Beautiful Tips About Capital Gains Tax Spreadsheet

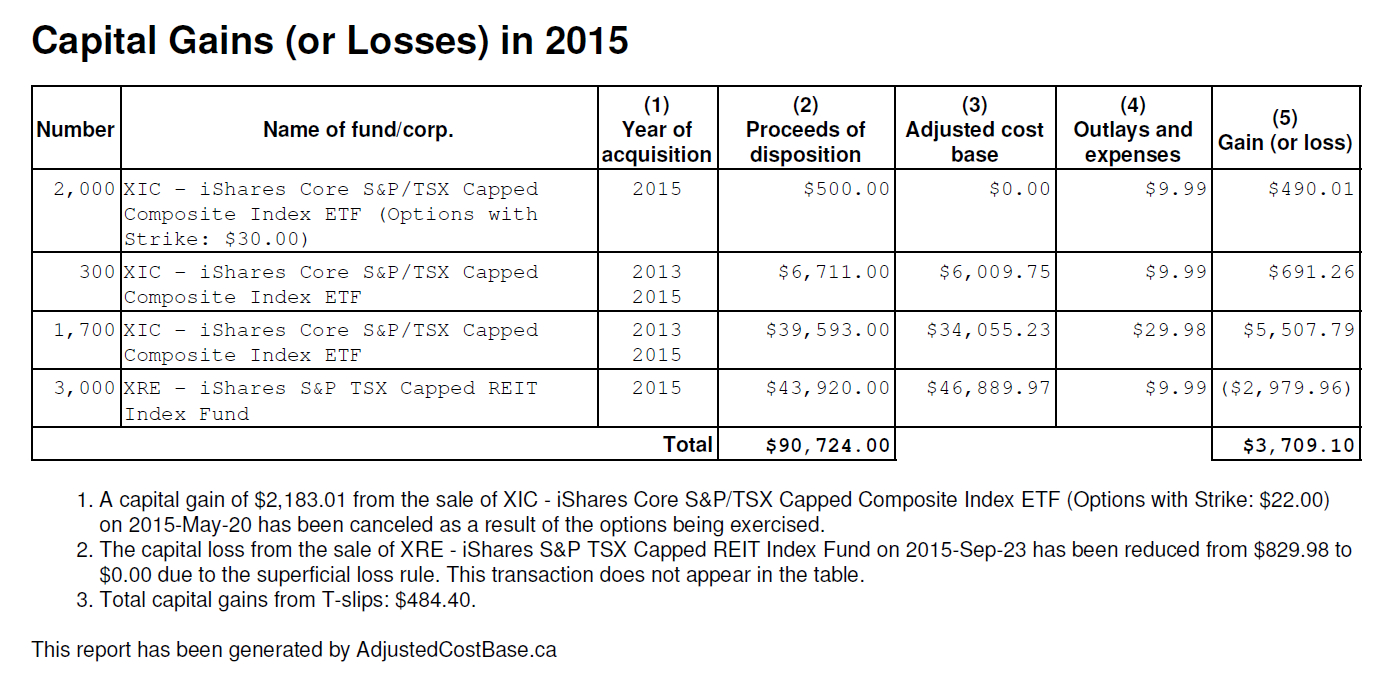

