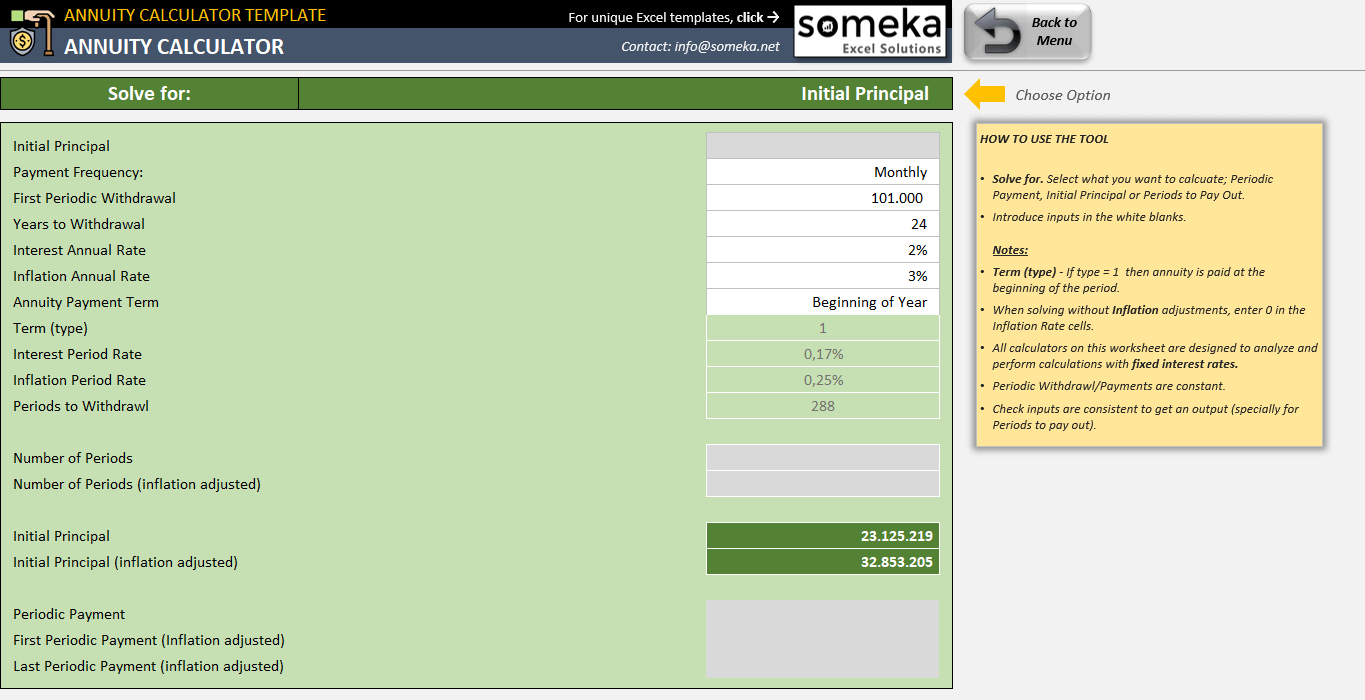

How to use annuity calculator template. Formula and calculator by svetlana cheusheva, updated on march 13, 2023 essentially, this tutorial gives. You can use rate to calculate the periodic interest rate, then multiply as.

