Marvelous Tips About Statement Of Income And Expenditure Format

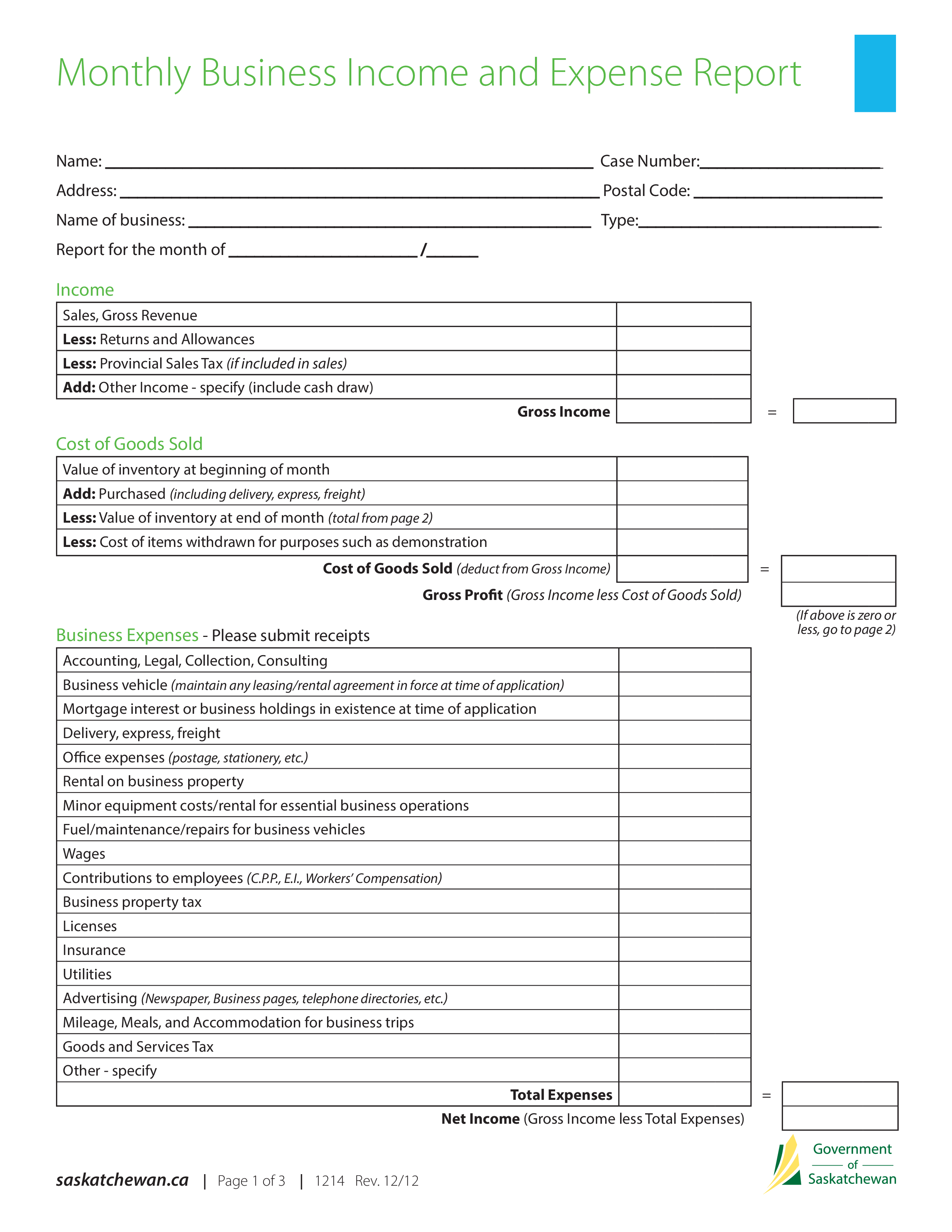

Budget & accounting free small business income statements, spreadsheets, and templates try smartsheet for free by andy marker | april 6, 2022.