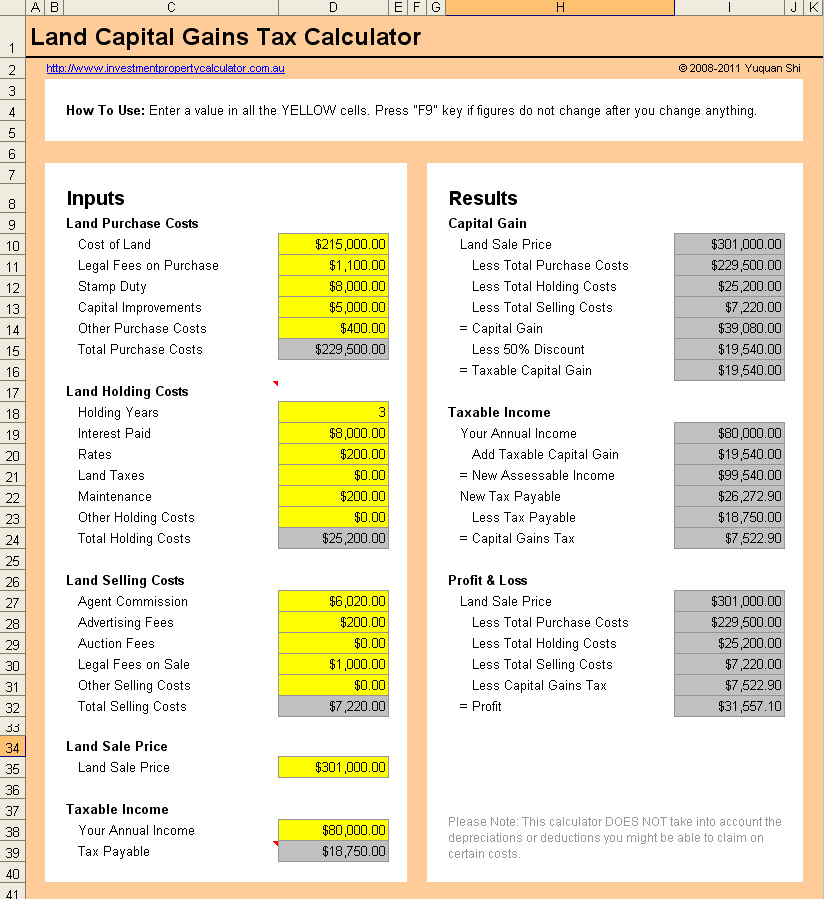

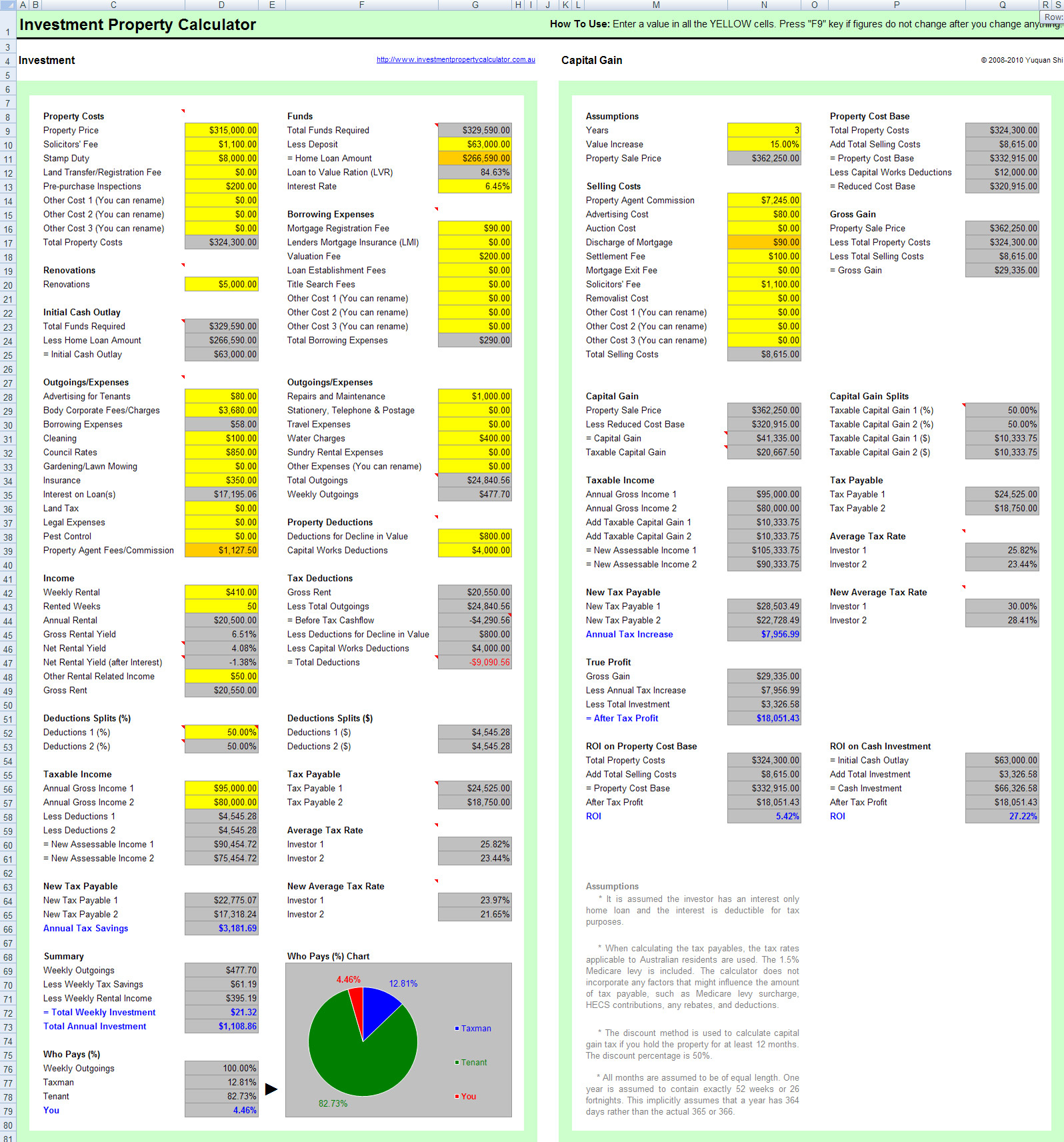