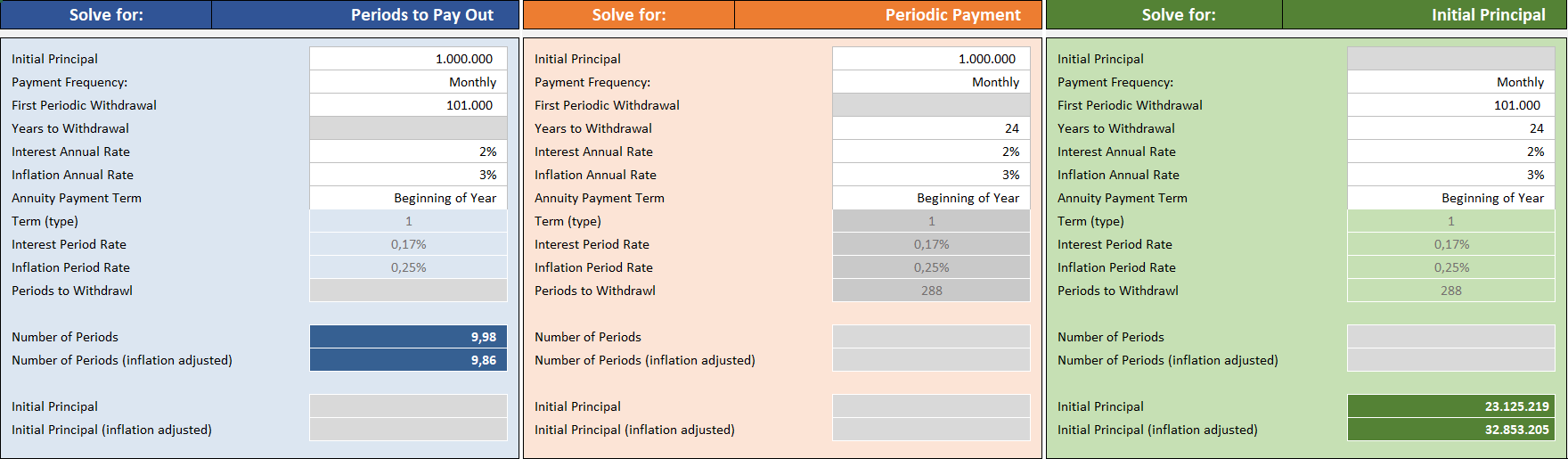

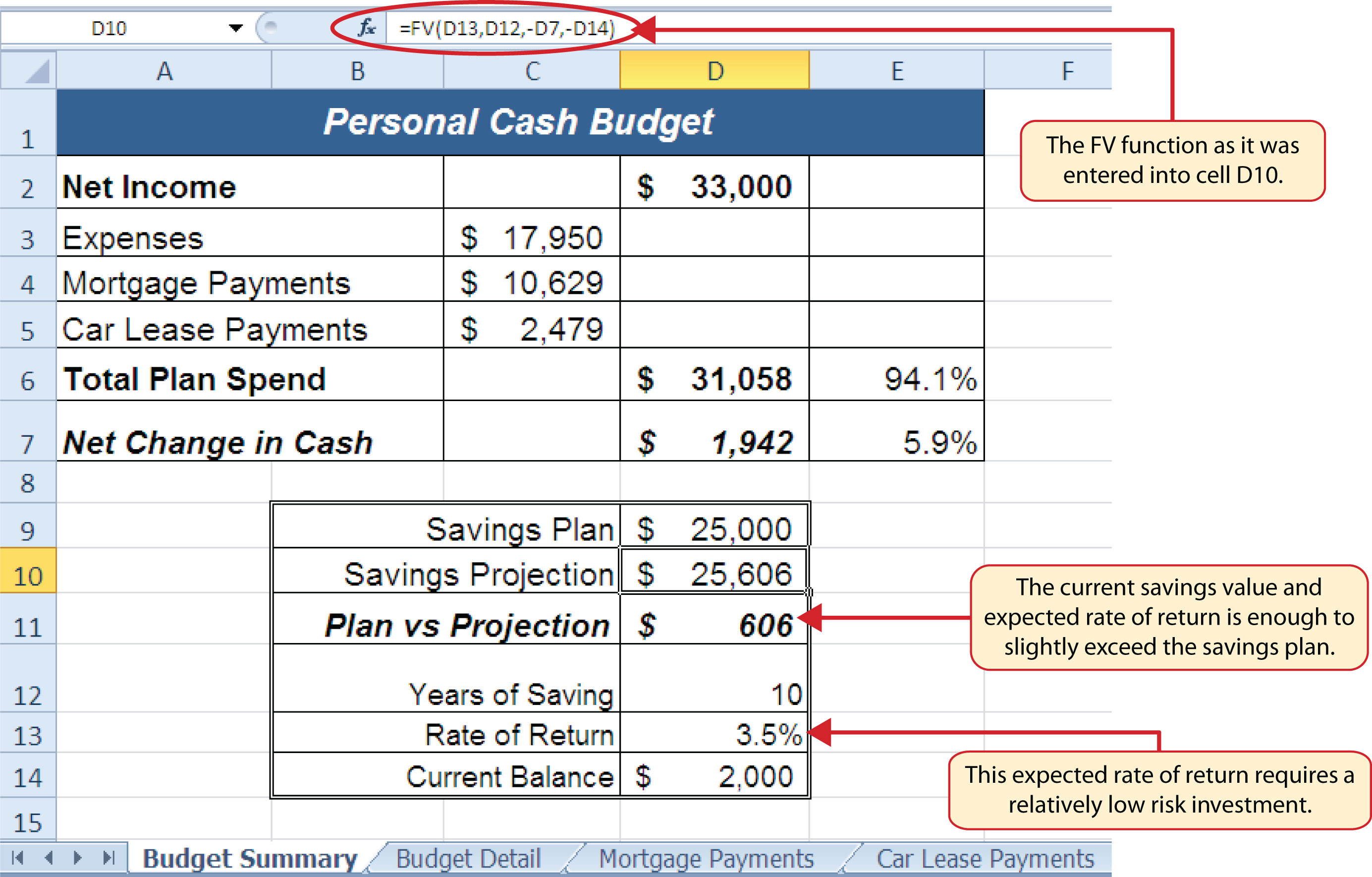

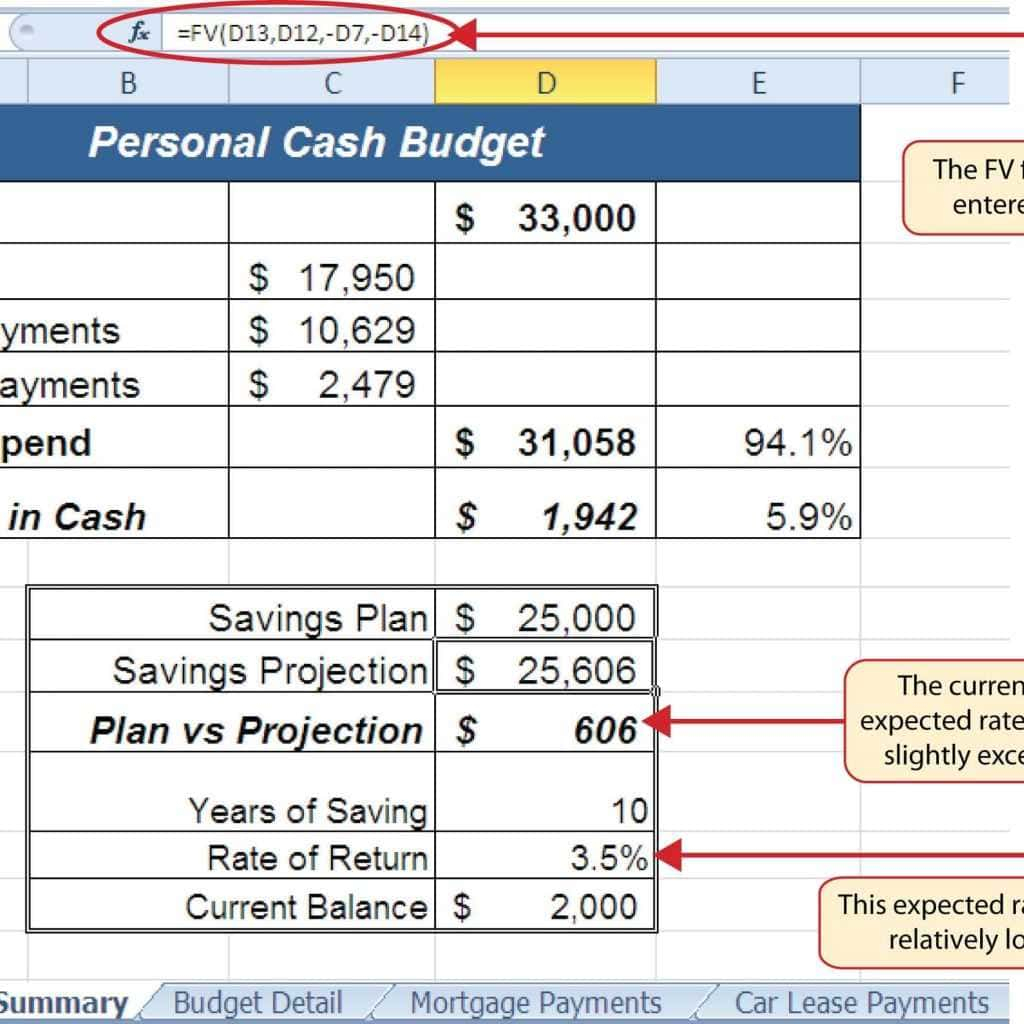

How to calculate present value of annuity in excel: There are three tables that will generate those numbers. Summary to get the present value of an annuity, you can use the fv function.

In the example shown, the formula in c7 is: Firstly, select a different cellc9 where you want to calculate theinterest rate. The excel pv function is a financial function that returns the present value of an investment.

To calculate the payment for an annuity due, use 1 for the type argument. You just need to put all required data to get the results. Secondly, use the corresponding formula in the c9cell.

This is a guide to annuity due formula.