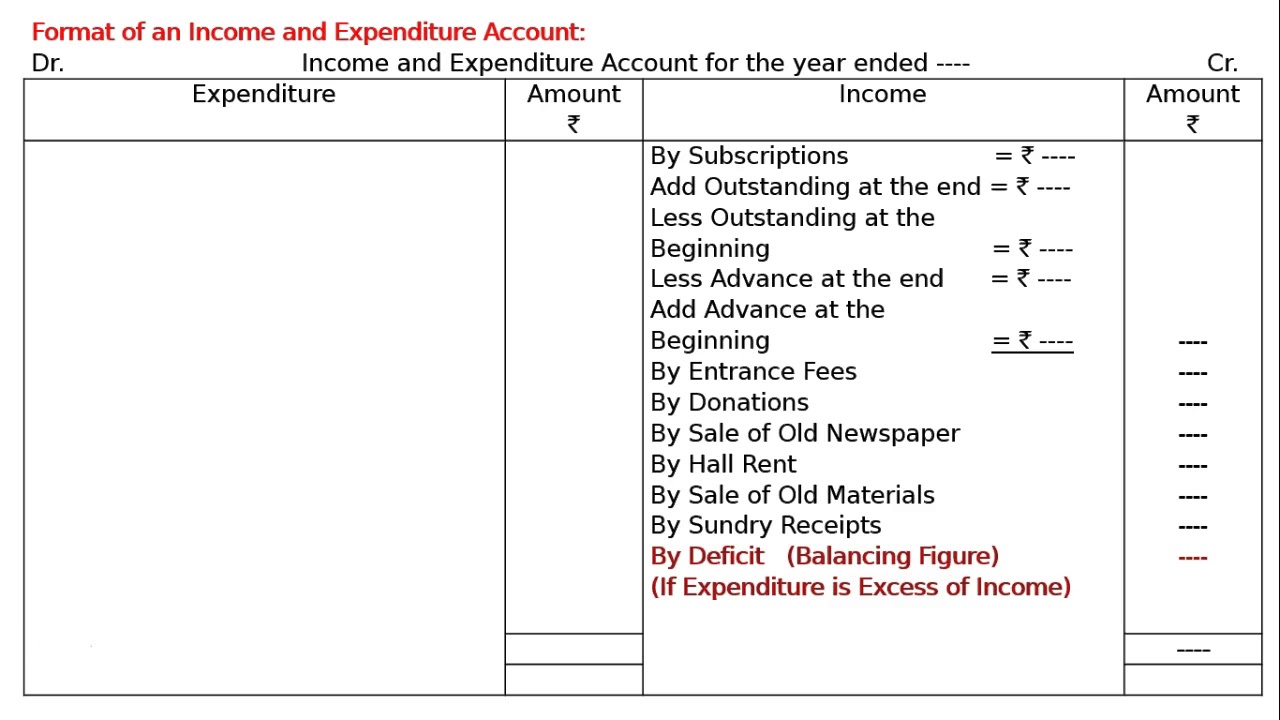

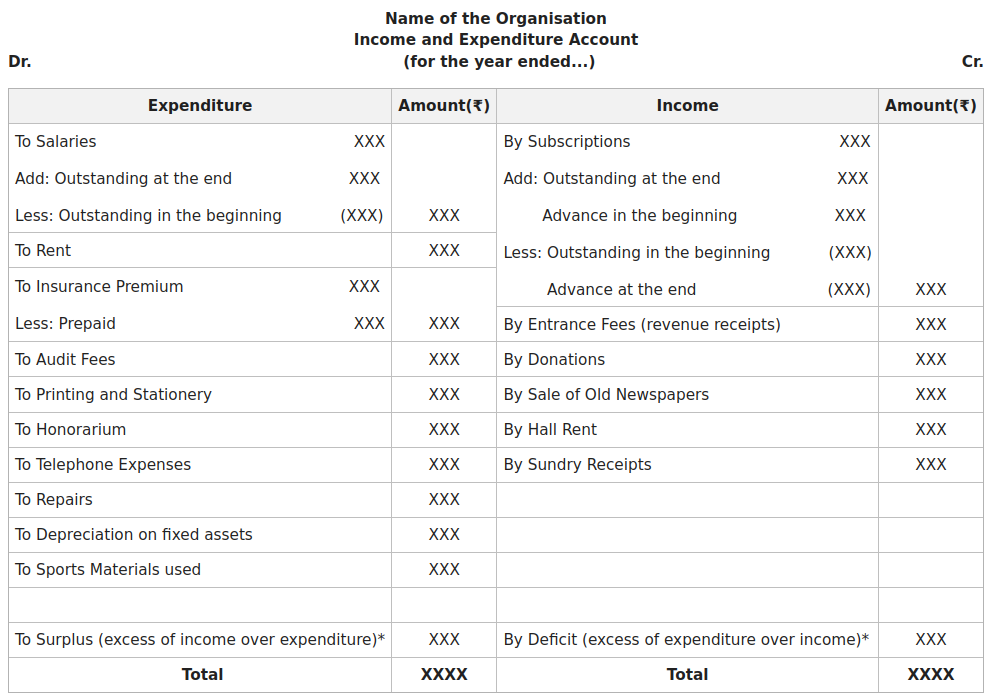

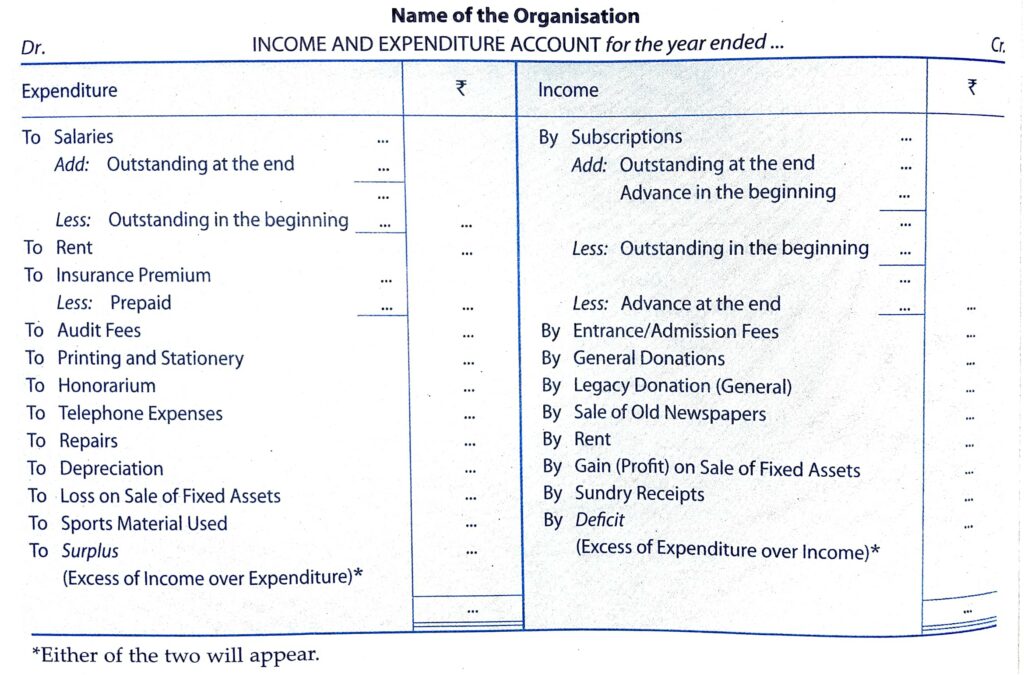

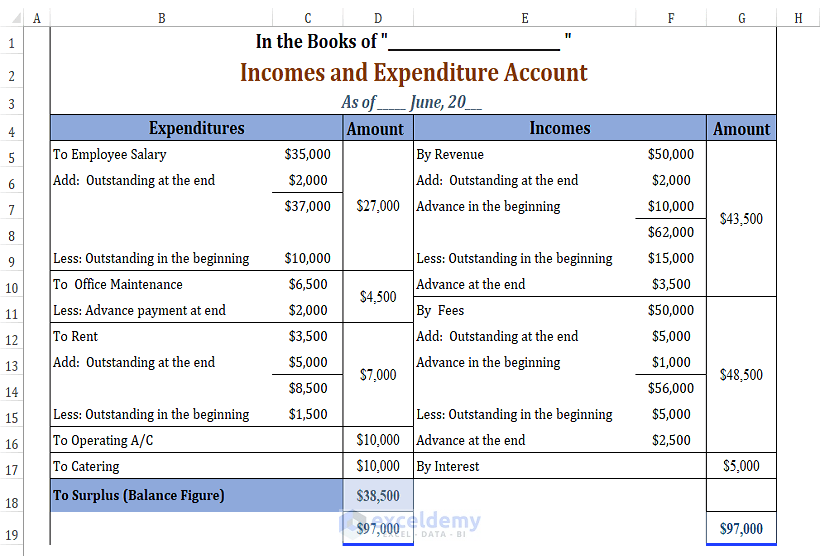