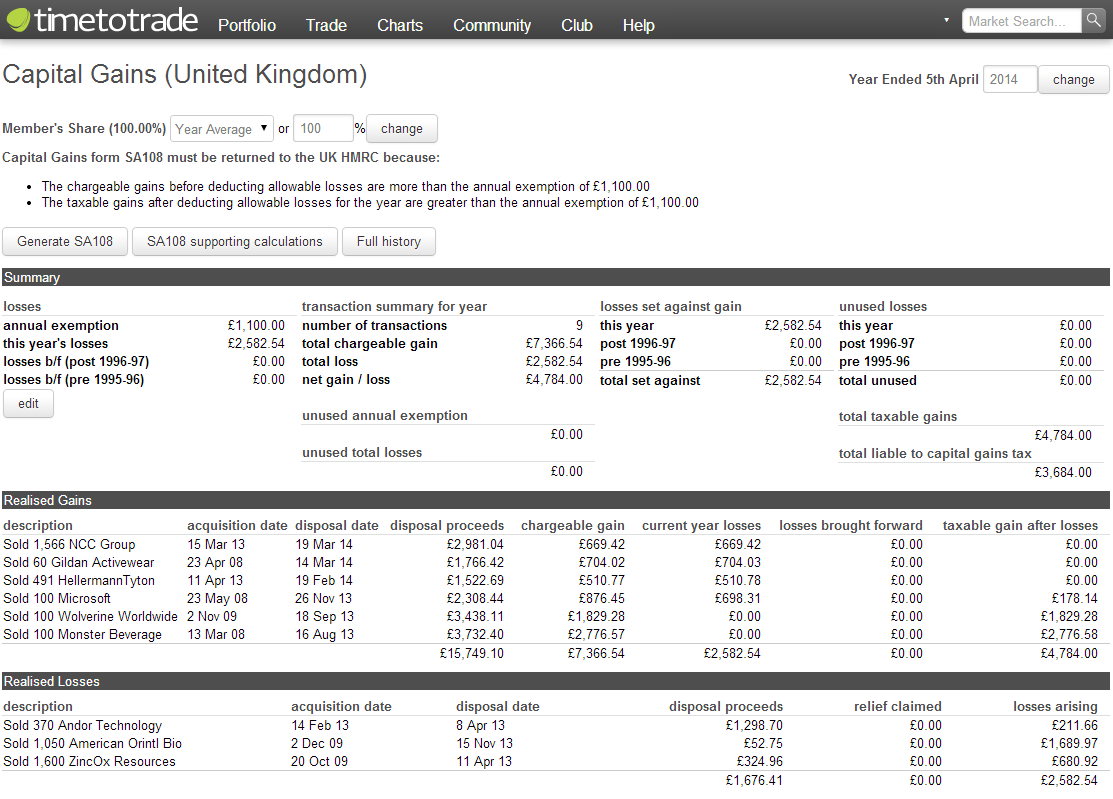

Calculate your capital gains tax on the sale of shares:

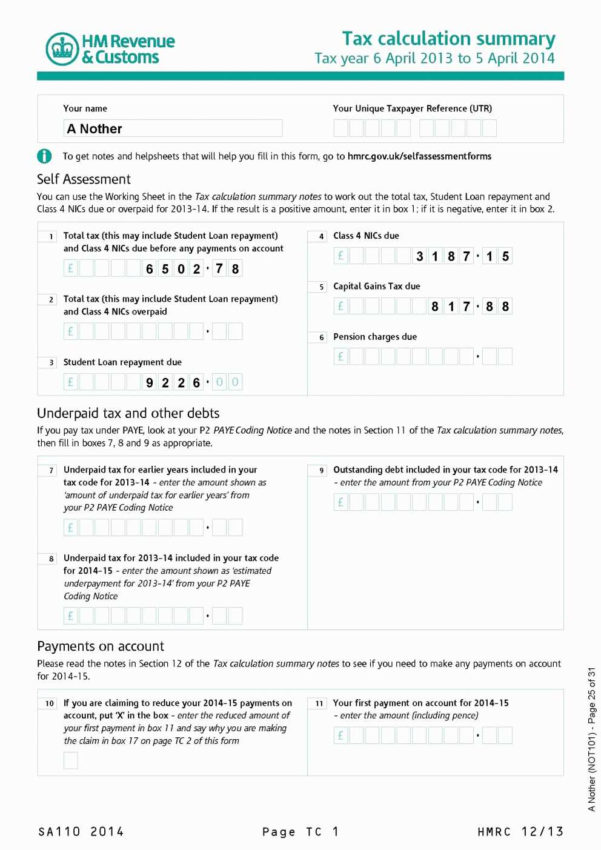

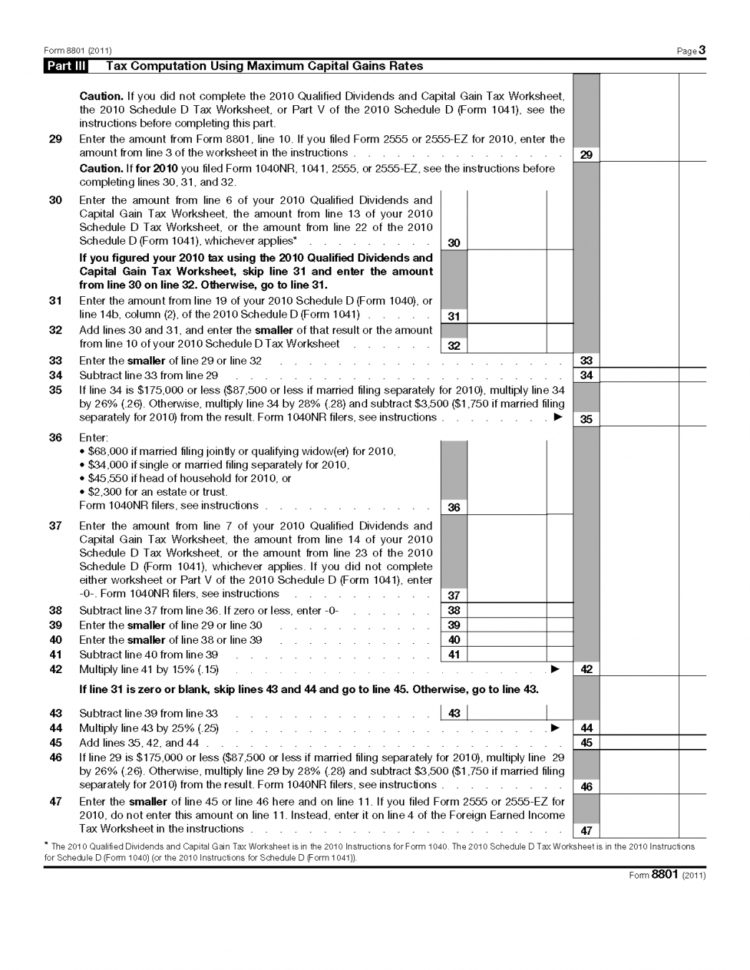

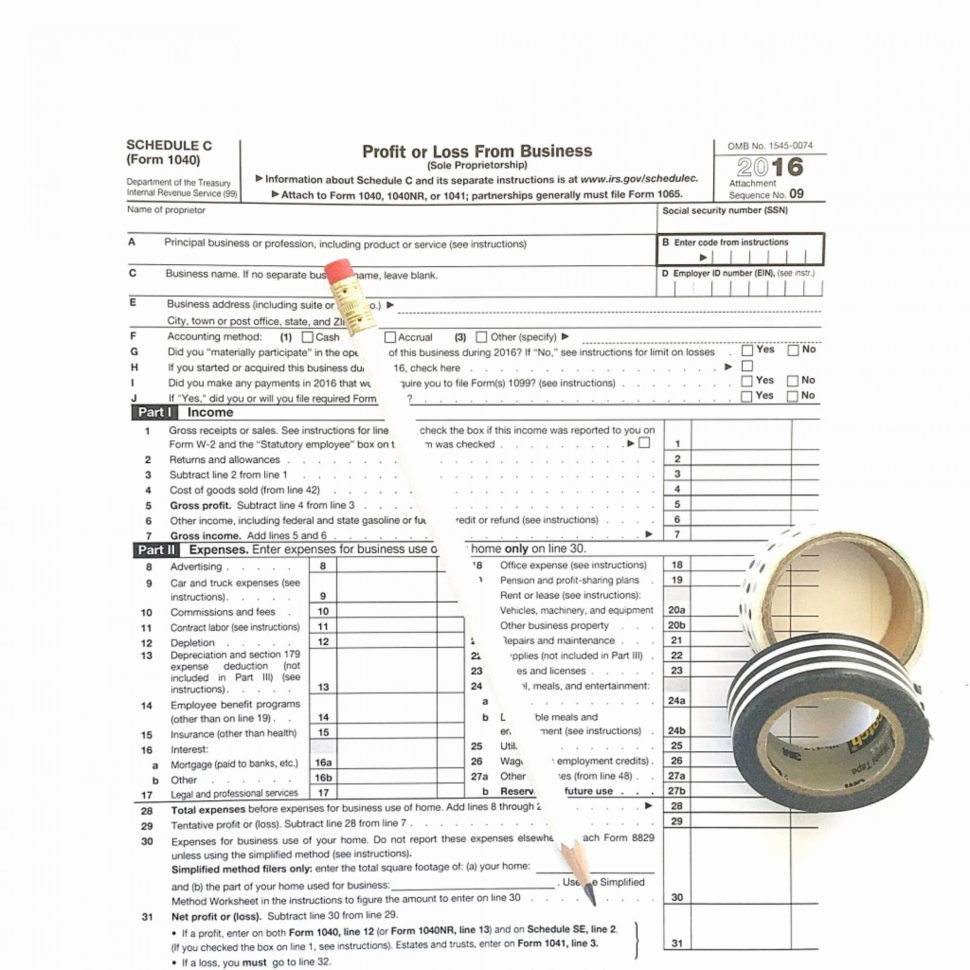