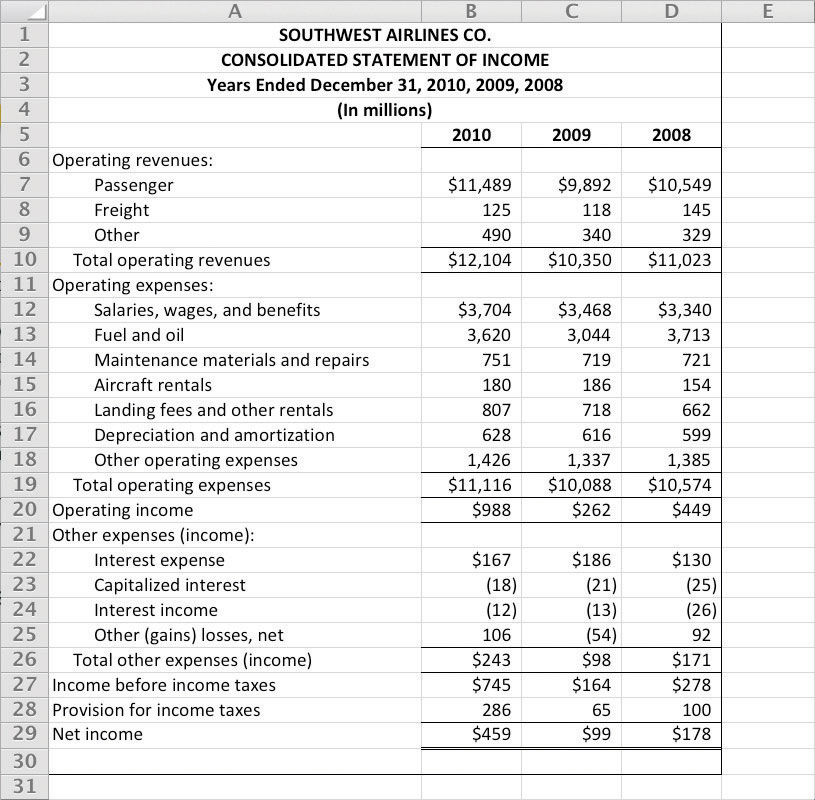

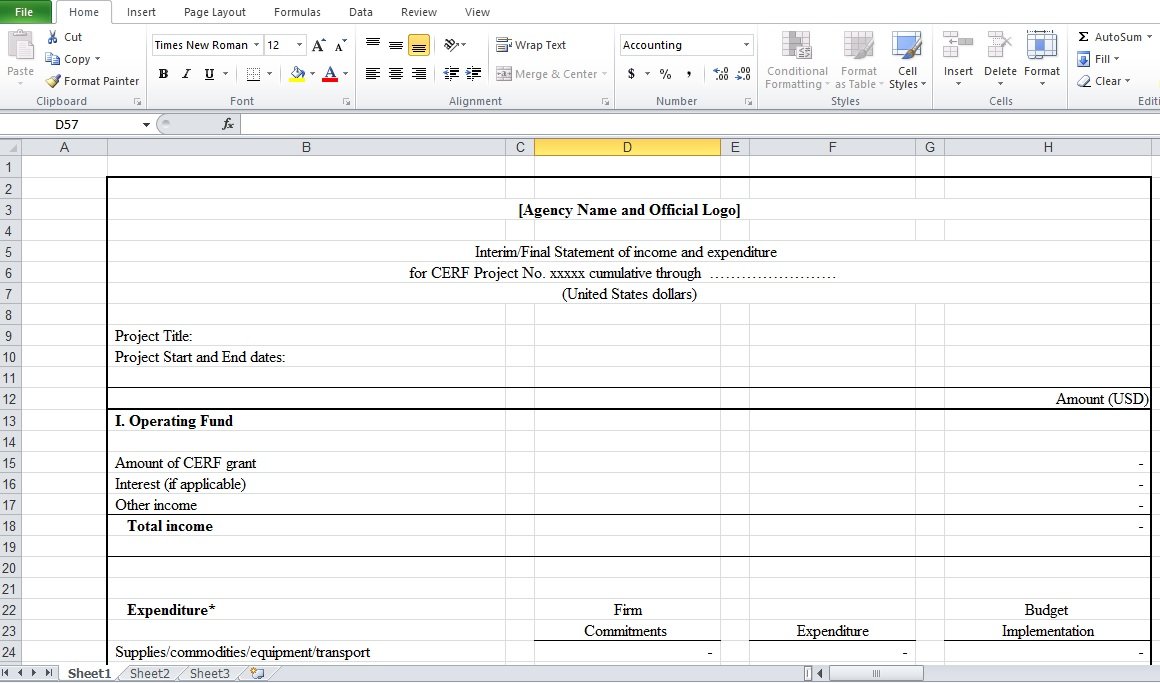

Statement of income and expenditure format. Similar to any other account,. A format of an income statement is very important as it is the means of communication of operating results to outsiders. Free school income and expenditure statement;