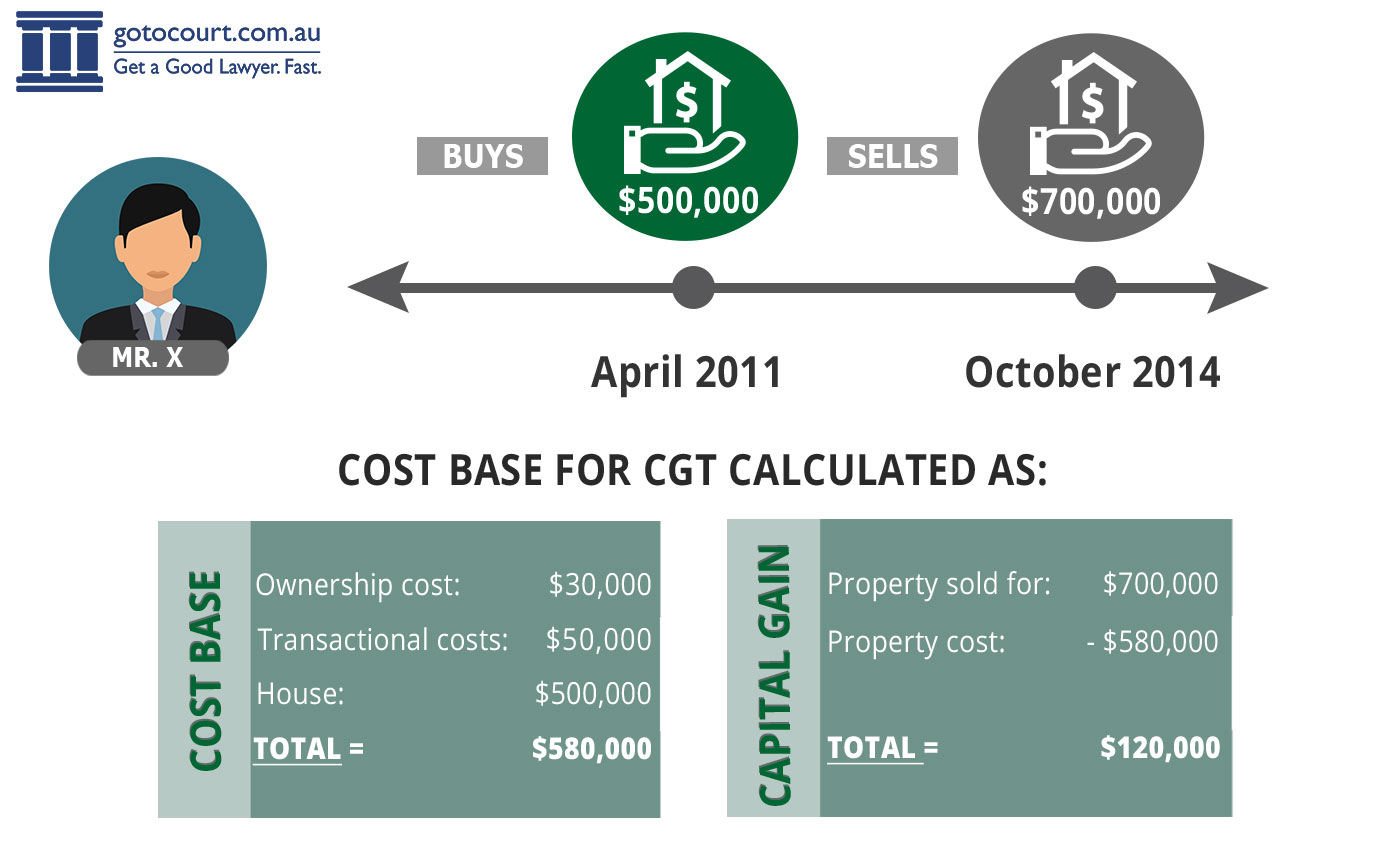

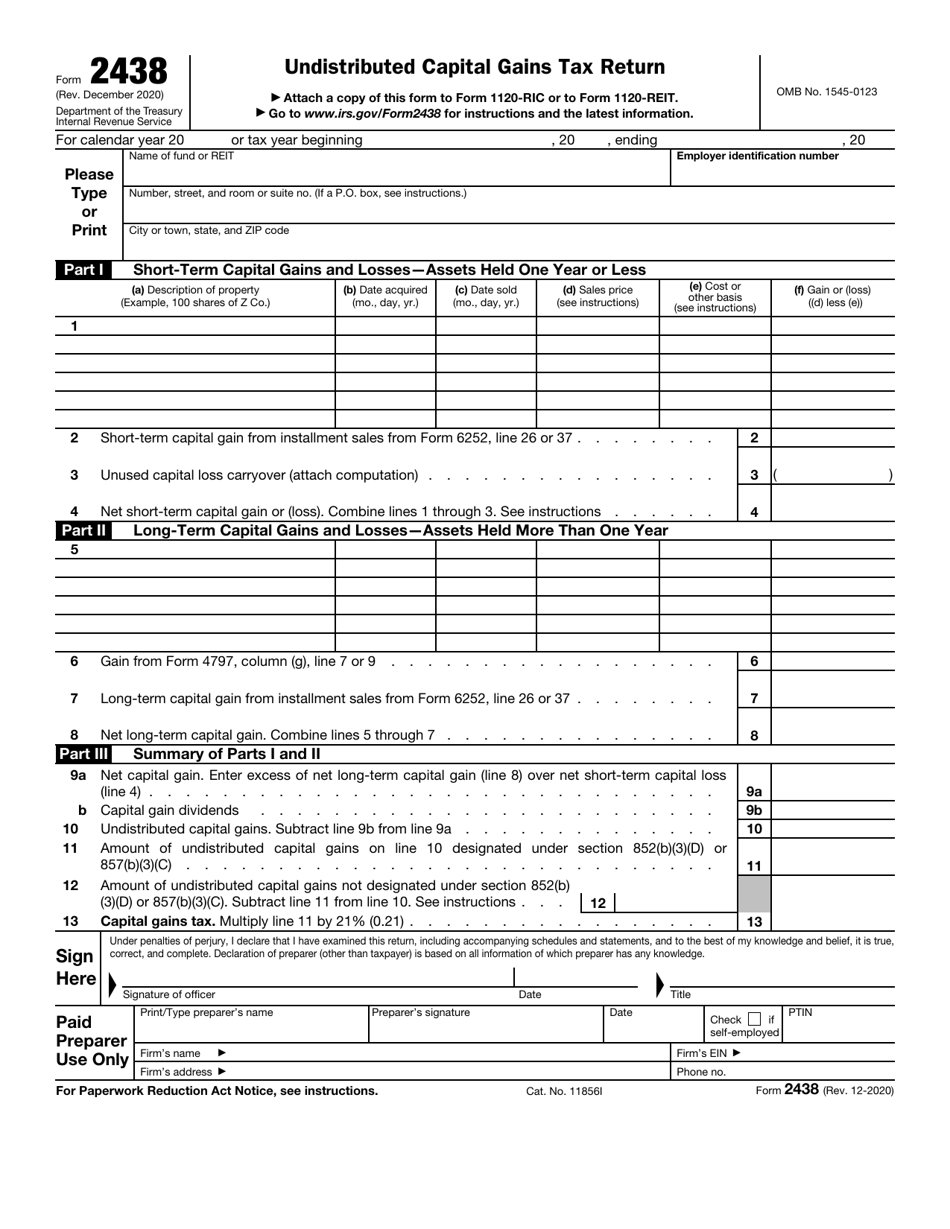

Capital gains tax spreadsheet. You'll need to bodge it by adding a bf cgt loss to get it. Last updated 24 may 2023. If the amount on line 5 is $100,000 or more, use the tax computation worksheet 14.

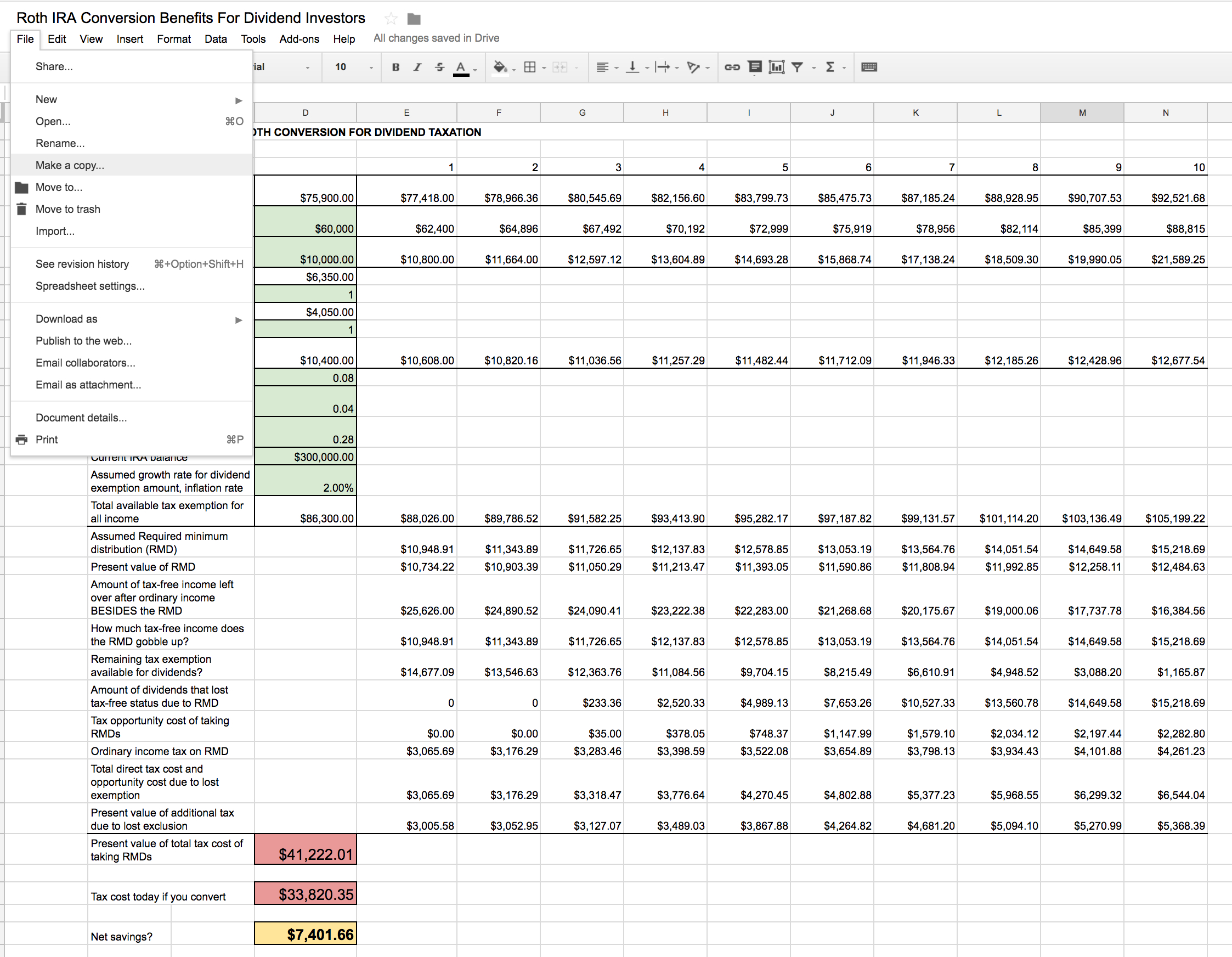

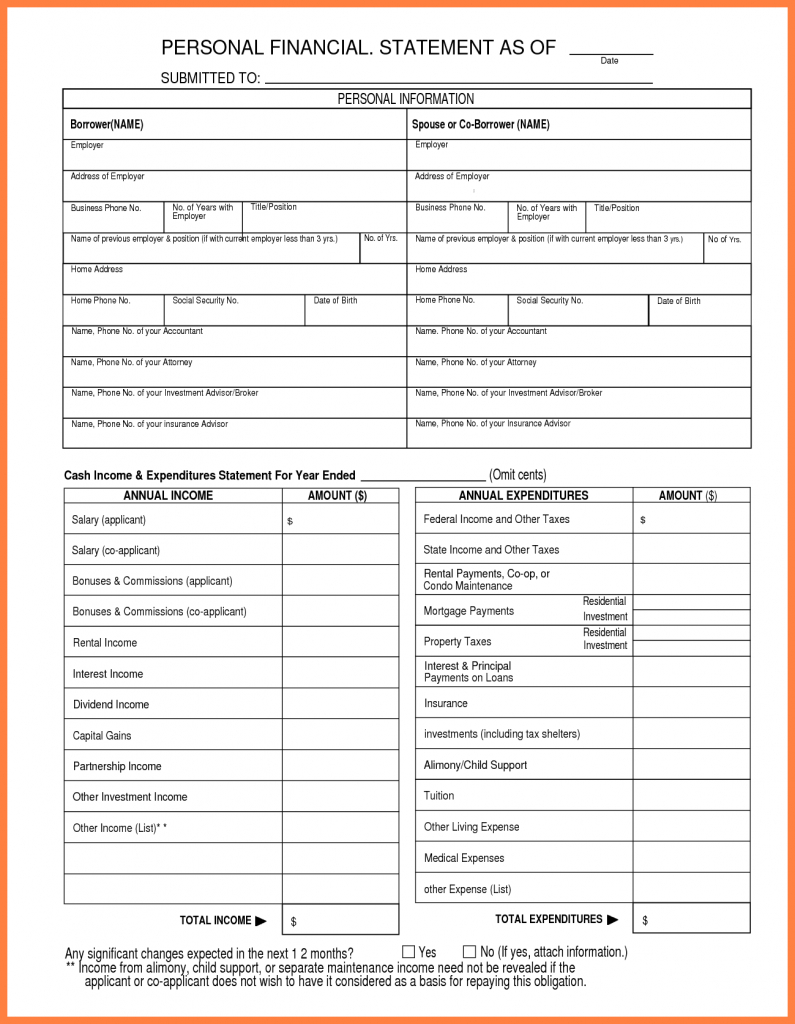

Forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. 25 replies by anura guruge on february 24, 2022. How much tax you are needed to pay depends on capital gain and losses?