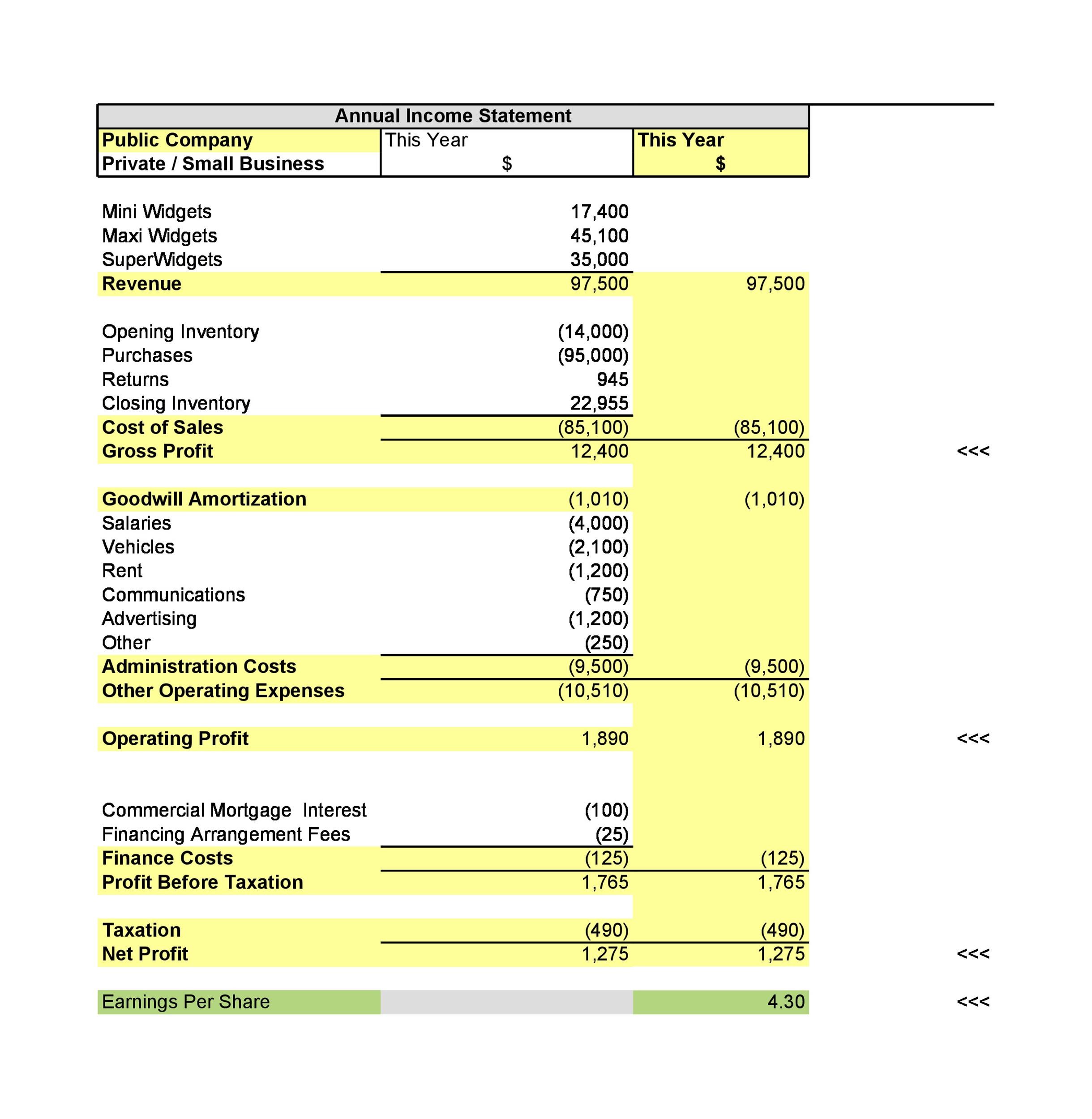

Also known as profit and loss (p&l). You’ll sometimes see income statements called a profit and loss statement. In this format, the statement displays a summary of the financial performance of the business over a specific time period.

It shows all revenues and expenses of the company over a specific period of time. It is a very simple format and has a few line items. Free annual income and expenditure statement;

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. The income and expenditure account is a summary of all items of incomes and expenses which relate to the ongoing accounting year. The income statement focuses on four key items:

Free income and expenditure statement template; An income statement summarizes a company's financial performance. It is prepared with the objective of finding.