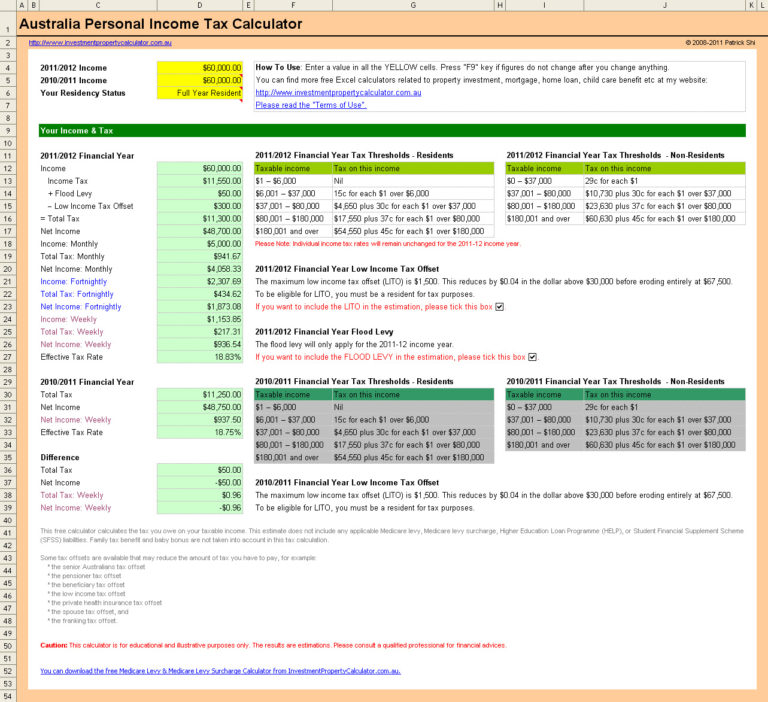

The toolkit for 2016 to 2017 has been removed. If you earn $40,000 (32.5% tax bracket) per year and make a capital gain of $60,000, you will pay income. Use the capital gain or capital loss worksheet 2023 to work out your capital gain or capital loss for your tax return.

The capital gains tax for shares toolkit 2021 to 2022 self assessment tax returns has been added to the page. Capital gains are taxed at the same rate as taxable income — i.e. Add lines 18, 21, and 22 15.

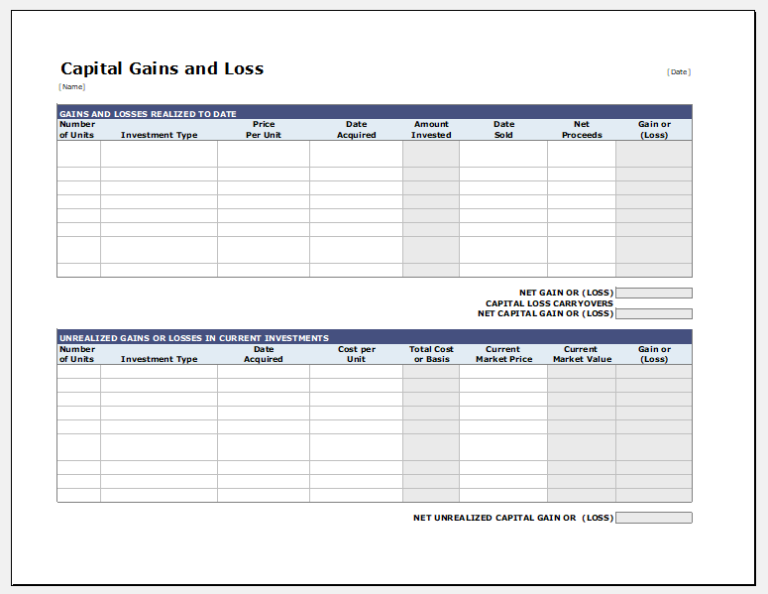

Capital gain or capital loss worksheet 2023. Capital gains tax shares calculator: You bought the 100 shares at $12 per.

Use this worksheet to help work out a capital gain or capital loss for a capital gains tax (cgt) asset or cgt event. Figure the tax on the amount on line 1. We've got all the 2023 and 2024.

Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Calculate capital gains when you sell a stock, you owe taxes on the difference between what you paid for the stock and how much you got for the sale. As a matter of fact, the tax is required to be paid on every capital gain.