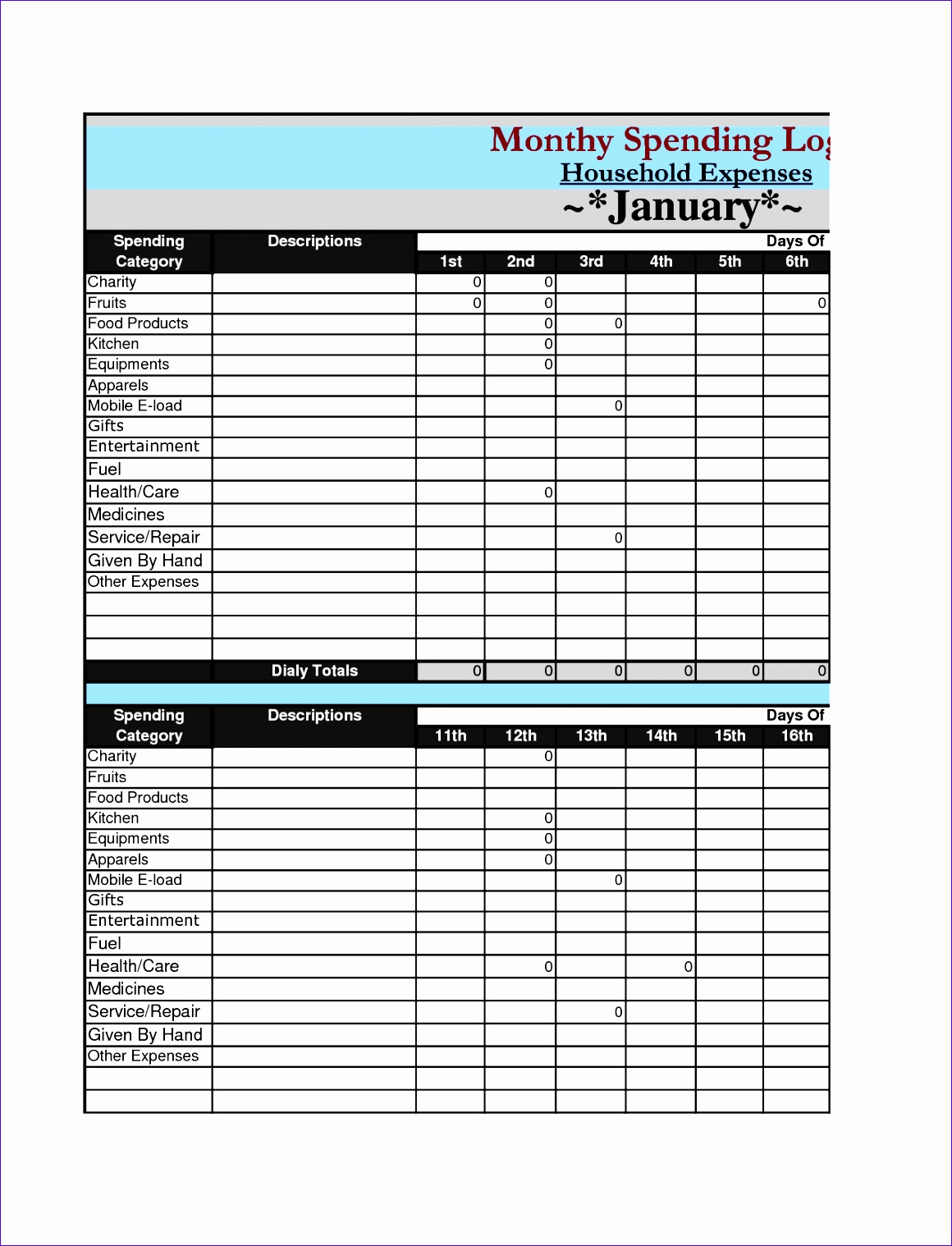

The excess of income over expenditure (or vice versa) is shown; Free comprehensive income and expenditure statement; The income and expenditure report template assists in tracking, handling & calculating your individual income, expenses & savings.

It can also be referred to as a profit and loss (p&l). Revenue, expenses, gains, and losses. Income and expenditure account is prepared on accrual basis of accounting and records income and expenses of revenue nature only.

The primary sheet is income. A typical income and expenditure and balance sheet contains 2 separate columns for each income and expenditure element. Format of income statement.

There are many ways to format an income statement. An income statement sets out your company income versus expenses, to help calculate profit.